CEO Lee Ji-hyo Changes US Business Trip Schedule for Early Return

Plans to Explain SSD Controller Order Status

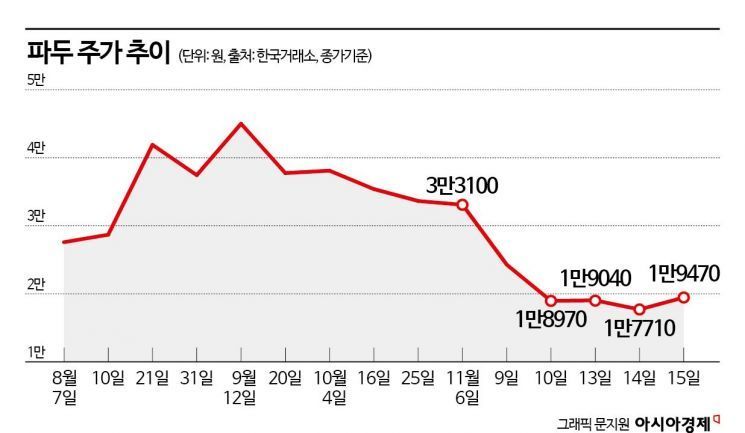

Pado is belatedly starting to communicate with investors. Misunderstandings grew due to a lack of communication with the market regarding the earnings shock, which led to a stock price plunge and allegations of 'revenue inflation.'

According to Pado on the 16th, it will hold an investor relations (IR) session for institutional investors as early as next week. To prepare for this, Pado CEO Lee Ji-hyo is changing her business trip schedule in the U.S. and is expected to return today. At this event, Pado plans to provide detailed explanations about the cancellation of solid-state drive (SSD) sales in the 2nd and 3rd quarters and the resumption of orders in the 4th quarter.

On August 7th, at the Korea Exchange, officials are taking a commemorative photo at the listing ceremony of Padu Co., Ltd. on the KOSDAQ market. From left to right: Yudo Seok, Executive Director of the Korea IR Council; Kang Wangrak, Vice Chairman of the KOSDAQ Association; Lee Buyeon, Deputy General Manager of the KOSDAQ Market Headquarters at the Korea Exchange; Lee Ji-hyo, CEO of Padu Co., Ltd.; Jung Young-chae, CEO of NH Investment & Securities; Bae Young-gyu, Head of the IB Group at Korea Investment & Securities.

On August 7th, at the Korea Exchange, officials are taking a commemorative photo at the listing ceremony of Padu Co., Ltd. on the KOSDAQ market. From left to right: Yudo Seok, Executive Director of the Korea IR Council; Kang Wangrak, Vice Chairman of the KOSDAQ Association; Lee Buyeon, Deputy General Manager of the KOSDAQ Market Headquarters at the Korea Exchange; Lee Ji-hyo, CEO of Padu Co., Ltd.; Jung Young-chae, CEO of NH Investment & Securities; Bae Young-gyu, Head of the IB Group at Korea Investment & Securities. Photo by Yonhap News

Pado was listed as a technology-specialized company in August. Its main business is producing SSD controllers used in data centers. Global IT companies such as Microsoft (MS), Meta, and Google receive NAND chips to operate their data centers. NAND has excellent storage capacity but suffers from slow processing speeds. To compensate for this, the device that controls speed and performance is the SSD controller.

Pado gained attention as a unicorn company before its listing by successfully securing a contract with Meta. Meta requested SK Hynix, which supplies NAND to Meta, to "deliver products equipped with Pado controllers."

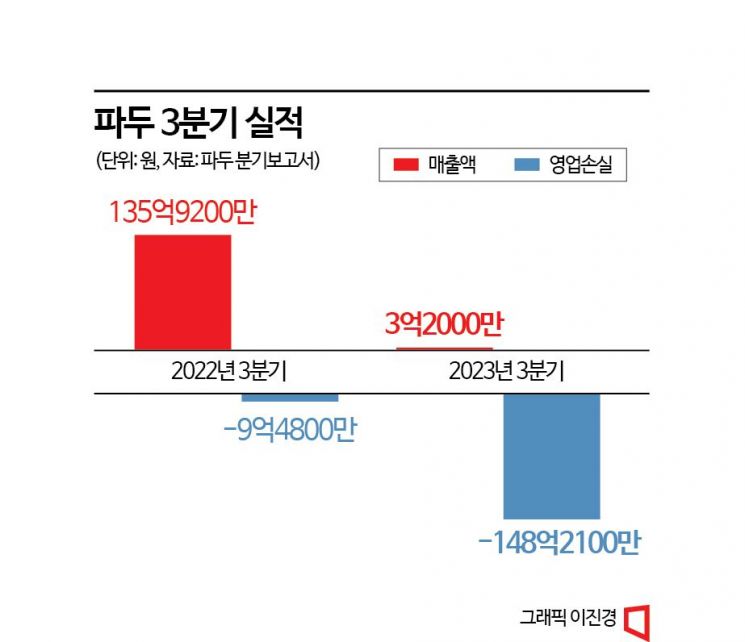

Although its technological capabilities were recognized, communication with the market was not smooth. In particular, there was a significant gap between the annual revenue estimate of 120.3 billion KRW disclosed in the securities registration statement during the listing preparation and the actual performance. This year, Pado recorded sales of 17.7 billion KRW in Q1, 590 million KRW in Q2, and 320 million KRW in Q3. Pado is not obligated to disclose half-year results, so the Q2 results became known only when the Q3 report was released. The cumulative sales for Q1 to Q3 amounted to 18 billion KRW, which is only about 15% of the estimated revenue. Even with a Q4 'earnings surprise,' it is considered difficult to reach the original estimate.

The Q3 earnings shock has its reasons. It was caused by the cancellation of orders for the main product, the 3rd generation SSD controller. Pado has been selling both 3rd and 4th generation SSD controllers. However, following Q2, the sales of the 3rd generation SSD controller were recorded as '0' in Q3 as well. This situation is completely different from the earlier expectation that "the order cancellation was a short-term inventory adjustment and purchases would resume from Q3."

As the controversy spread, financial authorities are now investigating whether Pado deliberately concealed the sharp decline in performance during the listing process. A Financial Supervisory Service official said, "We need to hear the company's explanation and verify the circumstances and facts regarding the absence of sales," adding, "It is too early to discuss the next steps."

Pado explained belatedly, "U.S. data center companies changed their direction and entered a tightening phase from the first half of this year, leading MS, Meta, and Google to start workforce restructuring and investment cuts. Because of this, the NAND suppliers, who are Pado's customers, also stopped purchasing SSD controllers, resulting in a halt in sales for Q2 and Q3."

A representative from a KOSDAQ-listed company commented, "Given the talks about SK Hynix developing its own controller, the fact that Pado did not mention the cancellation of orders in Q3 following Q2 seems to have increased investors' anxiety," adding, "The market environment is unfavorable, and missing the timing for communication exacerbated the situation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.