Financial Supervisory Service Chief: "Was the 'Suitability Principle' of the Financial Consumer Protection Act Properly Followed?"

Hong Kong ELS Known for Many Elderly Investors

'Incomplete Sales' Followed by 'Sales Suitability' Emerging as Key Issues

As concerns over massive losses from Hong Kong H-Index ELS (Equity-Linked Securities) grow, the issue of 'product sales suitability' has emerged as a key point in this incident. The Financial Supervisory Service (FSS) stated, "We will examine under the law whether it is appropriate for banks to sell complex derivative products like ELS to the elderly."

Until now, the focus was on 'incomplete sales,' questioning whether banks accurately explained the risks of the product when selling ELS. However, the FSS has taken a step further. They clarified that even if banks did not engage in incomplete sales regarding ELS, it would still be problematic if the sales were not suitable.

On the 29th, after a meeting with CEOs of asset management companies held at the Financial Investment Association in Yeouido, FSS Governor Lee Bok-hyun told reporters, "The fact that high-risk, complex products were sold in large volumes to elderly customers at bank counters raises doubts about whether the 'suitability principle' under the Financial Consumer Protection Act was properly observed."

Governor Lee said, "We need to consider whether the bank bears no responsibility just because consumers responded 'yes, yes' to dozens of pages of explanations that even I find hard to read," adding, "Regardless of whether explanations were given, it seems necessary to review whether the recommendation itself was appropriate."

Was it appropriate for banks to 'recommend' ELS products to the elderly?

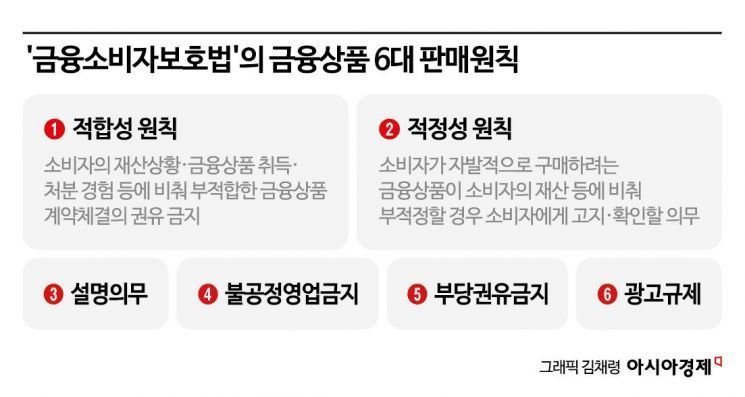

The principles banks must follow when selling financial products like ELS are specified in the Financial Consumer Protection Act (hereinafter, FCPA). Among the six major sales principles, the first is 'suitability,' and the second is 'appropriateness.' The core of suitability is whether the product was recommended. It prohibits banks from recommending unsuitable financial products based on the consumer's assets and experience in buying and selling financial products.

Appropriateness applies when the consumer voluntarily wants to purchase a product without the bank's solicitation. Even if the consumer expresses a desire to buy a product, if it is inappropriate considering the consumer's assets, the bank must notify and confirm this with the consumer.

If bank employees violate these principles, they face sanctions or fines. If consumers suffer losses, the bank is liable for compensation. An FSS official said, "Hong Kong ELS products were mainly handled for the elderly, and we will inspect whether banks properly followed these principles during the sales process."

Considering product risk, complexity, and understanding level

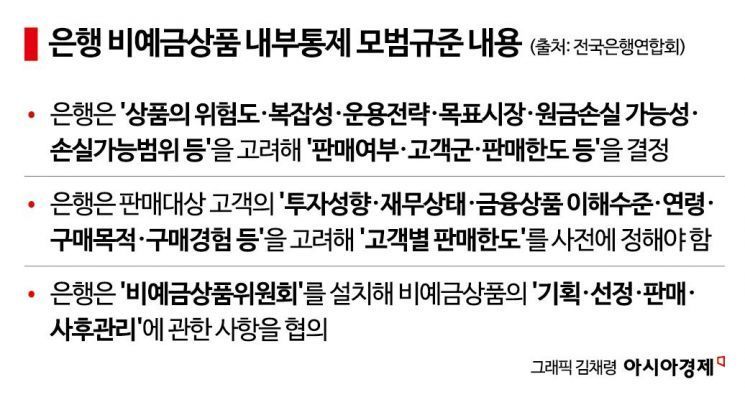

To assess the suitability of ELS sales, the FSS must also consider another factor. Three years ago, the FSS and the Korea Federation of Banks established the 'Model Internal Control Guidelines for Non-Deposit Products.' This was introduced to prevent large-scale loss incidents following the overseas interest rate-linked derivative-linked fund (DLF) crisis.

These guidelines require determining customer groups and sales limits by considering product risk, complexity, and the possibility of principal loss. Sales limits per customer are set in advance by considering the customer's investment propensity, understanding of financial products, age, and purchase experience. Each bank is to form a 'Non-Deposit Product Committee' to discuss these matters. If customer damage occurs during post-sales management, banks must reduce sales limits, change sales targets, or even suspend sales altogether as countermeasures.

Potential surge in elderly investors facing losses ahead of general elections

A financial industry insider said, "It seems likely that the FSS's inspection focus will shift from 'incomplete sales' to 'sales suitability.' Banks have mainly handled ELS products for the elderly, who tend to have relatively more disposable funds than younger people. If this continues, it is almost equivalent to issuing a ban on access, and banks will inevitably become more reluctant to sell derivative products."

Some speculate that, with the general elections scheduled for April next year, the FSS is quickly shifting direction to attribute responsibility to banks, as a surge in elderly investors suffering losses would be politically unfavorable.

Meanwhile, the number of investors expected to incur losses in this incident is anticipated to be much higher than during the 2019 DLF crisis. At that time, losses amounted to about 300 billion KRW each at Woori Bank and Hana Bank, with approximately 1,200 and 1,800 investors involved, respectively.

DLF had a minimum subscription amount of 100 million KRW and was a private fund, whereas the Hong Kong ELS is a public fund with a minimum subscription amount of 5 million KRW. Currently, losses are close to 4 trillion KRW, so the scale of investors suffering losses is inevitably larger than during the DLF incident.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.