Used Whiskey Sales Over 50,000 Won Increase

60% of Whiskey Buyers Are in Their 20s and 30s

Impact of MZ Generation's 'Digging' and SNS Verification Trend

The MZ generation (Millennials + Generation Z), who used to look for inexpensive whiskey to enjoy highballs, is now showing interest in high-end whiskeys. As more people seek to savor the unique flavors rather than mixing them in drinks, sales of mid-to-high-priced whiskeys over 50,000 won have doubled compared to a year ago.

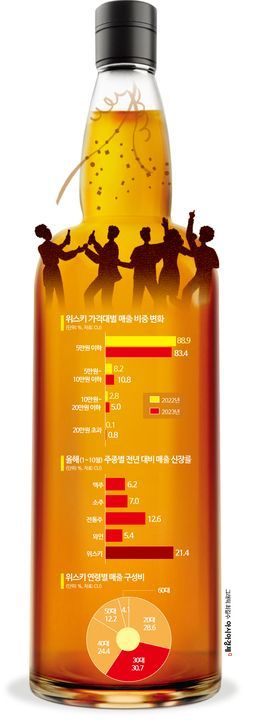

According to GS Retail on the 24th, the sales growth rate of whiskeys priced over 50,000 won from January to October this year was recorded at 100%. Considering that the sales growth rates for value-for-money whiskeys under 30,000 won and those priced between 30,000 and 50,000 won were only 45% and 30% respectively, it is interpreted that more consumers are seeking high-end whiskeys. At CU as well, while sales volume of whiskeys under 50,000 won decreased compared to last year, whiskeys priced over 50,000 won sold better. In particular, the sales share of whiskeys priced between 100,000 and 200,000 won accounted for 5% of total sales, doubling from 2.8% last year.

Currently, more than half of whiskey sales at convenience stores come from customers in their 20s (28.6%) and 30s (30.7%). A convenience store industry insider explained, "Among the MZ generation, the ‘digging’ trend?where individuals take a keen interest and act on specific fields?has taken root, increasing the number of whiskey enthusiasts," adding, "This behavior is reflected through social networking services (SNS), leading to trends where people showcase high-end or hard-to-find whiskeys."

As sales of high-end whiskeys increase, whiskey sales overall are also on the rise. Among alcoholic beverage categories at CU from January to October, whiskey showed the highest sales growth rate. It increased by 21.4% compared to the same period last year, surpassing traditional Korean liquors (12.6%), soju (7%), beer (6.2%), and wine (5.4%). With the rise in sales growth rate, the share of whiskey in the alcoholic beverage category also grew. From January to October, whiskey’s sales share was 4.2%, up 1 percentage point from 3.2% the previous year.

Following this trend, convenience stores are strengthening whiskey sales. GS25 has expanded its whiskey product lineup and currently offers about 1,000 different whiskey products. CU is promoting awareness of purchasing various whiskeys through liquor events. Recently, through the mobile ‘Letjugo’ event, 3,500 bottles of popular high-end whiskeys were sold, resulting in a 330% increase in whiskey sales compared to the week before the event.

The liquor industry expects whiskey’s popularity to continue for the time being. While the overall demand for whiskey might decrease if the highball craze cools down, it is assessed that whiskey’s popularity will not fade rapidly like wine. A representative from a major liquor company said, “Unlike wine, whiskey can be enjoyed over a long period since it can be savored slowly,” adding, “We believe demand from younger generations will continue, so liquor companies are continuously searching to diversify whiskey import sources.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)