Bitcoin Spot ETF Approval, Expectations for End of Tightening

Positive Signals from Exchange Bitcoin Holdings and Stablecoin Trading Volume

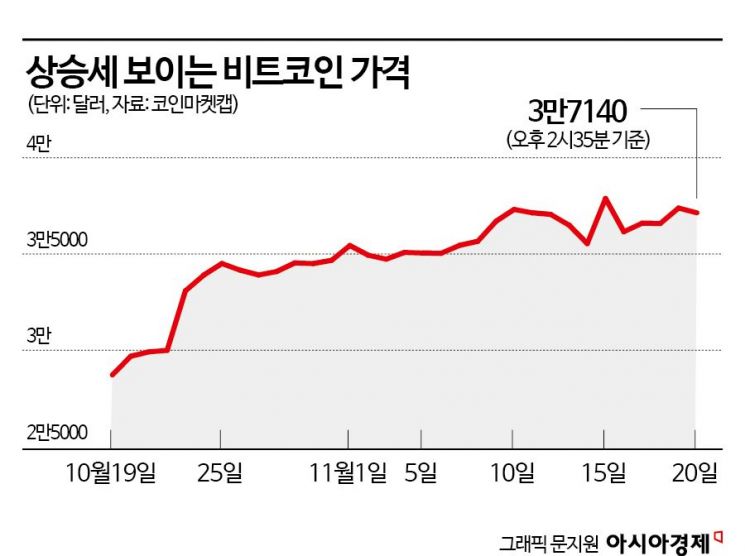

The price of Bitcoin, the leading virtual asset, surpassed $37,000, recovering to the price level seen in May of last year. As the price rises, indicators showing expectations for further price increases are also improving, attracting investors' attention.

According to the global virtual asset market tracking site CoinMarketCap, as of 2:35 PM on the 20th, the price of Bitcoin was recorded at $37,138 (approximately 47.98 million KRW), up 1.58% from the previous day. Compared to a month ago, this is a 27% increase, and more than 122% higher than a year ago.

Bitcoin's price rose due to expectations for the launch of a spot exchange-traded fund (ETF) and easing concerns about tightening. In particular, the launch of a Bitcoin spot ETF had a significant impact on the market. If approved, it is expected that investor inflows will increase significantly, and institutional investors' participation in the coin market will improve. This is because investors can invest in Bitcoin through securities accounts without needing a separate virtual asset account. Additionally, asset management companies operating Bitcoin spot ETFs are required to hold underlying assets roughly equivalent to the amount under management, which is expected to increase Bitcoin purchases.

Until last month, Bitcoin's price had not reached the $30,000 level, but thanks to these positive factors, it has maintained the $37,000 range after gaining upward momentum. There are also expectations that the "crypto winter" has ended and a bull market will emerge. Although the price briefly dropped to around $35,000 following news that the U.S. Securities and Exchange Commission (SEC) postponed the Bitcoin spot ETF application by the virtual asset specialized asset management company Hashdex, it recovered and returned to the $37,000 range.

Besides the price, other figures also reveal expectations for Bitcoin price increases. According to data from CryptoQuant, a virtual asset data provider, the amount of Bitcoin held by virtual asset exchanges has been gradually decreasing. Generally, the lower the amount of Bitcoin held by exchanges, the higher the buying pressure on Bitcoin, which tends to drive prices up. On the 13th of last month, exchanges held 2,056,284 Bitcoins, but this amount decreased to 2,010,023 by the 9th of this month. Since then, it has remained around 2,040,000.

Furthermore, the increase in trading volume of stablecoins, which serve as currency in the virtual asset market, is interpreted as a positive signal. Stablecoins are virtual assets designed to be pegged to fiat currencies and are used as a means of coin trading.

Comparing the average daily trading volume of Tether (USDT), the highest-ranked stablecoin by market capitalization, between last month and this month, a significant increase was observed. Last month, the average daily trading volume of USDT was 27.4079 billion units, which rose to 39.59895 billion units this month, marking a 44.52% increase.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.