Jang Mo (41, male), who lives in the Dongja-dong gosiwon village in Yongsan-gu, Seoul, likes sundae guk (Korean blood sausage soup). Until last year, he saved the monthly 200,000 KRW basic livelihood security allowance to eat it about three times a week. However, since last month, he has reduced the frequency to once a week because the price of sundae guk, which used to cost 7,000 to 8,000 KRW, has risen to around 10,000 KRW. Even though he tries to save, the 900,000 KRW he receives as basic livelihood benefits runs out within three weeks. Last year, even after eating sundae guk and going to PC bangs, his money did not run out so quickly. Jang said, "Prices have gone up, so I can't buy what I want to eat," adding, "I often have meals with ramen that I bought in advance."

Kim Mo (45, female), who works in finance and lives in an apartment in Seocho-gu, Seoul, increased her child's academy fees from 3.7 million KRW to 4.5 million KRW last month. This is because she switched some subjects to one-on-one tutoring to improve grades. Although it costs an additional 800,000 KRW per month, it is okay. She can save money on shopping. While she spent about 8 million KRW on shopping as of October last year, she reduced it to 3.8 million KRW last month. Kim said, "Last year, I spent a large amount suddenly when purchasing jewelry, but I didn't particularly reduce my shopping expenses," adding, "I plan to invest more in my child's education."

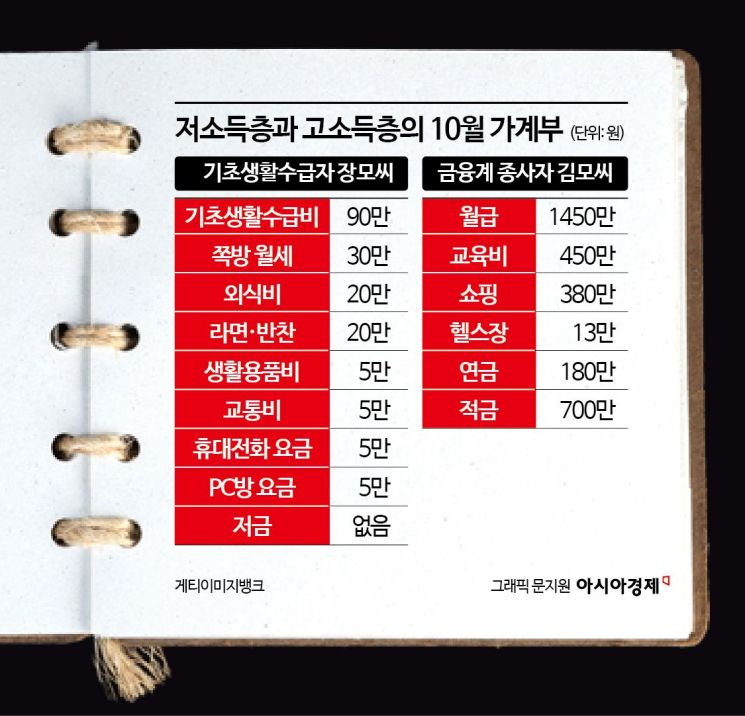

Comparing household accounts directly, the difference between Jang and Kim is even more pronounced. Jang received 900,000 KRW in basic livelihood benefits last month. Of this, he paid 300,000 KRW for the monthly rent of his gosiwon room and spent the rest on food, daily necessities, and leisure expenses. His dining out expenses were 200,000 KRW, ramen and side dishes 200,000 KRW, daily necessities 50,000 KRW, transportation 50,000 KRW, mobile phone bill 50,000 KRW, and PC bang fees 50,000 KRW. Saving money is out of the question. According to Jang, it is difficult to reduce costs in each category. The same goes for PC bangs. Last year, Jang practically lived in PC bangs, but recently he has minimized his visits. Since he has no computer or TV at home, he uses the PC bang to do document work that requires a computer or to watch dramas or movies he had postponed.

Instead, Jang decided to change hospitals. He has heart and back problems and needs to visit the hospital daily. However, since the subway base fare increased from 1,250 KRW to 1,400 KRW last month, even transportation costs to the hospital have become a burden. Jang is looking for a hospital near his home instead of the one that gave him thorough examinations. He said, "If I don't reduce transportation costs, my budget will be tight," adding, "If I can take my medicine well, there shouldn't be a big problem with my health."

On the other hand, Kim's household account was filled with relatively high amounts. Kim, who received a salary of 14.5 million KRW last month, spent 4.5 million KRW on education. She also spent 3.8 million KRW on shopping and about 130,000 KRW on gym fees. Additionally, she spent 1.8 million KRW on pensions and 7 million KRW on savings for the future. Kim said, "Prices for luxury goods, clothing, and fuel have definitely risen," but added, "I haven't particularly given up any consumption due to price increases. I continue to buy my favorite foods like eel and Shine Muscat grapes."

Although prices are rising, not everyone experiences the same hardship. Lower-income groups tightened their belts more in response to price increases, while higher-income groups maintained their consumption expenditures regardless of inflation.

According to the '2023 Q3 Household Trends Survey' released by Statistics Korea on the 23rd, the average monthly consumption expenditure of households in the lowest income quintile (bottom 20%) in the third quarter of this year was 1,237,000 KRW, a 0.7% decrease compared to the same period last year. Consumption expenditures decreased significantly in categories such as household goods and services (-19.7%), education (-13.9%), communication (-10.4%), transportation (-8.1%), and alcoholic beverages and tobacco (-7.2%). In particular, as prices for processed foods and dining out rose by 6.3% and 5.4% respectively in the third quarter, which are closely related to daily life, households in the lowest income quintile tightened their wallets.

In contrast, consumption expenditures of households in income quintiles other than the lowest increased. In the third quarter, consumption expenditures for the 2nd, 3rd, 4th, and 5th quintiles rose by 2.9%, 3.3%, 3.1%, and 6.5% respectively compared to the previous year. Income also increased more significantly in households other than the lowest quintile, widening the gap in disposable income between the lowest and highest quintiles. Disposable income for the lowest quintile was 907,000 KRW, a 0.6% increase from the previous year, while the highest quintile recorded 8,319,000 KRW, a 3.1% increase, showing more than a fivefold difference in growth rates. Disposable income refers to the money a household can actually spend after deducting interest and taxes from its earnings.

Prices are expected to rise further, which will impact economically vulnerable groups. According to the International Finance Center, the average forecast for South Korea's consumer price inflation rate next year, announced at the end of last month by eight major foreign investment banks (Barclays, Bank of America Merrill Lynch, Citi, Goldman Sachs, JP Morgan, HSBC, Nomura, UBS), is 2.4%. This is 0.2% higher than the average forecast of 2.2% announced in September. The Bank of Korea also stated on the 19th of last month in its monetary policy direction that "the upward risk to prices has increased," and "the timing for consumer price inflation to converge to the target level (2%) is likely to be delayed compared to initial expectations." Professor Sung Tae-yoon of Yonsei University's Department of Economics said, "When prices rise, the nominal value of assets also increases, but low-income groups do not benefit from this and face increased consumption burdens," adding, "It is difficult for financial authorities to raise interest rates sharply, so inflationary pressures are inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)