Minimum 61.7 Billion KRW in New Share Public Offering Funds Excluding 34.4% European Sales

Efforts to Improve Financial Structure by Lowering Debt Ratio

Bio-diesel producer DS Danseok is pursuing an initial public offering (IPO) to be listed on the Korea Exchange. Since all the funds raised will be used to repay debt and the proportion of existing shares sold exceeds 30%, attention is focused on whether the demand forecast will be successful.

According to the Financial Supervisory Service's electronic disclosure system on the 23rd, DS Danseok's public offering size totals 1.22 million shares, consisting of 800,000 new shares and 420,000 existing shares. The expected price range for the offering is set between 79,000 and 89,000 KRW per share. Excluding the sale of existing shares, the company plans to raise at least 61.7 billion KRW.

Founded in 1965 as Nobel Chemical Industry, DS Danseok operates three business divisions: bioenergy, battery recycling, and plastic recycling. The bioenergy division produces biodiesel for vehicles, bio-heavy oil for power generation, and bio-marine fuel for ships. DS Danseok has maintained the number one export market share in biodiesel since 2017, recording a 71% export share as of last year.

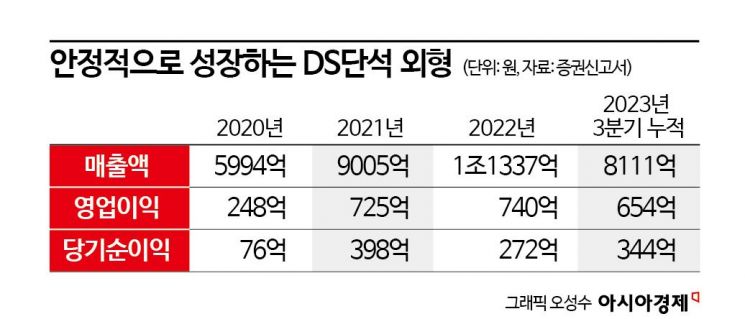

The battery recycling division collects waste lead-acid batteries (used batteries) generated worldwide and manufactures recycled lead metal. These products are sold to major domestic and international battery manufacturers. The plastic recycling division produces key additives used in petrochemical processing products based on naphtha extracted from the petroleum refining industry. As of the third quarter of this year, the sales composition ratio was 64.7% for the bioenergy division, and 21.5% and 6.7% for the battery and plastic recycling divisions, respectively. Last year, the company achieved sales of 1.1337 trillion KRW, operating profit of 74 billion KRW, and net profit of 27.2 billion KRW.

The funds raised from the public offering will be used to improve the financial structure. As of the end of October this year, total borrowings amounted to 386.6 billion KRW. Short-term and long-term borrowings were 280.1 billion KRW and 106.5 billion KRW, respectively, with short-term borrowings being higher. The company explained that most short-term borrowings are credit products for raw material purchases. The debt ratio stands at 240%, and it is expected that repaying debt with the 61.7 billion KRW raised from the offering will improve the debt ratio and reduce interest expenses.

The higher the offering price, the greater the funds raised and the more significant the debt ratio improvement. The demand forecast will be conducted over five business days from the 5th to the 11th of next month.

However, it is uncertain how institutional investors will judge the expected price range during the demand forecast. The lead underwriters, KB Securities and NH Investment & Securities, separately valued each business division to determine DS Danseok's appropriate corporate value. For the bioenergy division, they applied an average price-earnings ratio (PER) of 9.81 times based on Aekyung Chemical and JC Chemical. The battery recycling division was compared with Korea Zinc and Young Poong. The plastic recycling division was benchmarked against Songwon Industrial and KD Chem. The total value of the three divisions was 615.1 billion KRW, with a per-share value of 104,953 KRW. Applying a discount rate of 15.2% to 24.7%, the expected offering price range was set at 79,000 to 89,000 KRW.

The average discount rate applied by newly listed companies on the domestic stock market when presenting their expected offering price range is between 24.6% and 39.1%. The underwriters explained that the lower discount rate applied in this case reflects considerations of industry characteristics and profitability.

DS Danseok Chairman Han Seung-wook stated, "Through the IPO, we will solidify the competitive advantage of our key business divisions and will not hesitate to invest in business for high growth."

DS Danseok's existing share sales involve part of the 1.51 million shares held by major shareholder Stonebridge Eco No.1 Private Equity Partnership. Through the public offering, 420,000 shares will be sold, and the remaining shares will be subject to a lock-up period of at least three months.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)