Two Major SK Group Affiliates and Multiple Mid-sized Construction Firms

Increase in Repeat Applicants Sparks Fairness Debate

A total of 29 large and medium-sized enterprises, including SK Ecoplant, Hansol Paper, Socar, and Taepyeongyang Mulsan, are raising funds with the support of the Korea Credit Guarantee Fund (KODIT). Some companies, such as affiliates of the Hansol Group and the Isu Group, have issued private bonds several times this year with KODIT's support. It is reported that requests for financial support from companies facing difficulties in raising funds due to rising interest rates and deteriorating credit ratings are flooding KODIT.

Choi Wonmok, Chairman of the Korea Credit Guarantee Fund, who attended the National Assembly audit last October [Image source=Yonhap News]

Choi Wonmok, Chairman of the Korea Credit Guarantee Fund, who attended the National Assembly audit last October [Image source=Yonhap News]

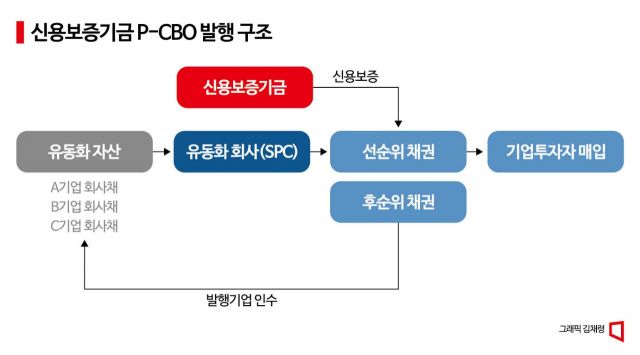

According to the investment banking (IB) industry, KODIT will issue Primary Collateralized Bond Obligations (P-CBO) worth a total of 457.4 billion KRW on the 27th. The method involves acquiring private bonds issued by 29 companies struggling to secure liquidity and then reissuing collateralized securities backed by multiple bonds as underlying assets (a type of collateral). KODIT will provide guarantees for the CBO equivalent to the government's credit rating. KB Securities, Samsung Securities, Korea Investment & Securities, IBK Investment & Securities, Kiwoom Securities, and Kyobo Securities participated as lead managers for the private bond issuance.

Among the companies securing liquidity with KODIT's support this time, two are SK Group affiliates: SK Ecoplant, a construction and eco-friendly business affiliate, and SK Advanced, a subsidiary of SK Gas engaged in the propane dehydrogenation (PDH) process business. Thanks to KODIT's support, SK Ecoplant and SK Advanced will raise 30 billion KRW and 40 billion KRW respectively through 3-year maturity bonds at interest rates of 6.32% and 5.66%. SK Ecoplant, preparing for an initial public offering (IPO), is facing difficulties due to a downturn in the construction market, while SK Advanced is struggling with fund raising amid consecutive losses.

Among medium-sized enterprises, Isu Exachem (21 billion KRW), Daeryun ENS (20 billion KRW), EasyBio (20 billion KRW), Megabox Joongang (16 billion KRW), Hansol Paper (15 billion KRW), Taepyeongyang Mulsan (15 billion KRW), and Socar (10 billion KRW) are included in the list of companies supported by KODIT. Among construction companies, Dongmoon Construction (20 billion KRW), Gyeryong Construction Industry (18 billion KRW), Ilseong Construction (9.6 billion KRW), and Pine Construction (5.4 billion KRW) issued private bonds with KODIT's support. The private bond issuance interest rates for medium-sized companies ranged from the mid-5% to mid-6% levels.

As the scale of KODIT's guarantee business increases due to real estate project financing (PF) defaults and deteriorating corporate credit ratings, the number of companies successfully raising funds with consecutive KODIT support is increasing. Affiliates of the Hansol Group such as Hansol Paper and Hansol Home Deco, affiliates of the Isu Group such as Isu Chemical and Isu Exachem, as well as Socar and Dongmoon Construction, were also included in the support list during the P-CBO issuance last October, securing liquidity.

An IB industry official said, "As the number of companies finding it difficult to raise funds due to high interest rates and economic downturn increases, competition to receive support from KODIT is intensifying," adding, "In this situation, some companies repeatedly receive government support, raising concerns about fairness in some quarters." The official also predicted, "As the government increases the scale of corporate financial support through KODIT and others, the scale of KODIT's P-CBO issuance will increase significantly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.