Bank of Korea Economic Outlook Report

US Leads Major Countries with Active Industrial Policies

Enhancing Supply Chain Stability and Securing Semiconductor Leadership

Korean Construction Machinery, Electric Vehicle, and Food Companies Benefit

However, Employment Slowdown Feared if Production Bases Move to US

Regarding the United States' efforts to revitalize its semiconductor and manufacturing industries through proactive industrial policies, the Bank of Korea analyzed that exports from South Korea's construction machinery, electric vehicle, battery, and food companies could also be positively affected.

However, it emphasized the need for South Korea to develop sophisticated countermeasures against U.S. industrial policies, as domestic production capacity and employment could weaken if many semiconductor and electric vehicle production bases move to the U.S. in the future.

The Bank of Korea stated this in an article titled "Current Status of U.S. Industrial Policy and Its Impact on Our Economy" in its economic outlook report released on the 1st.

According to the Bank of Korea, since the COVID-19 pandemic, major countries such as the U.S., Europe, and Japan have been pursuing active industrial policies in response to geopolitical risks and changes in industrial paradigms. While in the past these policies focused mainly on attracting industries and comparative advantage industries in emerging countries like China, now the scope of countries and industries involved has greatly expanded.

Among them, the U.S. is the most proactive in pursuing industrial policies, including the Chips and Science Act (CSA), the Inflation Reduction Act (IRA), and semiconductor export controls targeting China.

The Bank of Korea analyzed that the U.S. is strengthening supply chain resilience through industrial policies while securing global leadership in advanced sectors and promoting the revival of its manufacturing industry.

The U.S. government experienced a shortage of automotive semiconductors in 2021 and a wiring harness supply disruption last year (wiring harnesses are bundles of wires connecting electronic devices inside vehicles), which heightened the need for a stable supply chain.

It is also interpreted that the U.S. intends to regain leadership in advanced semiconductor production, which has mainly been held by some East Asian countries including South Korea, by building an advanced industrial ecosystem domestically.

U.S. Industrial Policy... Employment Up by 320,000, Growth Rate Increased by 0.2%

The Bank of Korea expects that with the U.S. significantly increasing investment in manufacturing and advanced technology, production and employment expansion will become visible from the second half of next year when factory construction is completed.

Calculating the economic effects of ongoing investment projects considering industrial linkages, the Bank of Korea estimated that U.S. industrial policies will increase employment by about 320,000 people (approximately 0.2% of total employment) and continuously expand annual gross domestic product (GDP) by about 0.2%.

The Bank of Korea forecasted, "Additional benefits may arise from improved labor productivity in advanced factories and ripple effects from technological advancements."

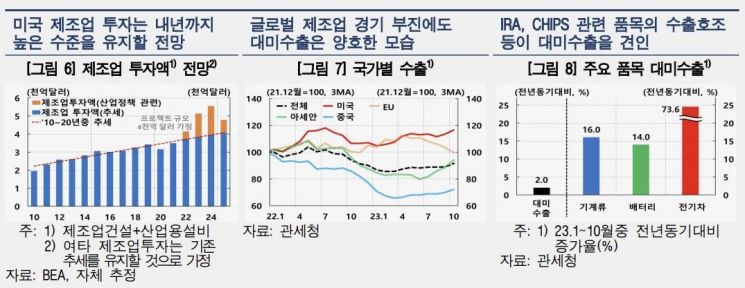

In fact, since major projects began construction last year, related investments have expanded and growth rates have shown positive trends. Manufacturing factory construction, which had minimal contribution to growth, increased, raising the growth contribution to 0.4 percentage points in the first to third quarters of this year, and related employment has shown a favorable recovery trend.

The 'Semiconductor Exhibition (SEDEX) 2023,' where domestic and international system semiconductor companies including Samsung Electronics and SK Hynix showcased a large number of new technologies and cutting-edge products, opened on the 25th at COEX in Samseong-dong, Seoul. Visitors at the exhibition hall on the day are viewing various semiconductor and component equipment booths. Photo by Yongjun Cho jun21@

The 'Semiconductor Exhibition (SEDEX) 2023,' where domestic and international system semiconductor companies including Samsung Electronics and SK Hynix showcased a large number of new technologies and cutting-edge products, opened on the 25th at COEX in Samseong-dong, Seoul. Visitors at the exhibition hall on the day are viewing various semiconductor and component equipment booths. Photo by Yongjun Cho jun21@

Expansion of U.S. Manufacturing Investment Boosts South Korean Exports

The Bank of Korea judged that such U.S. industrial policies are also affecting the South Korean economy through local entry of major manufacturing companies and export expansion.

The Bank of Korea explained, "Despite the overall global manufacturing downturn in the first half of the year, exports to the U.S. showed a favorable performance due to strong U.S. consumption and capital goods demand related to industrial policies. In particular, exports of machinery increased by 16%, and exports of industrial policy-related items such as electric vehicles (74%) and batteries (14%) also showed strong performance due to factory construction and facility expansion in the U.S."

Besides this direct increase in parts exports, it was found that as Korean companies build semiconductor and electric vehicle production bases in the U.S., lifestyle-related companies such as food businesses are also entering the market, forming supply chains within the U.S.

For example, in Georgia, where Hyundai Motor Group is constructing an electric vehicle factory worth $8.1 billion including joint ventures, eight parts suppliers have announced investment plans totaling $900 million, and CJ Foodville, which operates Tous Les Jours, has also decided to establish a factory. Korean food companies specializing in chicken and bakery products are expanding their branches beyond traditional Korean residential areas to all regions of the U.S.

However, the Bank of Korea also explained that these U.S. industrial policies could have negative effects on the South Korean economy.

The Bank of Korea emphasized, "In the medium to long term, it is difficult to exclude the risk that the employment base of our economy could shrink as production bases for core industries such as semiconductors and electric vehicles relocate to the U.S. It is necessary to comprehensively consider both the opportunities and risks arising from major countries' industrial policies and prepare sophisticated countermeasures accordingly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.