Meritz Fire & Marine Insurance Tops 3Q Net Profit... Surpasses Samsung Fire & Marine

CSM Scale Rises to 3rd Place... Reactions to 'Big 5' Reshuffle

As the third-quarter earnings of major non-life insurance companies were announced, there are forecasts that the long-standing 'Big 4' structure may change. With the introduction of the new accounting standard IFRS17 and regulatory guidelines to prevent earnings inflation, rankings have begun to fluctuate rapidly. Meritz Fire & Marine Insurance has made significant strides, surpassing the net profits of the existing four major companies. There are even voices suggesting a shift to a 'Big 5' or even 'Big 3' structure.

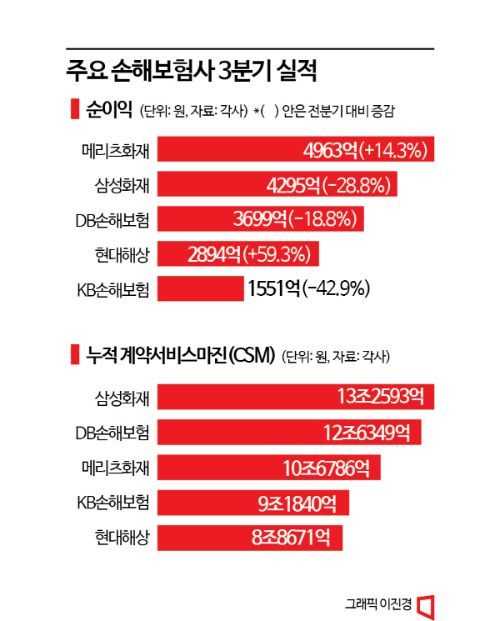

According to industry sources on the 14th, Meritz Fire & Marine Insurance recorded the highest net profit among domestic non-life insurers in the third quarter of this year. On a separate basis, it posted 496.3 billion KRW, an increase of 14.3% from the previous quarter and 29.2% year-on-year. It surpassed the net profits of the so-called 'Big 4' large companies, including Samsung Fire & Marine Insurance (429.5 billion KRW), DB Insurance (369.9 billion KRW), Hyundai Marine & Fire Insurance (289.4 billion KRW), and KB Insurance (155.1 billion KRW).

The net profit growth was also commendable. Meritz Fire & Marine Insurance's third-quarter net profit increased by 14.3% compared to the previous quarter, outperforming Samsung Fire & Marine Insurance (-28.8%), DB Insurance (-18.8%), and KB Insurance (-42.9%).

As a result, the cumulative net profit from the first to the third quarter of this year rose to a level sufficient to break the 'Big 4' structure. It recorded 1.3353 trillion KRW up to the third quarter, a 26.7% increase year-on-year. It ranked second after Samsung Fire & Marine Insurance (1.6433 trillion KRW). It also surpassed DB Insurance (1.2624 trillion KRW), which decreased by 8.2% year-on-year, and achieved results twice as high as Hyundai Marine & Fire Insurance (786.4 billion KRW) and KB Insurance (680.3 billion KRW).

Meritz Fire & Marine Insurance also ranked high based on the new profitability indicator Contractual Service Margin (CSM) introduced with the IFRS17 accounting standard. CSM is a concept that amortizes and recognizes the profit generated from insurance contracts annually, reflecting the insurer's future profits. As of the end of the third quarter, Meritz Fire & Marine Insurance's CSM was 10.6786 trillion KRW, ranking third after Samsung Fire & Marine Insurance (13.2593 trillion KRW) and DB Insurance (12.6349 trillion KRW). It surpassed the 10 trillion KRW mark faster than KB Insurance (9.184 trillion KRW) and Hyundai Marine & Fire Insurance (8.8671 trillion KRW).

The changed structure compared to the first half is attributed to the impact of the Financial Supervisory Service's IFRS17 guideline application. Previously, the Financial Supervisory Service judged that non-life insurers inflated their earnings by loosely assuming the loss ratio of indemnity medical insurance and the lapse rates of no-surrender and low-surrender insurance when adopting the new IFRS17 accounting standard, and thus created stricter application guidelines to be reflected from the third-quarter results. Meritz Fire & Marine Insurance is considered the most conservative company in applying related assumptions in the industry. Lee Hong-jae, a researcher at Hyundai Motor Securities, explained, "Considering the difference between Meritz Fire & Marine Insurance's first-quarter estimates and actual figures and the scale of surrender reserves, it is estimated that conservative assumptions were already applied, so the impact of accounting treatment methods will be relatively small." Meritz Fire & Marine Insurance also explained the reason for its strong performance as "a result of focusing on fundamentals, such as not recklessly joining overheated sales competition, pursuing qualitative growth centered on high-quality contracts, and conservative asset management."

Amid this upward trend, there are voices in the industry that the Big 4 structure based on performance may be broken. An insurance industry official said, "Everyone is surprised by Meritz Fire & Marine Insurance's growth," adding, "We need to observe future net profit trends, but if the gap widens this much, there are even reactions that it might be necessary to refer to the group as the Big 5 or, like the life insurance industry, as the 'Big 3'."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.