"My Money, What Now?" Consumers in Uproar

Moves to Prepare Class Action Lawsuits

Banks Hit by Multiple Adverse Factors Declare ELS Sales Suspension

"It's a bank I've dealt with for over 25 years, but now I don't even want to see them."

Mr. Lee (51), an office worker living in Mapo-gu, Seoul, has recently been losing sleep. When the maturity of the Hong Kong H Index equity-linked securities (ELS) product he subscribed to comes in April next year, nearly half of the 800 million KRW he saved over more than 25 years of working life is expected to disappear. He had been using Bank A as his main bank for a long time and subscribed to the Hong Kong H Index ELS product on the recommendation of a teller he had dealt with for over 10 years.

Meeting with our newspaper and showing the Bank A app on his phone, he expressed frustration, saying that until recently he was completely unaware of the loss situation. Even after entering the app, he had to click through several places before he could check the loss status. Mr. Lee said, "The bank never called me first, and when I found out about this situation around August and confronted them, they instead encouraged me to subscribe to additional related products to make up for the loss," adding, "If they had explained from the beginning that losses could occur, I wouldn't have entrusted my entire fortune just to get a few percentage points more interest."

"I believed it was safe because it was a bank... Consumers are furious"

Subscribers to the Hong Kong H Index ELS product are boiling with anger as large-scale principal losses are expected next year. Those who subscribed around the same time as Mr. Lee have taken collective action, saying things like "I'm about to lose my retirement funds" and "I'm at risk of losing the money I've saved my whole life." The Naver cafe where investors gather has quickly surpassed 500 members in less than a week since its opening. Various investment loss cases are also being shared in KakaoTalk open chat rooms. Considering that elderly investors and others who were unaware of the loss situation may face additional losses, the situation is expected to escalate over time.

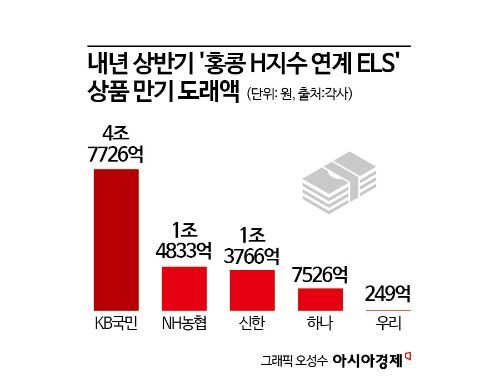

ELS is a type of derivative product whose returns are linked to the price of underlying assets or stock indices. If the price stays above a certain level until maturity, profits occur, but if it enters the 'Knock In' (principal loss occurrence zone) and the final price at maturity falls below a certain level, principal loss occurs. The Hong Kong H Index consists of Chinese company stocks listed in Hong Kong, which have plummeted from around 12,000 to 5,000 over the past three years. Those who subscribed to related ELS products through banks around 2021, like Mr. Lee, are now facing large-scale losses as the maturity approaches in the first half of next year. Among the Hong Kong H Index-linked ELS sold by the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup), the outstanding sales balance maturing in the first half of next year amounts to 8.41 trillion KRW, and the financial sector expects principal losses in the range of 3 to 4 trillion KRW considering the product structure and current stock price levels.

"Movements to prepare for class-action lawsuits"

As the situation unfolds, some have begun preparing lawsuits. Attorney Lee Jung-yeop of the law firm LKB & Partners, who is preparing a class-action lawsuit, told our newspaper in a phone interview, "We believe a lawsuit is possible due to incomplete sales, and we are planning to file a claim," adding, "Compensation amounts usually start at 50%, and in cases where the damage is truly recognized, cancellation may also be possible."

In the future, issues such as 'whether incomplete sales occurred' and the 'principle of suitability' under the Financial Consumer Protection Act are expected to become key points. This principle prohibits banks from recommending unsuitable financial products based on the consumer's assets and experience in buying and selling financial products. Financial Supervisory Service Governor Lee Bok-hyun also said on the 29th of last month, "The fact that high-risk products were sold en masse to elderly customers at bank counters, of all places, raises doubts about whether the 'principle of suitability' under the Financial Consumer Protection Act was properly observed."

However, if the ELS investment is not the first time, it is not easy to recognize incomplete sales or violations of the suitability principle. Attorney Lee added, "Not all investments are covered unconditionally; if someone invested a lot in the past and failed this time, it might be difficult. Those who were not properly explained will mainly be the focus."

"Embarrassed banks... Sales halted one after another"

Banks, which had been pressured to coexist amid criticism of interest-based profits, are now facing another crisis due to the ELS incident. Consumer complaints are growing, and financial authorities have launched a full investigation. A bank official said, "Not all branch staff can be considered to have perfect expertise, but they must have relevant certifications to sell these products," adding, "However, such (plummeting) situations are unpredictable even for analysts, so banks are equally embarrassed."

Ultimately, banks have announced the suspension of sales of the Hong Kong H Index ELS. KB Kookmin Bank stopped selling the Hong Kong H Index ELS product from the day before yesterday, and Hana Bank will stop selling Hong Kong H Index-based equity-linked funds (ELF) and equity-linked trusts (ELT) products starting from the 4th of next month. Woori and Shinhan Banks stopped selling Hong Kong H Index-included ELS from last year, and NH Nonghyup Bank has not been selling principal non-guaranteed ELS since last month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)