No Brand Sales from January to October Up 8.7% YoY

Surpassing Supermarket Growth Rate... "Affordable and High-Quality Products Popular Amid High Inflation"

As high inflation persists, sales of private brand (PB) products at large discount stores have significantly increased. Since PB products are cheaper than those made by national brands (NB) but do not differ much in quality, consumers trying to save even a small amount of money have flocked to PB products in large numbers.

According to the distribution industry on the 16th, the sales of No Brand, which is stocked at E-Mart, grew by 8.7% year-on-year from January to October. Considering that the sales of domestic large discount stores in the first and second quarters of this year increased by only 0.3% and 1.8% year-on-year, respectively, No Brand's sales growth rate far exceeded the overall growth rate of the stores. Last month, the consumer price index rose by 3.8% compared to the same month last year, approaching 4%, and amid the ongoing high inflation, PB products, which are relatively cheaper than NB products, attracted consumers.

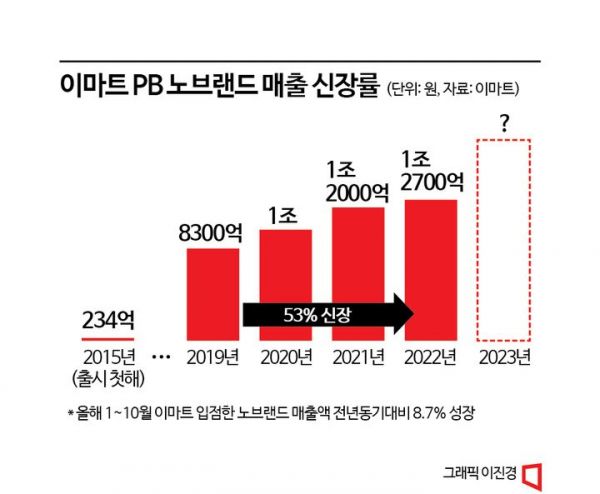

The PB market size has been growing every year. No Brand's sales increased by 53%, from 830 billion won in 2019 to 1.27 trillion won in 2022. Among Homeplus's PB brands, 'Homeplus Signature' showed a sales growth rate close to 219% compared to 2019. Additionally, Lotte Mart's food and beverage (F&B) PB brand 'Yorihada' recorded a growth rate exceeding 20% year-on-year from January to October.

Looking at individual products, milk showed particularly remarkable sales growth among PB products at large discount stores. Homeplus's ultra-low-price PB brand 'Simple Plus' milk sales increased by 60% year-on-year from January to October this year. Lotte Mart's PB milk products also showed growth rates in the 50% range. As raw milk prices increased by 88 won per liter (8.8%), milk manufacturers raised milk prices by an average of 4-9% starting last month, prompting consumers to start purchasing the more affordable PB milk products. Currently, the price of Homeplus 'Simple Plus Grade 1 Milk 900mL' (2-pack) is 3,990 won. Although the price has risen by about 5% due to the raw milk price increase, it is only about 70% of the price of NB milk products.

An official from the distribution industry said, "There is also an effect of retaining customers by offering high-quality products at reasonable prices," adding, "Due to high inflation, sales of PB products, which offer extreme cost-effectiveness, are expected to increase significantly this year as well."

Although PB product consumption is increasing, there are opinions that it cannot be said that domestic consumers are currently receiving more high-quality products. Professor Seo Yong-gu of the Department of Business Administration at Sookmyung Women's University said, "The PB ratio is a barometer of how developed the distribution industry is as a corporate distribution industry, but in Korea, there are many 'mom-and-pop stores' (ordinary small business stores), so discount stores have not competitively launched PB products to attract consumers," adding, "PB demand will grow further, but due to the structure of the domestic distribution industry, it will take time to receive high-quality products like in advanced countries."

In fact, looking at the PB sales ratio of domestic large discount stores, E-Mart has the highest at around 20%, while Lotte Mart and Homeplus are both around 10%. In contrast, the PB ratio of large discount stores in advanced countries such as Europe and North America ranges from 50% to 100%. The UK retailer 'Marks & Spencer' has a PB ratio approaching 100%, and the German supermarket chain 'Aldi' approaches 90%. Aldi is known for offering ultra-low-price products where marketing and brand costs are not passed on to prices, earning high trust from American consumers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)