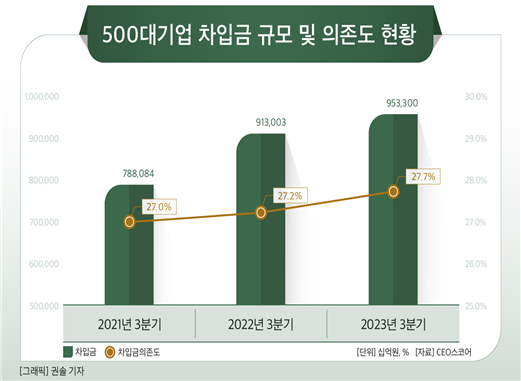

CEO Score Survey... Debt Reliance at 27.7%, Up 0.7%p

Among the top 500 domestic companies by sales, 272 companies have increased their borrowings by more than 165 trillion won over the past two years. The total amount reached 953 trillion won. Borrowings refer to debts on which companies must pay interest. The borrowing dependency ratio is the proportion of borrowings relative to assets. A ratio above 30% is interpreted as an increased financial risk.

On the 6th, CEO Score, a corporate data research institute, investigated 272 companies (excluding financial firms) among the top 500 companies that reported from 2021 to the third quarter of 2023. The borrowings in the third quarter amounted to 953.3001 trillion won. The borrowing dependency ratio was 27.7%. Borrowings increased by 21.0% compared to the third quarter of 2021. The borrowing dependency ratio rose by 0.7 percentage points (p).

Over the past two years, among the 272 companies surveyed, 179 companies (65.8%) increased their borrowings. There were also 29 companies whose borrowings more than doubled.

On April 27th, last month, Samsung Seocho Building, Seocho-gu, Seoul.

On April 27th, last month, Samsung Seocho Building, Seocho-gu, Seoul. [Photo by Jinhyung Kang aymsdream@]

The company with the largest increase in borrowings was Korea Electric Power Corporation (KEPCO). KEPCO's borrowings in the third quarter were 138.0492 trillion won, a 72.2% increase compared to the third quarter of 2021. SK Hynix (18.7202 trillion won), Korea Gas Corporation (16.3722 trillion won), Hyundai Motor Company (14.5407 trillion won), and LG Chem (7.8888 trillion won) were also among the top five companies with the largest increase in borrowings.

The company that reduced borrowings the most was Samsung Electronics. Samsung Electronics' borrowings in the third quarter were 10.05 trillion won, a 47.3% decrease compared to the third quarter of 2021.

Although Samsung Electronics borrowed 20 trillion won from its subsidiary Samsung Display in February this year at an annual interest rate of 4.6%, its borrowing scale actually decreased compared to two years ago. This contrasts with semiconductor competitor SK Hynix, whose borrowings more than doubled. SK Hynix raised funds by issuing corporate bonds totaling 7.4416 trillion won this year.

As of the third quarter of this year, the highest borrowing dependency ratio was Hyosung Chemical at 78.6%. Korea Gas Corporation (72.8%), Deutsche Motors (65.6%), Lotte Rental (62.7%), Lotte Global Logistics (62.4%), and Emart Everyday (61.4%) were among 27 companies with a borrowing dependency ratio above 50%.

Hyundai Engineering (0.3%), KEPCO KPS (0.5%), LX Semicon (0.8%), Lotte Fine Chemical (1.0%), S-1 and Nongshim (1.9%), Daeduck Electronics (2.0%), and 40 other companies had a borrowing dependency ratio below 10%.

By industry, public enterprises had the highest borrowing dependency ratio at 51.1% as of the third quarter of this year, while holding companies had the lowest at 6.0%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)