Securitization of Receivables from Hanwha Solutions and LG Household & Health Care

Seeking Alternative Financing Amid Credit Rating Downgrades and Rising High-Interest Burden

Yeocheon NCC and Isu Chemical have raised funds by securitizing accounts receivable from supplying petrochemical products to Hanwha Solutions, LG Household & Health Care, and others. It is interpreted that petrochemical companies, facing difficulties in raising funds due to high interest rates and deteriorating credit ratings, secured liquidity by utilizing accounts receivable (money to be received) from affiliates and business partners.

According to the investment banking (IB) industry, Yeocheon NCC raised approximately 100 billion KRW by issuing asset-backed securities based on accounts receivable. They entrusted 210 billion KRW worth of accounts receivable to Shinhan Bank and issued asset-backed securities using trust beneficiary certificates as collateral. Shinhan Investment Corp. acted as the lead arranger for the fund raising.

Yeocheon NCC decomposes naphtha, a raw material for petrochemicals, into intermediate materials such as ethylene and propylene, and supplies them to petrochemical companies. Hanwha Solutions and DL Chemical separated and established the naphtha cracking center (NCC) facility, and currently, both companies hold 50% equity each. Yeocheon NCC holds accounts receivable worth approximately 800 billion KRW as of the end of Q3 this year from supplying products to its shareholders and related companies. It is known that sales to shareholders and related parties exceed 50% of this amount.

Yeocheon NCC utilized accounts receivable from Hanwha Solutions for this fund raising. Going forward, when Hanwha Solutions makes payments using a dedicated purchase credit card, principal and interest will be paid to the investors of the asset-backed securities. Through this accounts receivable securitization, Yeocheon NCC can secure immediate liquidity, while Hanwha Solutions can manage cash liquidity by postponing the payment date of accounts receivable.

Isu Chemical, a petrochemical company affiliated with the Isu Group, recently raised 40 billion KRW by using future accounts receivable as collateral. Future accounts receivable securitization involves issuing asset-backed securities based on accounts receivable that will be generated in the future, rather than existing confirmed accounts receivable. This method raises funds by utilizing non-existent receivables as securitized assets.

Isu Chemical mainly supplies petrochemical products to its top affiliate, Isu Exachem. Isu Exachem is a company wholly owned by Kim Sang-beom, chairman of the Isu Group. It acts as a sales and distribution channel by purchasing products from Isu Chemical, adding a margin, and then selling to the final consumers. Because of this, Isu Exachem has been pointed out as a corporation used to support the major shareholder. The accounts receivable securitization this time utilized receivables from LG Household & Health Care, Aekyung Chemical, and others.

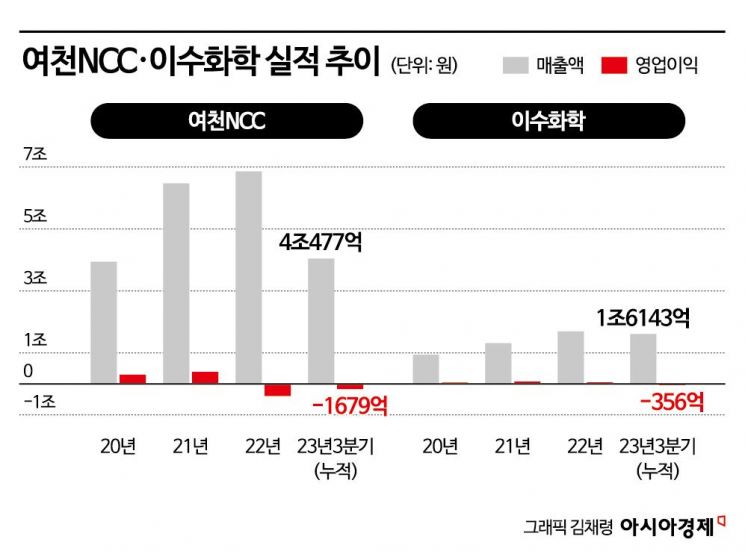

Yeocheon NCC and Isu Chemical’s use of accounts receivable to raise funds is interpreted as a result of weakened financing ability due to high interest rates and deteriorating credit ratings. Yeocheon NCC recorded an operating loss of 386.7 billion KRW last year and a cumulative loss of 167.9 billion KRW through the end of Q3 this year. Consecutive losses combined with the burden of facility expansion have increased borrowings, leading to a deteriorating credit rating. Their credit rating has dropped one notch to A and A2 (short-term credit rating) this year. Isu Chemical’s financial burden has increased due to continued support for affiliates such as Isu Construction and Isu Exachem. Despite the financial burden, sales have steadily increased. Its credit rating remains at BBB, making corporate bond issuance difficult.

An IB industry official said, "With continued interest rate hikes this year and polarization in the bond market intensifying, accounts receivable securitization by construction and petrochemical companies suffering from sluggish business conditions is increasing," adding, "As investors continue to avoid corporate bonds with low credit ratings, the securitization of accounts receivable by these companies is expected to keep rising."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.