8 of the Top 10 Stocks by Trading Value Through November This Year Are Secondary Battery Stocks

Samsung Electronics Ranks First... EcoPro Surpasses Samsung Electronics in Market Capitalization Turnover Rate

This year, the sector with the most active trading by investors in the domestic stock market was secondary batteries. Fueled by a buying frenzy among individual investors, it also outperformed other sectors in terms of returns. However, unlike this year, the cathode material market is expected to face a 'contract gap period' next year, leading to greater uncertainty.

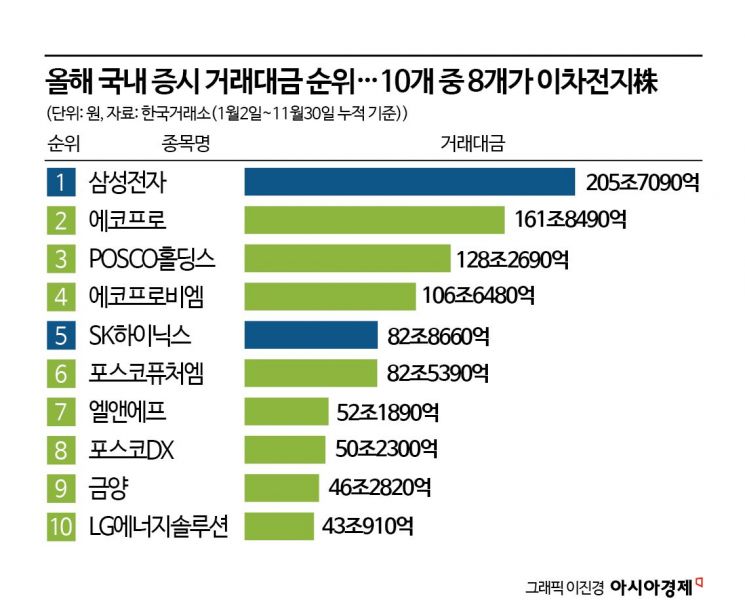

According to the Korea Exchange on the 1st, among the top 10 stocks with the highest cumulative trading value (January 2 to November 30) across the KOSPI and KOSDAQ markets this year, 8 were related to secondary batteries, including EcoPro. The remaining two stocks were Samsung Electronics and SK Hynix. Trading was more active in the secondary battery theme than in semiconductors.

Looking at individual stocks, Samsung Electronics had the highest trading value at a total of KRW 205.709 trillion among all listed companies. EcoPro followed with KRW 161.849 trillion. However, Samsung Electronics’ market capitalization reached KRW 434.6 trillion (based on the closing price on November 30), while EcoPro’s was only KRW 19.92 trillion. Considering the size difference of about 22 times between the two companies, EcoPro’s market capitalization turnover rate was significantly higher than Samsung Electronics’.

Besides EcoPro, stocks classified under the secondary battery theme such as POSCO Holdings (KRW 128.269 trillion, trading value), EcoPro BM (KRW 106.648 trillion), POSCO Future M (KRW 82.539 trillion), L&F (KRW 52.189 trillion), POSCO DX (KRW 50.23 trillion), Geumyang (KRW 46.282 trillion), and LG Energy Solution (KRW 43.091 trillion) were all ranked within the top 10 in trading value. LG Energy Solution is the second-largest company by market capitalization on the KOSPI after Samsung Electronics, but its stock trading value ranked only 10th overall. A Korea Exchange official said, “Due to the secondary battery investment frenzy that swept the market from the beginning of the year, the domestic stock market this year was virtually a solo stage for the so-called ‘EcoPro brothers’ and POSCO Group listed companies.”

Secondary battery stocks dominated not only in trading value but also in returns compared to other sectors. POSCO DX’s stock price rose more than ninefold from the beginning of the year, ranking first in price fluctuation among all listed companies. Among the top trading value group, returns such as POSCO DX (816.8%), EcoPro (626.21%), and Geumyang (436.82%) far exceeded those of Samsung Electronics (31.65%) and SK Hynix (78.53%).

However, due to the prolonged high interest rate environment and global economic slowdown, recent demand for electric vehicles has been sluggish. There is significant uncertainty about whether the high valuation of cathode material companies, a core material of secondary batteries, will continue into next year. Anna Lee, a researcher at Yuanta Securities, said, “Although the profitability of cathode material companies was not very good this year, they were highly valued because there was a major momentum in the form of ‘long-term supply contracts’ that could cover uncertainties.” She pointed out, “From the second half of last year to the first half of this year, many long-term supply contracts were made by cell and cathode material companies, and in 2024, they will enter a ‘contract gap period.’” She added, “Next year, all uncertainties will surface. Since the U.S. presidential election is scheduled for November next year, there is also policy uncertainty related to the Inflation Reduction Act (IRA).”

Meanwhile, in terms of trading value by stock market this year, the KOSPI market slightly outpaced the KOSDAQ market. As of the end of last month, the cumulative total trading value of the KOSPI market was KRW 2,124.685 trillion, and the KOSDAQ total trading value was KRW 2,097.521 trillion. Until the first half of the year, the investment frenzy in secondary batteries caused the unusual phenomenon of KOSDAQ’s trading value surpassing KOSPI’s, but in the second half, KOSPI regained the lead.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.