KB Seondo Apartment 50 Index Turns Downward from September This Month

Buying Demand Weakens Due to Loan Interest Rate Hikes

The recent recovery trend in prices of major high-end apartment complexes in South Korea is slowing down. This is attributed to weakened buyer sentiment due to loan regulations and the continuation of a high-interest rate environment, leading to an increase in sellers lowering prices to attract buyers.

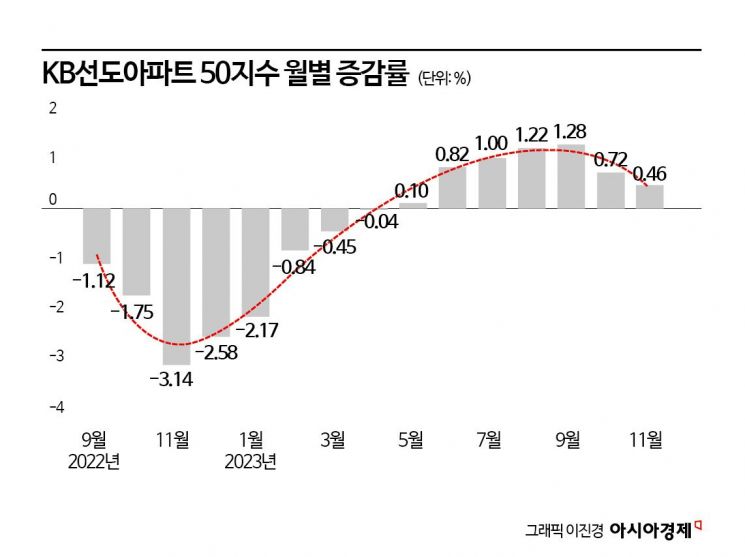

According to KB Real Estate statistics on the 28th, the monthly growth rate of the November KB Leading Apartment 50 Index was 0.46%, a decrease from the previous month’s 0.72%. This index had plummeted to -3.14% in November last year but turned positive at 0.10% in May this year and rose to 1.28% by September, showing signs of recovery. However, the growth rate slowed in October and decreased further this month.

The KB Real Estate Leading Apartment 50 Index is a statistical index that annually selects the top 50 apartment complexes nationwide by market capitalization (number of households × price). The list of leading apartments includes Helio City in Songpa-gu, Parkrio, Jamsil Elite (Els, Resentz, Tridium), Olympic Athletes’ Village, Banpo Xi in Seocho-gu, and Eunma Apartments in Gangnam-gu. Since these are high-end, major apartment complexes in Seoul, the index provides insight into market trends. It is especially regarded as a useful statistical indicator for gauging market flow during downturns.

The trend toward price stabilization is also confirmed in actual transactions. According to the Ministry of Land, Infrastructure and Transport’s Real Transaction Price Disclosure System, an 84㎡ unit in Helio City, Garak-dong, Songpa-gu, was traded at 2.13 billion KRW in September but sold for 2.0 billion KRW (8th floor) last month. The same unit type in this complex hit a peak price of 2.38 billion KRW in October 2021, dropped to 1.53 billion KRW earlier this year, then recovered to 2.13 billion KRW last month, before falling by 130 million KRW within a month. Helio City, which had relatively active transactions despite price drops of several hundred million KRW earlier this year, recorded no transactions as of the 27th.

An 84㎡ unit in Parkrio, Sincheon-dong, Songpa-gu, was traded up to 2.17 billion KRW in October but fell by 180 million KRW this month, selling for 1.99 billion KRW (23rd floor) and 1.92 billion KRW (19th floor).

The slowdown in the price rise of high-end apartments is due to increased loan interest rates amid the high-interest rate environment. The Cost of Funds Index (COFIX), which serves as the benchmark for variable-rate mortgage loans, has risen for two consecutive months, pushing the maximum mortgage interest rate above 7% per annum. Additionally, concerns about a possible economic recession next year have spread in the market, further dampening buying demand. The Housing Purchase Consumer Sentiment Index for Seoul in October, released by the Korea Research Institute for Human Settlements, dropped by 11.4 points from the previous month to 116, barely maintaining an upward trend.

Experts say the slowing trend of the leading index reflects the future direction of Seoul’s housing market. Kim Kyun-pyo, Senior Deputy Director of KB Real Estate Statistics, stated, "A change rate of 0.5% can be considered almost stable. If representative complexes in Korea hover around zero in price, areas on the outskirts of Seoul are likely to decline further. When Seoul apartment prices showed positive growth, the leading index’s increase was much higher." In fact, the November price change rates for housing and apartments in Seoul were 0.01% and 0.04%, respectively, lower than the leading index.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)