Samil PwC Governance Center Publishes '2023 Board Trends Report'

Only 34% Separate Board Chair and CEO... Female Ratio 9%

Although the independence of the board of directors is required for sustainable management, the independence of boards in domestic listed companies remains insufficient. Additionally, the proportion of companies with female directors on their boards is only 9%, indicating that there is still a long way to go in terms of diversity.

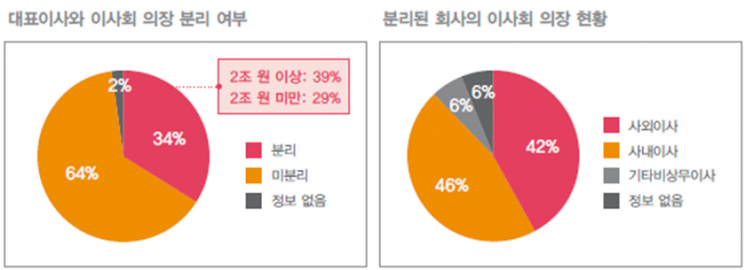

Sam-il PwC Governance Center recently announced on the 6th that it has published the "2023 Board of Directors Trend Report," which contains these findings. According to the report, the separation rate of CEO and board chairperson, an indicator related to board independence, was only 34% among domestic listed companies. The survey targeted 267 non-financial KOSPI-listed companies with total assets of over 1 trillion KRW. Among them, 142 companies had assets of 2 trillion KRW or more based on separate financial statements, and 125 companies had assets between 1 trillion and 2 trillion KRW.

According to the report, even among companies where the CEO and board chairperson are separated, only 42% had an outside director serving as the board chairperson, which is less than half. Rather, 46% had an inside director other than the CEO serving as the chairperson. The Governance Center pointed out, "Even if the CEO and board chairperson are separated, there is a possibility that independent oversight is not properly conducted."

The Korea ESG Standards Institute’s governance best practices recommend that if the board chairperson and CEO are not separated, a lead outside director should be appointed and disclosed. The lead outside director has the authority to convene outside board meetings separately from the chairperson and plays a role in consolidating the opinions of outside directors. Recently, Samsung Electronics introduced the lead outside director system to strengthen the status and authority of outside directors.

However, among the surveyed companies, only 5% had appointed a lead outside director, and among companies that did not separate the CEO and board chairperson roles, only four had a lead outside director. Furthermore, although the governance best practices recommend holding separate meetings composed solely of outside directors, only 24% of companies disclosed that they had held such a meeting at least once. However, the Governance Center added that 45% of companies did not disclose this information, so there may be discrepancies regarding actual appointments.

Jang On-gyun, head of the Governance Center, emphasized, "Outside directors can relatively freely discuss and share company issues or concerns through meetings composed solely of outside directors. It is important to review the frequency and duration of these meetings to make them effective."

Meanwhile, in terms of diversity, one of the important values in board composition, the level of domestic companies was also found to be insufficient. According to the survey, only 9% of companies had female directors on their boards. For listed companies with total assets of 2 trillion KRW or more, the Capital Markets Act prohibits boards from being composed entirely of one gender, but the proportion of female directors remains low.

The proportion of female directors varied by company size: companies with total assets under 2 trillion KRW had female director ratios of 5% (for companies with audit committees) and 3% (for companies without audit committees). The proportion of female inside directors was even lower, ranging from 2.1% to 3.4%. This indicates that it is not easy to identify female director candidates within companies.

According to the global female director status included in the report, Korea showed the lowest proportion of female directors compared to major countries. The European Union (EU) leads in board gender diversity and plans to introduce a female director quota system starting in 2026. Target companies must disclose reasons for non-compliance and plans to achieve the quota, and may face penalties such as fines and public disclosure of names. This contrasts with Korea, which does not have separate sanctions for companies violating related regulations.

Center head Jang advised, "The difference in systems between Europe and Korea may be a major cause of the large gap in female director ratios, so continuous attention should be paid to global trends and institutional developments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.