Recorded the Highest Monthly Return This Year with Slowing Uptrend This Month

Expectations for Interest Rate Cuts Decline... "Short-term Selling Absorption Process, Uptrend Not Broken"

The KOSPI's upward momentum, which recorded the highest monthly return so far this year, is slowing down. Since it rose rapidly, it appears to be taking a breather, leading to forecasts that the recovery of the 2600 level may be delayed until early next year.

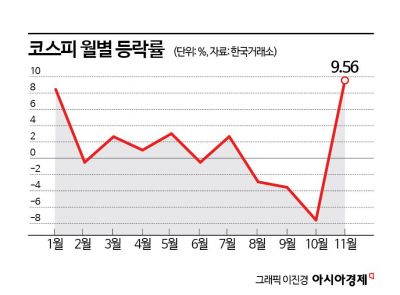

According to the Korea Exchange on the 28th, the KOSPI rose 9.56% this month, the highest monthly figure this year. Considering that it fell 7.59% last month, marking the largest monthly drop, this month's rise stood out.

However, the recent upward momentum is showing signs of slowing. On the 24th, the KOSPI fell 0.73%, dropping below the 2400 level, and it closed slightly down the following day, remaining below 2400 for two consecutive days. Analysts suggest that after such a steep rise, it is time for a breather. Kim Dae-jun, a researcher at Korea Investment & Securities, said, "The KOSPI recorded the highest monthly return this year in November, largely thanks to domestic and international interest rate declines and changes in supply and demand due to the short-selling ban. However, given the rapid pace of the rise, it would not be surprising if it takes a break at any time."

The retreat of expectations for interest rate cuts, which had been a driving force behind the stock market's rise, also seems to have influenced the slowdown. Lee Kyung-min, a researcher at Daishin Securities, explained, "At one point, the expectations for U.S. Federal Open Market Committee (FOMC) interest rate cuts in May and June next year were as high as 65% and 89%, respectively, but they have dropped to 47% and 70%. The market had expected a total of 100 basis points (1bp = 0.01 percentage points) of rate cuts starting in May next year, but after the release of the FOMC minutes, it seems the market has begun to recognize that the rate cut expectations were somewhat excessive." He added, "Fluctuations due to changes in interest rate cut forecasts (consensus) are inevitable for the time being."

Although it was initially expected that the 2600 level would be recovered by the end of the year, the breather is likely to delay the recovery of the 2600 level. Lee Jae-sun, a researcher at Hyundai Motor Securities, said, "The current valuation of the KOSPI has risen to the high end of a price-to-earnings ratio (PER) of around 10 times, eliminating its undervaluation appeal. Unless there is a rebound in Chinese indicators that affect the profit improvement of export stocks, the recovery of the previous high of 2600 is expected to occur in early next year rather than by the end of this year."

Although the market will go through a process of digesting short-term selling pressure, the upward trend is not expected to break. Researcher Lee Kyung-min said, "Although short-term volatility expansion is inevitable, it is likely to be a short-term correction during the upward process that has been unfolding since the late October low. What is needed is the digestion of short-term selling pressure and the resolution of overheating, not a break in the upward trend."

As the market looks for the next catalyst after interest rate stabilization, attention is expected to focus on the U.S. and China’s November Purchasing Managers' Index (PMI) and South Korea’s November export figures. Lee Kyung-min explained, "Through China’s November PMI, it is expected that the validity of China’s economic recovery can be confirmed, but if it is weaker than expected, concerns about the Chinese economy could expand, leading to a weaker yuan, a weaker won, and instability in the Korean stock market’s supply and demand." This suggests that the KOSPI’s short-term fluctuations may last longer.

The U.S. November PMI is expected to fall short of expectations. Kim Dae-jun said, "Last Friday, the U.S. November S&P Manufacturing PMI was released, recording 49.4, which was lower than both the previous month and the forecast. Since it did not exceed the 50 mark, which is the threshold for economic expansion, the Institute for Supply Management (ISM) Manufacturing PMI, scheduled to be announced on the 1st of next month, is also likely to be weak."

South Korea’s November exports, to be released on the 1st of next month, are expected to grow 5.7% year-on-year, continuing the increase for two consecutive months. Lee Kyung-min said, "There is a high possibility that semiconductor exports will turn positive for the first time in 16 months. The clear improvement in the manufacturing economy and exports led by semiconductors will provide support for the KOSPI’s rebound."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.