Financial Authorities "Instruct to Explore Measures to Directly Lower Interest Rates"

Likely to Reduce Interest Rates on Both New and Existing Loans

Possibility of Significant Expansion in Interest Rate Support Targets

Kim Ju-hyun, Chairman of the Financial Services Commission, and Lee Bok-hyun, Governor of the Financial Supervisory Service, are attending the 'Financial Holding Company Chairmen Meeting' held on the 20th at the Korea Federation of Banks building in Jung-gu, Seoul, exchanging opinions. Photo by Kang Jin-hyung aymsdream@

Kim Ju-hyun, Chairman of the Financial Services Commission, and Lee Bok-hyun, Governor of the Financial Supervisory Service, are attending the 'Financial Holding Company Chairmen Meeting' held on the 20th at the Korea Federation of Banks building in Jung-gu, Seoul, exchanging opinions. Photo by Kang Jin-hyung aymsdream@

The eight major financial holding companies (KB, Shinhan, Hana, Woori, NH Nonghyup, BNK, DGB, JB) have agreed to prepare a plan to reduce interest rates for self-employed individuals and small business owners worth 2 trillion won by the end of the year. The banking sector expects that the beneficiaries of the interest reduction will be significantly expanded to include not only new borrowers but also existing borrowers.

On the 20th, Financial Services Commission Chairman Kim Joo-hyun said at a meeting with the chairmen of the eight major financial holding companies, "Considering the desperate situation of self-employed individuals and small business owners burdened by high interest rates, please devise a 'tangible and directly felt measure' that can 'lower the certain level of interest burden that has increased after the end of COVID-19' within the 'maximum range that does not harm the soundness' of financial companies." Accordingly, the eight major financial holding companies have formed a task force (TF) led by the Korea Federation of Banks to start preparing countermeasures.

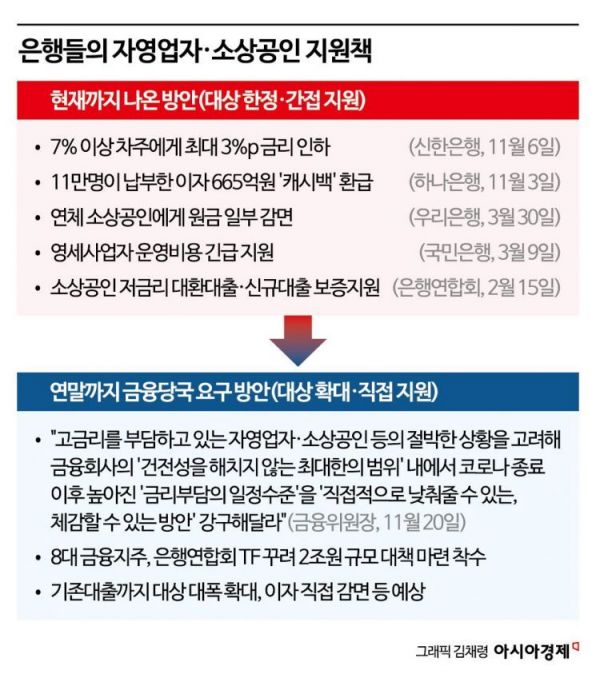

Interest Reduction Should Extend to Existing Loans to Be Felt

So far, support measures for self-employed individuals and small business owners have occasionally come from the banking sector. However, most were limited in scope or indirect measures. Early this month, measures included "reducing interest rates by up to 3 percentage points for borrowers paying over 7% interest (Shinhan Bank)" and "refunding about 66.5 billion won of interest paid by approximately 110,000 people in the form of a 'cashback' (Hana Bank)." In March this year, measures such as "writing off part of the principal for delinquent small business owners (Woori Bank)," "emergency support for operating costs for micro-businesses (Kookmin Bank)," and "low-interest refinancing loans and new loan guarantee support (jointly by the Korea Federation of Banks)" were also introduced.

The financial authorities judge that these measures are insufficient. Before this meeting, the financial holding companies submitted coexistence plans to the Financial Services Commission, but these were rejected, and new plans were requested by the end of the year for this reason. A representative from a commercial bank said, "For example, if interest reductions were only given to self-employed borrowers with a 7% interest rate until now, the target should be expanded to borrowers with 6% or 5% interest rates in the future." He added, "Since President Yoon said that 'small business owners are serving as bank slaves,' and the financial authorities have stepped in, interest reduction benefits should be extended not only to new loans but also to existing loans so that small business owners can feel the benefits evenly."

Universal Support Expected Like Communication Fee Reduction

Another commercial bank official interpreted, "Just as telecom companies reduced communication fees for the entire population, the financial authorities might mean to provide universal support to small business owners by saying 'we will reduce interest rates by a few percentage points starting next month'." The official added, "After President Yoon's 'bank money feast' remark in February this year, the government's approval rating rose. Since the parliamentary elections are approaching next year, unprecedented support measures for the self-employed through the banking sector would help gain votes."

The support scale is likely to be around 2 trillion won. The Democratic Party of Korea referred to the 'windfall tax' bill it proposed on the 14th. The windfall tax imposes additional taxes on banks under the name of 'coexistence finance contributions.' If this bill passes, the burden on the banking sector this year will be about 1.9 trillion won. Chairman Kim said, "Financial holding companies are probably aware that the National Assembly expects at least this much from the windfall tax." This essentially serves as a guideline to prepare measures equivalent to this amount.

Financial Services Commission: "The Scope and Extent of Interest Rate Reduction Are Key"

Kim Juhyun (third from right), Chairman of the Financial Services Commission, and Lee Bokhyun (fourth from left), Governor of the Financial Supervisory Service, are greeting the financial holding company chairmen attending the "Financial Holding Company Chairmen Meeting" held on the 20th at the Federation of Banks Building in Jung-gu, Seoul. Photo by Kang Jinhyung aymsdream@

Kim Juhyun (third from right), Chairman of the Financial Services Commission, and Lee Bokhyun (fourth from left), Governor of the Financial Supervisory Service, are greeting the financial holding company chairmen attending the "Financial Holding Company Chairmen Meeting" held on the 20th at the Federation of Banks Building in Jung-gu, Seoul. Photo by Kang Jinhyung aymsdream@

The financial authorities and President Yoon have stepped up pressure because banks have achieved record profits through interest income during the period of rising interest rates. According to the Financial Supervisory Service, the cumulative net income of domestic banks from the first to the third quarter this year was 19.5 trillion won, an increase of 5.4 trillion won (38.2%) compared to the same period last year. Interest income (revenue concept) from the first to the third quarter was 44.2 trillion won, up 3.6 trillion won (8.9%) from the same period last year.

A senior official from the Financial Services Commission said, "The support measures should be designed so that benefits go mainly to borrowers with high interest rates," adding, "The key to the support measures is how banks decide the level of high interest rates and how much interest they will reduce."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.