Newly Listed Companies Exempt from Earnings Disclosure...No Obligation for Q2 Earnings Disclosure

Key Issue: Whether the Rule Is Being Deliberately Abused...Unfair Trading Practices Also Under Review

Institutional Investors and Timing of Sales by Underwriters Also Being Investigated

Financial authorities are broadly investigating Pado, which was listed as a technology-specialized company last August, ranging from 'revenue inflation' to potential unfair trading practices. It has been confirmed that the financial authorities have requested additional explanations from Pado.

According to financial authorities on the 22nd, Pado recently completed the first round of explanations regarding the contents of the securities registration statement submitted at the time of listing to the Financial Supervisory Service (FSS). An FSS official stated, "Some parts have been explained, but some still require additional clarification."

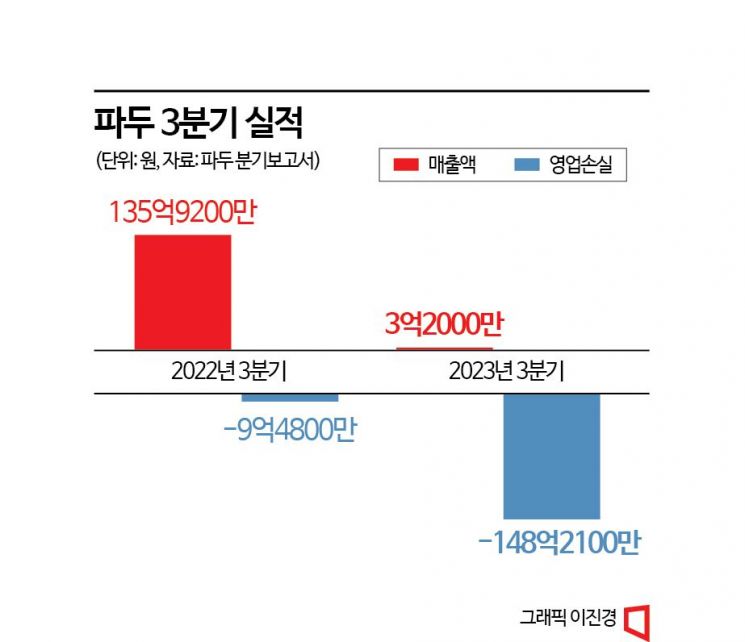

The reason the FSS is scrutinizing Pado's listing process is due to the third-quarter earnings announcement. Pado disclosed that its third-quarter sales this year were 321 million KRW, a 98% decrease compared to the same period last year. The cumulative sales up to the third quarter were 18.044 billion KRW, down 44.6%. The second-quarter sales confirmed through the cumulative third-quarter results were 59 million KRW. The market was shocked by this figure, which is practically negligible sales.

The issue of the second-quarter results being highlighted in the third-quarter earnings disclosure stems from the earnings disclosure deferral rule applied to newly listed companies. According to Articles 159(3) and 160 of the Capital Markets Act, if a newly listed company discloses matters equivalent to a business report in its securities registration statement, it is exempted from submitting the report for that quarter.

Newly listed companies are obligated to submit business reports from the time the public offering funds are paid in. However, if the obligation arises after the fiscal year-end, the report can be disclosed starting from the next quarter. Pado's public offering fund payment date was August 1. Since the first quarter fiscal year-end of June 30 had passed, there was no obligation to disclose second-quarter results.

Pado reportedly had no sales of third-generation SDD controllers in the second quarter. This was due to a global IT customer with a data center canceling their order. It appears Pado did not anticipate the order cancellation. CEO Lee Ji-hyo was conducting meetings in the U.S. for new orders and additional contracts until recently but hurriedly returned this week after the FSS requested explanations.

The FSS is primarily verifying whether Pado deliberately concealed unfavorable information by exploiting the disclosure blind spot. The key issue is when the company became aware of the order cancellations. Even if the company learned of the performance deterioration late, it is criticized for not actively informing the market about the earnings shock.

On August 7th, the Korea Exchange held a listing ceremony for Padu Co., Ltd. on the KOSDAQ market.

On August 7th, the Korea Exchange held a listing ceremony for Padu Co., Ltd. on the KOSDAQ market. [Image source=Yonhap News]

Furthermore, the FSS is investigating not only Pado but also the possibility of unfair trading practices by early institutional investors and the listing underwriters. Both the Disclosure Review Office and Investigation Division 1 are involved in the Pado case.

Investigation Division 1 handles violations of the Capital Markets Act, especially unfair trading practices. According to Article 178(2) of the Capital Markets Act, making false statements or omitting important matters to gain financial benefits constitutes fraudulent unfair trading.

Forest Partners, an early investor in Pado, sold its shares between the 2nd and 8th, just before the earnings announcement, earning about 29 billion KRW. The selling price per share was slightly higher than the public offering price of 31,000 KRW, ranging from 33,000 to 34,000 KRW. On the day of the earnings announcement (the 9th), the stock price hit the lower limit, falling into the 20,000 KRW range, and continued to plunge the next day, closing at 18,970 KRW.

When a company is listed on KOSDAQ, underwriters are required to subscribe to at least 3% of the shares. Pado's lead underwriter is NH Investment & Securities, and the joint underwriter is Korea Investment & Securities. NH Investment & Securities reportedly sold some of Pado's shares and retains the rest.

A financial investment industry official said, "Recently, the Korea Exchange extended the lock-up period for mandatory subscription shares from three months to six months, which is interpreted as a repercussion of the Pado incident. If Pado's earnings improve clearly, the controversy will subside, but if the fourth-quarter results are also poor, how the FSS judges Pado's explanations will be important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)