Bank of Korea: "Reducing the Fuel Tax Cut Will Increase Prices"

Concerns have been raised that disinflation (price slowdown) in South Korea may proceed slowly due to accumulating cost pressures from the pandemic and war, coupled with significant additional supply shocks emerging since mid-year. In particular, government policy support measures such as limiting increases in electricity and gas rates and reducing fuel taxes, which had buffered cost increases after the pandemic, are analyzed to have delayed the timing of related price hikes, thereby slowing the disinflation trend.

On the 1st, the Bank of Korea stated in its report "Comparison of Inflation Situations in Major Countries" that "Since the second half of the year, price increases have appeared recently in some items such as alcoholic beverages, travel, and accommodation, triggered by rising oil prices, exchange rates, agricultural product prices, and public utility rate hikes."

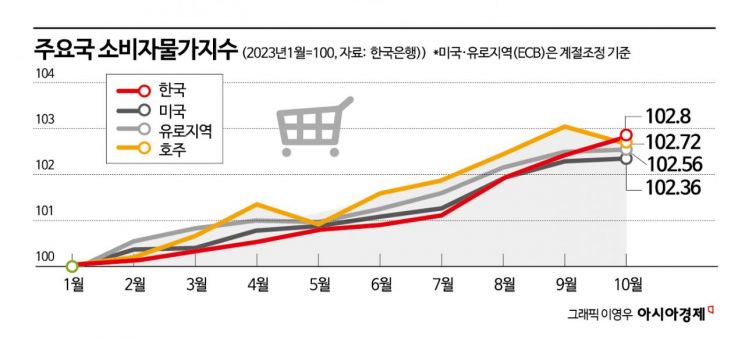

According to the report, the consumer price inflation rates in the United States and South Korea showed a clear deceleration trend for a year after peaking in mid-last year, but rebounded sequentially from mid-this year due to rising international oil prices and the disappearance of base effects. The U.S. consumer price inflation rate rebounded by 0.7 percentage points over three months from July and then fell again to 3.2% in October.

In contrast, South Korea, whose peak was one month later than the U.S. in August last year, saw a 1.5 percentage point increase over three months from August, reaching 3.8%, but it is expected to decline again in November. The Euro area, with a relatively late peak in October last year, has maintained a deceleration trend until recently. While South Korea's consumer price inflation rate has been lower than that of major advanced countries, unlike other countries, a sharp rise in agricultural product prices at the rebound point caused the October inflation rate to be higher than that of the U.S. and the Euro area.

The Bank of Korea explained, "Comparing the inflation rates over the recent three months as of October, South Korea's rate was 2.0%, significantly exceeding the U.S. (1.1%) and the Euro area (0.9%). By item, unlike major countries, agricultural product prices in South Korea rose sharply, contributing substantially to the recent three-month increase."

Regarding core inflation rates, major advanced countries continue to show a gradual deceleration trend. South Korea also shows a somewhat slower deceleration recently at the low 3% range, but this is significantly lower than the major advanced countries, which are in the 4% range as of October.

The slow deceleration of core inflation rates in major countries is analyzed to be influenced by differentiated factors by country. In the U.S., the impact of supply shocks has largely eased, weakening the rise in goods prices, but service price inflation is decelerating slowly due to stronger-than-expected growth and a tight labor market.

In the Euro area, despite weak growth, the ongoing secondary effects of supply shocks and high wage increases have constrained the deceleration of core inflation by keeping service price inflation high. In contrast, South Korea, unlike major countries, continues to see a deceleration in service price inflation due to weakening domestic demand pressures, but the deceleration in goods price inflation is not yet clear due to accumulated cost pressures.

The Bank of Korea stated, "Some cases of shrinkflation, where quantities or weights are reduced instead of raising prices, and skimpflation, where raw material content is reduced, have appeared. Electricity and gas rates have been limited in their increases compared to major countries, which helped moderate last year's sharp rise in consumer prices, but the delayed timing of hikes means the ripple effects last longer. Therefore, if the current fuel tax reductions (25% for gasoline, 37% for diesel) are reduced, it will act as a factor driving price increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.