Financial Services Commission's Innovative Finance Review Subcommittee Passes... Regulatory Sandbox Approval Expected by End of Month

Korea Exchange Finalizing Procedures for STO Listing, Trading, and Disclosure

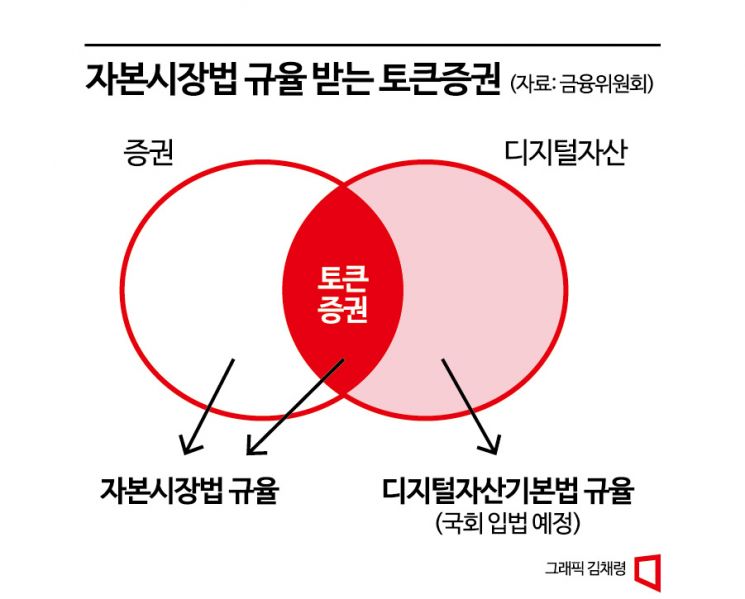

The financial authorities will approve the regulatory sandbox for the digital securities market within this month. Once the regulatory sandbox is passed, from next year, token securities (STO) backed by assets such as artworks and real estate will be tradable on the exchange market. The Korea Exchange also plans to hold a briefing session for the industry early next year and actively proceed with the establishment of the STO exchange market.

According to the Financial Services Commission, last week the Innovative Financial Services Review Subcommittee approved the "Pilot Plan for Opening the Investment Contract Securities and Non-Monetary Trust Beneficiary Certificates Market (Pilot Opening of the STO Exchange Market)." The Financial Services Commission plans to hold a main committee meeting at the end of this month to approve the regulatory sandbox.

STOs are mainly issued in the form of investment contract securities or trust beneficiary certificates. In the case of investment contract securities, unlike stocks (equity securities) or bonds (debt securities), trading (circulation) on the exchange market is not possible. The STO-related bill, which includes the issuance of STOs through blockchain and over-the-counter market circulation, is currently pending in the National Assembly. Therefore, to circulate STOs issued in the form of investment contract securities backed by assets such as artworks on the exchange market, regulatory exemptions must be obtained.

Together Art, Sotu, and Yeolmae Company are representative companies recognized as issuers of fractional investment investment contract securities. They are currently preparing to submit securities registration statements to the Financial Supervisory Service. However, even if the securities registration statement is approved, trading on the exchange market is impossible if the market is not established.

With the Financial Services Commission submitting the pilot opening of the STO exchange market to the Innovative Financial Services, the establishment of the STO market is also gaining momentum. The Korea Exchange, as the operator of the exchange market, plans to hold a briefing session for the industry after the Financial Services Commission’s approval of the regulatory exemption.

A Korea Exchange official said, "We are in the final stages of detailing regulations on STO listing procedures, trading, and disclosure," adding, "We plan to listen to industry opinions at the briefing session and make improvements to open the STO exchange market without any setbacks."

Experts expect that the listing procedures for STOs issued as investment contract securities will be similar to those for equity securities (stocks). However, it is explained that conditions will be adjusted to fit the nature of the underlying assets rather than focusing on performance indicators such as sales and operating profit. It is also evaluated that applying the disclosure standards for listed companies as they are will be difficult.

A representative of a token securities issuer explained, "Even if the financial authorities approve the regulatory exemption at the end of this month and the securities registration statement is approved, the exchange listing review must be passed," adding, "Considering the listing procedures and disclosure preparations, it may take more time before actual circulation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)