Only the Insurance Index Among 28 KRX Indices Declined This Month

Stock Prices of All 10 Listed Insurance Companies Underperform KOSPI Growth

Concerns Over Reduced Dividend-Available Profits Due to New Accounting Standard (IFRS17) Implementation

Recently, the stock market has been on an overall upward trend, triggered by the slowdown in inflation rates in the United States. However, insurance industry stocks have yet to recover from their sluggish performance. Although investors typically show increased interest in bank and insurance stocks, which usually have high dividend payout ratios, during the year-end dividend season, this year they have not gained momentum due to newly implemented accounting standards, macroeconomic factors, and regulatory authorities.

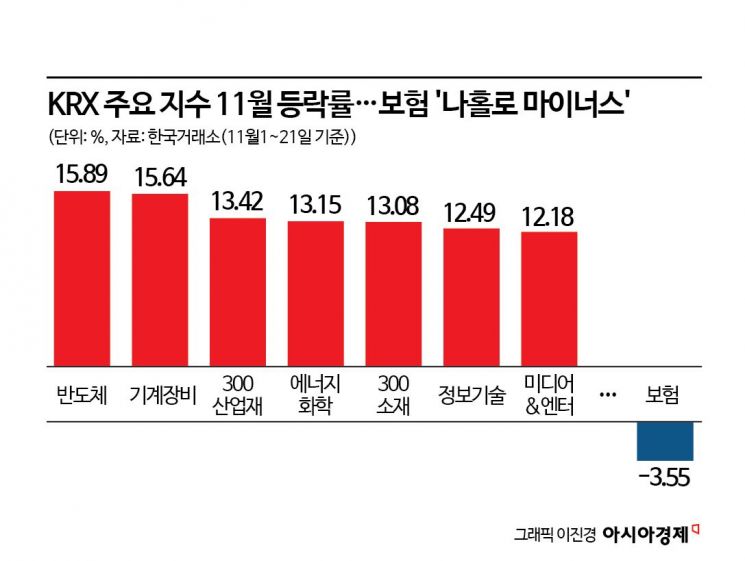

According to the Korea Exchange on the 22nd, out of the 28 KRX indices, 27 have risen this month, with the insurance index being the only one to decline. Compared to the end of last month, the KRX insurance index fell by 3.55%. Considering that the KOSPI rose by 10.20% this month, the insurance sector has effectively been running "solo in reverse" against the market trend. The KRX semiconductor index rose the most among all KRX indices, up 15.89%, followed by KRX machinery equipment (15.64%), KRX 300 industrials (13.42%), KRX energy chemicals (13.14%), and KRX 300 materials (13.08%).

The KRX insurance index is composed of 10 insurance company stocks listed on the domestic stock market, all of which underperformed the KOSPI's rise. Among them, DB Insurance's stock price dropped the most this month, falling by 7.96%. Six stocks, including Samsung Life Insurance, Samsung Fire & Marine Insurance, and Hyundai Marine & Fire Insurance, recorded negative returns.

Insurance stocks are typically considered representative dividend stocks alongside banks. Furthermore, the insurance industry's performance up to the third quarter has been evaluated as better than previously feared. Nevertheless, the reason for the sluggish stock prices is concerns that the introduction of the new accounting standard (IFRS17) this year may reduce distributable profits. With the adoption of IFRS17, the 'Contractual Service Margin (CSM),' which represents future recognized profits, has emerged as a key investment indicator, making the acquisition of new contracts extremely important.

However, new contract growth in the insurance industry is expected to slow somewhat next year. Seol Yong-jin, a researcher at SK Securities, stated, "This is due to the base effect from discontinued marketing of short-term payment whole life insurance this year and the increase in savings-type insurance since the end of 2022," adding, "Overall, we expect new contract CSM to be similar to or slightly lower than this year."

Additionally, the recent U.S. October Consumer Price Index (CPI) release falling short of market expectations has led to hopeful forecasts that the timing of interest rate cuts may be brought forward, which negatively impacted insurance stocks. As investment funds in the stock market have concentrated on growth stocks such as secondary batteries and IT, the insurance sector, classified as a defensive industry, has been relatively neglected. Ahn Young-jun, a researcher at Hana Securities, analyzed, "There is still significant uncertainty before strong earnings translate into increased dividends," and "If the recent stock price decline does not coincide with a significant increase in dividends per share (DPS), the expected dividend yield is not considered attractive." He added, "Since this is the first year of IFRS17 adoption, DPS increases should be viewed somewhat conservatively."

However, securities firms expect the insurance industry to continue its earnings growth next year and maintain its value as a 'dividend stock' in the long term. Jung Min-ki, a researcher at Samsung Securities, said, "Potential variables next year include interest rate declines and possible dividend regulations," but added, "With IFRS17 adoption, the actual fundamental changes due to interest rate fluctuations have been reduced compared to the past, so the focus is expected to be on stable dividend growth over the mid to long term rather than rapid short-term dividend increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.