Robotics Industry Growth Policy Boosts Expectations, Up 115% This Month

Strengthening North American Market Partnerships Next Year, Opening Sales Channels in UK and Germany for European Expansion

Doosan Robotics' stock price has been hitting new highs day after day, settling in the 80,000 KRW range. This is due to growing expectations for growth following the government's recent robot industry promotion policies, as well as steady purchases by pension funds.

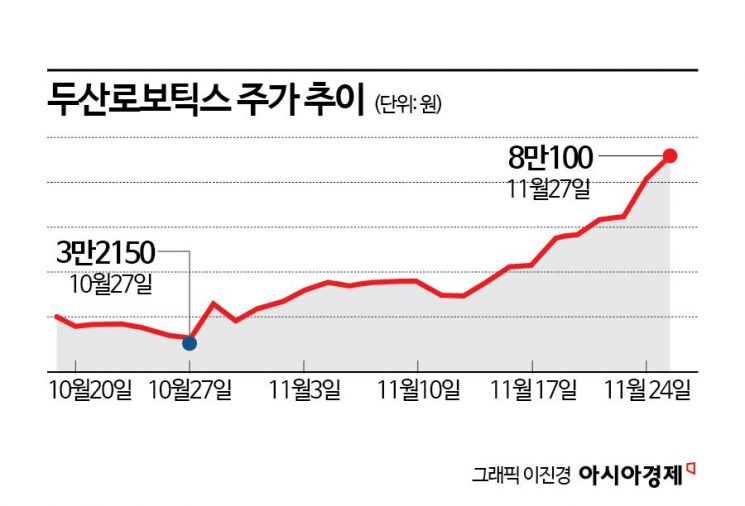

According to the Korea Exchange on the 28th, Doosan Robotics' stock closed at 80,100 KRW based on the previous day's closing price. It rose 115.03% in just one month compared to the end of last month (37,250 KRW), entering the 80,000 KRW range for the first time since its listing. During intraday trading, it even surged to 89,100 KRW, approaching the 90,000 KRW mark. Compared to the initial public offering price (26,000 KRW) at the time of listing on the 5th of last month, it has more than tripled.

The robot industry is considered a representative future growth sector. In particular, since the amendment to the "Intelligent Robot Development and Distribution Promotion Act (Intelligent Robot Act)" came into effect on the 17th, Doosan Robotics has emerged as a key beneficiary. The core of the amendment is to recognize robots as "pedestrians," allowing them to move on outdoor sidewalks just like people. As a result, the potential for robots to be used in various fields such as food delivery, shipping, outdoor cleaning, and disinfection has greatly increased.

However, Doosan Robotics has yet to escape operating losses. According to Doosan Robotics, in the third quarter, sales amounted to 12.511 billion KRW, with an operating loss of 6.137 billion KRW. Although sales increased about 1.5 times compared to the same period last year, the deficit widened. The loss also increased compared to the previous quarter. Doosan Robotics explained the poor performance by stating, "The recovery speed of the North American front market was delayed due to the continued global high interest rates."

The securities industry evaluates that Doosan Robotics has great growth potential. Globally, demand for robots is on a clear upward trend. It is analyzed that Doosan Robotics has laid the foundation for external growth by achieving its goal of securing 103 sales channels earlier than planned this year. Baek Gi-yeon, a researcher at Meritz Securities, said, "There is robot demand, but the company is expected to sequentially enter markets it has not yet penetrated," adding, "From 2024, sales channels in the UK and Germany will be opened for entry into advanced European markets, and partnerships with Rockwell Automation in the existing North American market will be strengthened to further expand sales channels."

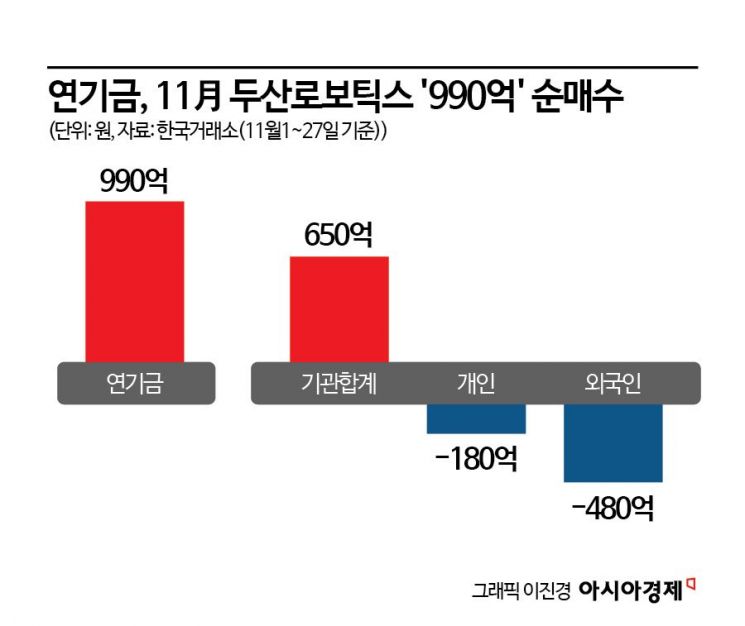

It is also noteworthy that conservative pension funds have been net buyers of Doosan Robotics this month. Pension funds have net purchased a total of 98.8 billion KRW worth of Doosan Robotics shares this month. During this period, this was the largest net purchase amount by pension funds among all listed companies in Korea. While the domestic stock market experienced increased volatility in November due to issues such as the full ban on short selling, pension funds reduced their stock asset proportions by selling 304 billion KRW worth of stocks overall. Amid this, they actively bought Doosan Robotics shares. Following Doosan Robotics, the top stocks net purchased by pension funds were Samsung SDI (66.9 billion KRW), Kakao (44.3 billion KRW), Hanwha Aerospace (43.5 billion KRW), and Krafton (39.1 billion KRW), in that order.

Meanwhile, the stock most sold by pension funds this month was Celltrion, with a net sale of 118 billion KRW. This was followed by Samsung Electronics (-54.2 billion KRW), KB Financial Group (-54.1 billion KRW), Hana Financial Group (-45.5 billion KRW), POSCO Holdings (-45.3 billion KRW), and SK Hynix (-45 billion KRW), respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)