Burden of Prolonged High Interest Rates on Actual Buyers

Impact of Government Policy Loan Reduction

Seoul Apartment Transactions Collapse Below 3,000 Cases

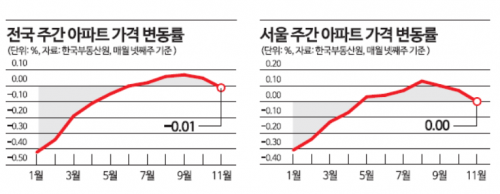

Nationwide housing prices turned downward for the first time in 23 weeks since the third week of June. Seoul housing prices also stopped rising after 28 weeks and stabilized. In particular, concerns are growing that the decline in sales prices in the Gangnam area, known as the 'housing price barometer,' could spread the downward trend throughout Seoul. As the government began tightening loans amid prolonged high interest rates, the burden on actual buyers increased, causing the previously recovering real estate market to tighten once again.

According to the Korea Real Estate Board on the 1st, the nationwide apartment sales prices in the fourth week of November fell by 0.01% compared to the previous week. This marked the end of the upward trend after 23 weeks since the third week of June. Both the metropolitan area and provinces turned downward. The metropolitan area shifted from 0.01% last week to -0.01%, marking a decline for the first time in 26 weeks, while the provinces changed from stable (0%) to -0.02% during the same period. In the metropolitan area, Seoul and Gyeonggi Province both ended their upward trends that began in the fourth week of May and the third week of June, respectively, and recorded stability. Incheon fell by 0.07%, continuing its downward trend for four consecutive weeks.

Especially, the consecutive decline in the Gangnam area, which leads nationwide apartment prices, is causing a significant shock in the market. Gangnam-gu, which entered a downward trend last week after 31 weeks, fell another 0.04% compared to the previous week. Seocho-gu also stopped its upward trend and declined by 0.02%. Songpa-gu rose by 0.01%, but the increase was significantly smaller than the 0.05% rise the previous week.

The real estate market, which had been recovering thanks to various deregulations including the 1·3 measures, appears to be freezing again due to concerns over prolonged high interest rates and the reduction of policy financing.

Recently, the upper limit of variable interest rates on mortgage loans from commercial banks exceeded 7%. Additionally, as the government reduced policy loans such as the Special Bogeumjari Loan, the burden on actual buyers increased. Moreover, with the cycle between housing price declines and rises shortening, buyers face the risk of losing hundreds of millions of won depending on their timing, causing hesitation among actual buyers and cooling transactions. The number of apartment transactions in Seoul, which had been around 3,000 per month from April to September, sharply dropped to the 2,000 range in October.

Ham Young-jin, head of the Zigbang Big Data Lab, explained, "The prolonged high interest rates have increased the burden, and with the end of the general type of the Special Bogeumjari Loan and the reduction of policy loans, barriers to purchasing homes have grown. As a result of various factors including fatigue from rising housing prices, transactions have paused and housing prices have begun to adjust."

Yeo Kyung-hee, senior researcher at Real Estate R114, said, "With the short-term rapid price increase, rising loan interest rates, reduction in policy financing, and the seasonal off-season coinciding, buyers have become more cautious, leading sellers to lower asking prices and causing Seoul apartment prices to turn downward. Although transactions remain sluggish, since uncertainty about interest rates has decreased, apartment prices are more likely to move within a range rather than plummet."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.