Case of Acquisition Tax Evasion by Hospital Director A through Establishing a False Head Office Outside Major Cities and Acquiring Real Estate within Major Cities

Case of Acquisition Tax Evasion by Hospital Director A through Establishing a False Head Office Outside Major Cities and Acquiring Real Estate within Major Cities

Gyeonggi Province identified 11 corporations that evaded acquisition tax surcharges by relocating their corporate headquarters outside metropolitan areas but actually conducting headquarters operations within metropolitan areas, and reclaimed 14.6 billion KRW.

From August 14 to November 3, Gyeonggi Province conducted a focused investigation on 15 corporations that evaded the surcharge tax rate by falsely registering their headquarters outside metropolitan areas while acquiring real estate within metropolitan areas. It announced on the 22nd that it reclaimed 14.5 billion KRW in evaded acquisition tax surcharges from 9 corporations and 100 million KRW in omitted acquisition incidental costs (interest, fees, etc.) from 2 corporations.

Earlier, starting in June, Gyeonggi Province selected 217 corporations that established headquarters outside metropolitan areas as investigation targets. Using aerial photos, road views, and internet portal searches, it excluded 76 corporations judged to have offices actually existing and operating at their registered addresses, selecting 141 corporations for the first round of investigation.

Subsequently, through on-site inspections and inquiries at the time of real estate acquisition, 35 corporations were selected for in-depth investigation. Visits to business sites, interviews with representatives and employees, and multifaceted analysis of the types of acquired properties led to the final investigation of 15 corporations suspected of evading acquisition tax surcharges.

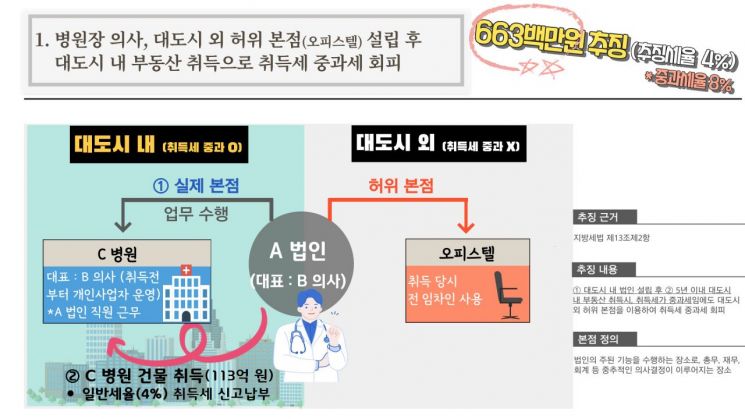

In a key case, Mr. B, a doctor and representative of Corporation A, established headquarters in an officetel outside the metropolitan area and acquired the C Hospital building within the metropolitan area for 11.3 billion KRW, reporting and paying acquisition tax at the general rate (4%). Gyeonggi Province confirmed that until the acquisition date, tenants resided in the officetel outside the metropolitan area and that Corporation A had no access there. Furthermore, both Mr. B and employees worked at the acquired C Hospital building within the metropolitan area, leading to the conclusion that Corporation A’s actual headquarters operations were conducted within the metropolitan area, resulting in a 700 million KRW reclaim.

One-person company Corporation D established headquarters at an acquaintance’s office outside the metropolitan area and acquired land and buildings of a knowledge industry center within the metropolitan area for 192.3 billion KRW, reporting and paying acquisition tax at the general rate. However, Gyeonggi Province obtained a statement from the acquaintance’s office confirming only the address was lent, and employee testimonies stating all corporate work was conducted at the office of related Corporation E within the metropolitan area. It also confirmed that most business promotion expenses such as welfare costs were spent near Corporation E’s office, reclaiming 5.4 billion KRW.

One-person company Corporation F established headquarters at a shared office outside the metropolitan area and acquired land within the metropolitan area for 44 billion KRW, reporting and paying acquisition tax at the general rate. However, Gyeonggi Province found that due to the small size of the shared office (contract area 3.3㎡) and its characteristics, it was unlikely to be used for accounting, general affairs, or finance work. Employee testimonies confirmed all corporate work was conducted at the office of related Corporation G within the metropolitan area, leading to a reclaim of 2 billion KRW.

Ryu Young-yong, Director of the Tax Justice Division of Gyeonggi Province, stated, "This investigation allowed us to focus on verifying the likelihood of evasion through false headquarters registrations and metropolitan area surcharge evasion. We will expand related investigations to block intelligent evasion acts and strive to realize fair tax justice."

Meanwhile, under the current Local Tax Act, if a corporation is effectively established and operated in metropolitan areas such as Gyeonggi and Seoul and acquires real estate within metropolitan areas through purchase within five years, an acquisition tax rate of 8%, double the general rate of 4%, is applied. In Gyeonggi Province, 14 cities including Suwon, Goyang, Uijeongbu, Gunpo, and Gwacheon fall under this regulation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.