Maturity of ELS Products Sold by Commercial Banks Starts from January Next Year

Large-Scale Losses Concentrated from January to May if H Index Does Not Rise

Minimum Subscription Amount for DLF is 100 Million Won, Relatively Few Victims

Minimum Subscription Amount for ELS is 5 Million Won, If Losses Reach 3-4 Trillion Won

Number of Investors Suffering Losses Will Be Much Higher Than During DLF Incident

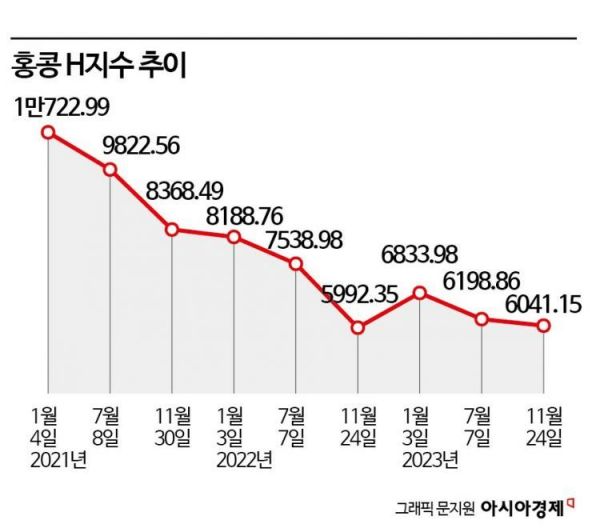

It is expected that the multi-trillion won losses from Hong Kong H Index equity-linked securities (ELS) will begin in earnest from January next year. The financial industry anticipates that the number of investors suffering losses in this incident will be much larger than during the 2019 interest rate-linked derivative-linked fund (DLF) crisis. On the 29th, a financial regulator official stated, "The damage from the Hong Kong H Index sold by commercial banks will start in January and concentrate in the first half of the year," adding, "Those who invested when the H Index peaked from January to May 2021 will reach maturity sequentially, so large-scale losses could occur every month in the first half of next year."

The scale of investors facing losses is inevitably larger than during the DLF crisis. This can be understood by comparing with the past DLF incident. The loss amount was about 300 billion KRW each for Woori Bank and Hana Bank, with related investors numbering approximately 1,200 and 1,800 respectively. Another financial regulator official said, "DLF had a minimum subscription threshold of 100 million KRW and was a private fund, so losses were limited to that extent. However, the Hong Kong ELS is a public offering fund with a minimum subscription amount of 5 million KRW, and losses currently approach 4 trillion KRW, so the range of investors suffering losses will be much broader than during the DLF incident."

If You Have a History of Investing in ELS, Saying 'I Didn't Know' Won't Work

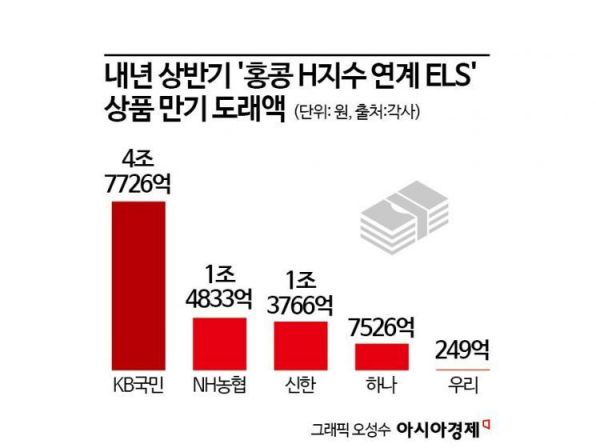

According to the financial sector, the outstanding sales balance of Hong Kong H Index-linked ELS maturing in the first half of next year, sold by the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup), amounts to a total of 8.41 trillion KRW. Considering the product structure and current stock price levels, the financial sector expects unavoidable principal losses in the range of 3 to 4 trillion KRW. The outstanding sales balance maturing in the first half of next year by bank is as follows: KB Kookmin Bank (4.7726 trillion KRW), NH Nonghyup Bank (1.4833 trillion KRW), Shinhan Bank (1.3766 trillion KRW), Hana Bank (752.6 billion KRW), and Woori Bank (24.9 billion KRW).

ELS incur losses if the price of the underlying asset falls by 35-55% or more at maturity compared to the subscription time. The H Index, which rose to 12,106.77 in February 2021, dropped to 5,957.08 as of the 28th, halving in value.

As the risk of multi-trillion won losses looms, the issue of incomplete sales by banks has become a focal point. Authorities believe that when investors subscribe 'non-face-to-face' via mobile phones, they must understand the product risks and structure themselves, so the probability of incomplete sales is low. However, the situation differs for face-to-face subscriptions at bank counters. The Financial Supervisory Service (FSS) inspects incomplete sales by reviewing investors' product subscription contracts one by one and identifying unchecked items. Since ELS sales at banks have a high proportion of counter subscriptions, the authorities do not rule out the possibility of incomplete sales.

If the authorities find evidence of incomplete sales, investors may receive partial or full principal refunds. During the Lime trade finance fund incident, the authorities proposed a settlement plan to refund 100% of the principal. In the DLF incident, they also decided to compensate up to 80% of investment losses.

However, even if investors subscribed to ELS face-to-face at banks, compensation is difficult if they have a history of subscribing to similar products in the past. An FSS official said, "For investors who previously earned profits from ELS products, saying 'I thought it was a deposit' or 'I didn't expect losses' will not be accepted just because they suffered losses this time," adding, "Even elderly investors who have invested in ELS products would have understood the product characteristics, so this is taken into account when inspecting incomplete sales."

A significant portion of H Index-linked ELS subscribers are known to be elderly. A commercial bank official said, "People in their 30s and 40s with income have to spend money on home purchases or childcare, so they lack the financial capacity to invest in products like ELS," adding, "Many retirees subscribe to invest their retirement funds to generate returns."

Commercial Banks Suspend or Plan to Suspend Sales

Meanwhile, as concerns over large-scale losses from Hong Kong H Index ELS spread, major banks have either suspended sales or are considering doing so. KB Kookmin Bank, which has the highest sales volume in the banking sector, is currently reviewing plans to suspend sales of H Index-included ELS. NH Nonghyup Bank completely suspended sales of H Index-linked equity-linked trust (ELT) products last month. Shinhan Bank stopped selling Hong Kong H Index ELS from the end of last year. Hana Bank significantly reduced its sales proportion and now sells only on a limited basis upon request.

Some in the financial sector argue that regulations banning banks from selling high-risk derivative products should be reconsidered. After the DLF incident, authorities announced follow-up measures banning commercial banks from selling high-risk investment products. However, the banking sector opposed this, saying it would lose a trust market exceeding 40 trillion KRW. Consequently, limited sales of ELTs were allowed. A Financial Services Commission official said, "Since ELS losses have not yet started, it is premature to review this immediately, and it is a sensitive matter as it would eliminate banks' sources of non-interest income."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.