Jung Seonggong Omidia Senior Researcher Presentation

Outlook on the DRAM Industry Changing in the AI Era

HBM Share Continues to Increase in the DRAM Market

"Competition Shifts Toward Qualitative Growth"

According to market research firm Omdia's survey of DRAM market share in the third quarter, SK Hynix's share reached 35%. As the importance of high-bandwidth memory (HBM) grows in the era of artificial intelligence (AI), there is a forecast that the DRAM industry landscape could shift to a winner-takes-all structure focused on quality.

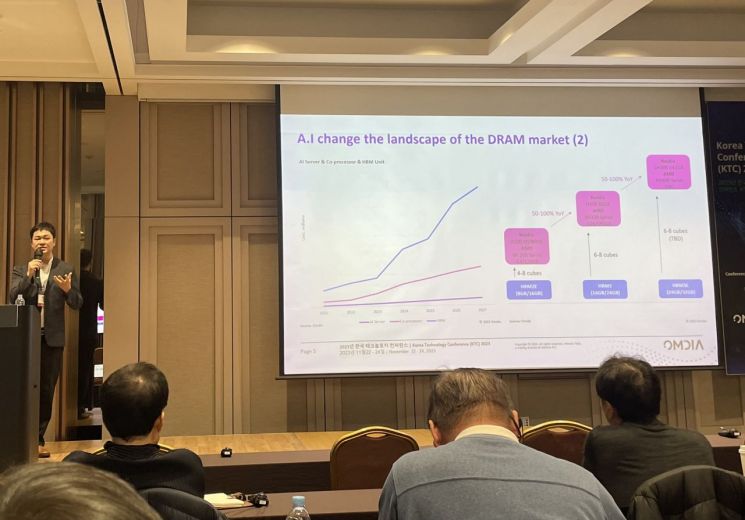

Jung Sung-gong, a senior researcher at Omdia, stated this on the 23rd at the 'Omdia Korea Conference 2023' held at COEX. In his presentation titled "AI Changes the Landscape of the DRAM Market," Jung said, "DRAM is one of the industries that has greatly benefited from AI growth," and predicted significant changes in the DRAM industry going forward.

Jung Seong-gong, Senior Researcher at Omdia, is giving a presentation at the 'Omdia Korea Conference 2023' held at COEX on the 23rd. / Photo by Kim Pyeong-hwa

Jung Seong-gong, Senior Researcher at Omdia, is giving a presentation at the 'Omdia Korea Conference 2023' held at COEX on the 23rd. / Photo by Kim Pyeong-hwa

Jung explained that the proportion of AI servers has recently increased due to the generative AI effect, and AI demand is expected to continue in the mid to long term. He also mentioned that since DRAM plays a significant role in AI training, related demand is increasing as well. In particular, he highlighted the remarkable growth of HBM, which is gaining attention as memory for AI.

From this year through 2027, the DRAM market revenue growth rate is expected to average 21% annually, while the HBM market is projected to grow by 52%. The share of HBM in DRAM market revenue is expected to exceed 10% this year and approach 20% by 2027.

Jung said, "Major global IT companies are lining up to receive HBM," adding, "Although HBM manufacturers plan to more than double their capacity next year, the waiting demand has extended to 52 weeks, so this will not be sufficient to meet it."

HBM is priced 5 to 7 times higher than general products and has a short replacement cycle of 1 to 2 years. For major HBM suppliers such as Samsung Electronics and SK Hynix, this represents a great opportunity to increase DRAM performance. SK Hynix's DRAM market share has also increased due to the HBM effect. Jung explained, "According to Omdia's data, SK Hynix's share reached 35% in the third quarter," calling it "the highest share since SK Hynix's founding."

The phenomenon of HBM demand exceeding supply is expected to continue. Additionally, DRAM manufacturers are likely to increase supply centered on premium products such as HBM, placing mainstream products as a lower priority starting next year. In this case, Jung explained that supply constraints will enhance the price negotiation power of DRAM manufacturers for mainstream products.

The DRAM industry's practice of achieving economies of scale by focusing on high-demand products to secure cost competitiveness and thereby enhance business competitiveness is also expected to change. Since HBM is a premium product and it is difficult to improve production yield (the ratio of good products among finished goods), quality must be guaranteed to increase supply volume in the market.

Jung said, "In the past, DRAM manufacturers actively expanded capacity in a 'space war' competition, but now qualitative growth is important," adding, "Going forward, market trends may change depending on technological competition, especially in back-end processes."

He also said, "Since the HBM market is not one that everyone can enter, in the upcoming upcycle, some companies with technological capabilities will dominate the market," and added, "The market will shift to a form where companies with technological competitiveness continuously monopolize profits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)