WGBI, a Strong Candidate for Transfer Next Year... Short-Selling Temporary Ban Hinders Qualitative Evaluation

10-Year Challenge to MSCI Watchlist Status Also Virtually Dashed

Foreign Media Uniformly Criticize, "Advancement of Korean Capital Market Will Be Delayed"

The inclusion of Korea in the Morgan Stanley Capital International (MSCI) Developed Markets Index and the World Government Bond Index (WGBI) has long been a key aspiration of the Korean government to demonstrate the advancement of its domestic securities and government bond markets and to achieve a leap forward in its capital markets. However, recent unexpected temporary bans on short selling have been widely reported by foreign media as significant obstacles to Korea's capital markets advancing to developed market status. In the case of the WGBI, since Korea met the quantitative criteria, it was expected to be included next year, but the prevailing view is that this will effectively be a lost cause. This is due to the likelihood of negative qualitative evaluations stemming from inconsistent and unsuitable regulatory policies.

Next Year’s WGBI Inclusion Effectively a Lost Cause

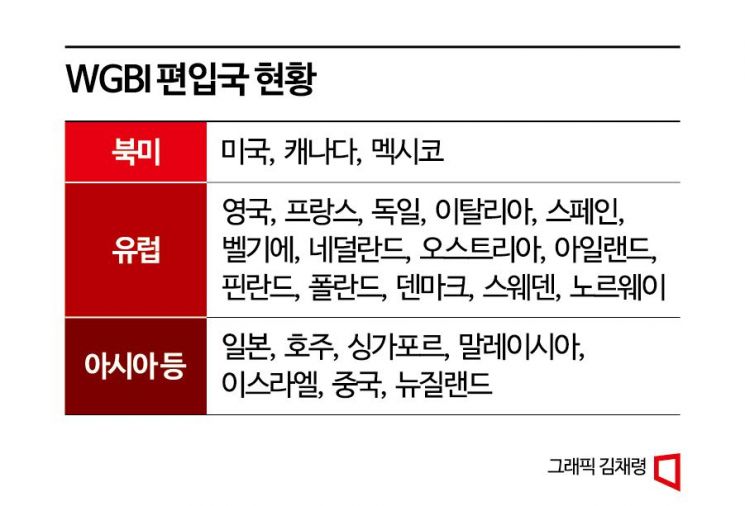

Korea’s early inclusion in the WGBI this year ultimately failed. The WGBI is a government bond index published by the UK-based Financial Times Stock Exchange (FTSE) Russell. It is a representative global bond index that includes government bonds from major developed countries such as the United States. The WGBI is classified as one of the world’s three major bond indices alongside Bloomberg-Barclays (BBGA) and JP Morgan Emerging Market Bond Index (GBI-EM).

New inclusions in the WGBI occur during biannual regular reviews. Countries with a high likelihood of inclusion are listed as WGBI watch list countries in FTSE Russell’s bond market country classification report. After confirming whether inclusion criteria are met, an official inclusion announcement is made. Korea was added to the WGBI watch list at the end of September last year, raising expectations for early inclusion in the second half of this year.

On September 28 (local time), FTSE Russell announced the FTSE bond market country classification, maintaining Korea’s watch list status but deferring WGBI inclusion. The WGBI inclusion criteria set by FTSE Russell include quantitative standards such as market size and credit rating, as well as qualitative criteria. Quantitative evaluation requires a government bond issuance balance of $50 billion (approximately 62 trillion KRW) and a sovereign credit rating of A- or higher by Standard & Poor’s (S&P). Korea meets both quantitative criteria: market size of $50 billion and credit ratings of A- (S&P) and A3 (Moody’s).

However, Korea failed due to some qualitative criteria related to market accessibility. Market experts explained, "The market accessibility under-evaluation factors include tax burdens on non-residents, foreign exchange market openness, and convenience of using global custodians."

Korea has been pursuing WGBI inclusion since the latter part of the Moon Jae-in administration. In the first year of the Yoon Suk-yeol administration last year, efforts were made to improve conditions, including a tax law revision that exempted foreigners (non-residents) and foreign corporations from taxes on interest and capital gains from Korean government bonds. Additionally, efforts were made to enhance connectivity with international central securities depositories and to expand foreign exchange market openness to improve market accessibility required for index inclusion.

Thanks to these tax reforms and other efforts, Korea was added to the watch list in September last year. Although early inclusion this year failed, market experts judged that inclusion next year was likely. Lee Bok-hyun, Governor of the Financial Supervisory Service, also predicted that inclusion would be possible next year since most WGBI inclusion conditions were met, unlike the more challenging MSCI developed market index which requires lifting restrictions on offshore won trading and short selling bans. In an interview with the Financial Times (FT) in September, Governor Lee expressed optimism, saying, "Inclusion will bring more medium- to long-term bond funds into the market, contributing to foreign exchange market stability."

However, with the full ban on short selling starting November 6, voices expressing uncertainty about next year’s WGBI inclusion are growing. A senior official in the financial investment industry noted, "Quantitative criteria mostly relate to bonds, so there is no direct impact, but qualitative evaluation will receive negative scores."

The evaluation focuses on how freely foreigners can access the domestic bond market, and concerns about Korea’s capital market are already being expressed in global markets. The short selling ban has maximized negative evaluations. The official said, "Qualitative evaluation assesses regulatory consistency, coherence, predictability, and rationality overall. However, foreigners view the short selling regulations very negatively in terms of regulatory consistency, so passing the qualitative evaluation will be difficult." Another industry insider added, "Although the ban is temporary until the end of June next year, unless fundamental improvements to prevent illegal short selling are introduced, it is uncertain when short selling will resume. The unique characteristics and uncertainties of Korea’s capital market are increasing, so it is unlikely that the market accessibility evaluation will be positive."

MSCI Inclusion Expectations Dim

Expectations for inclusion in the MSCI Developed Markets Index have become unattainable. MSCI is one of the global stock market benchmark indices developed by the US mega investment bank Morgan Stanley. Along with the FTSE indices published by FTSE International Limited, established by the UK’s Financial Times and London Stock Exchange, MSCI indices serve as investment benchmarks for international financial funds. The MSCI indices are broadly divided into MSCI DM (Developed Markets), MSCI EM (Emerging Markets), Frontier Markets, and Single Markets.

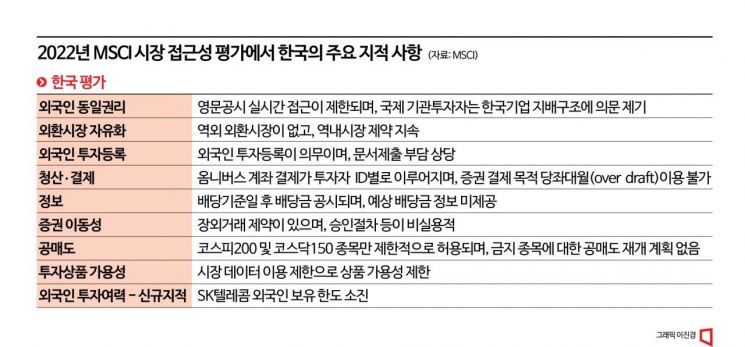

Korea has been part of the MSCI Emerging Markets Index since its first inclusion in January 1992. In 2008, Korea was listed as a watch list country for promotion to the MSCI Developed Markets Index, raising hopes for inclusion, but repeated failures occurred due to insufficient institutional improvements pointed out by MSCI. In 2014, Korea was even removed from the watch list, pushing the advancement of its capital markets further away.

The Korean government resumed efforts to join the MSCI Developed Markets Index in 2015. In November 2021, then Deputy Prime Minister Hong Nam-ki requested watch list status in a meeting with MSCI but failed. As of the end of last year, 23 countries including the US, UK, and Switzerland are included in the MSCI Developed Markets Index. In Asia, Hong Kong, Japan, and Singapore are included. The Emerging Markets Index includes 26 countries, including Korea.

This year, Korea again failed to be added to the watch list due to insufficient market improvements. MSCI Chairman Fernandez, who visited Korea last year, said, "The previous (Moon Jae-in) administration started discussions on MSCI developed market inclusion, and the current government is also focusing on it, but so far no meaningful actions have been seen," signaling that failure to be added to the watch list was expected.

Heo Yul, a researcher at NH Investment & Securities, noted, "MSCI is a conservative institution that verifies whether market improvements have actually been implemented through government policies before proceeding." Kim Dong-young, a researcher at Samsung Securities, also pointed out, "MSCI has shown a conservative approach, promoting upgrades only when institutional improvements are irreversibly confirmed. Therefore, they do not add countries to the watch list based solely on plans or proposals for institutional improvements."

It will be difficult to be added to the watch list next year as well. Morgan Stanley considers economic growth level, stock market size and liquidity, and market accessibility for foreign investors as conditions for MSCI Developed Markets Index inclusion. Currently, Korea’s capital market has no issues with economic growth or stock market size and liquidity, but market accessibility is evaluated as lagging. Short selling is also a factor hindering market accessibility improvement.

Foreign media have focused on Korea’s unilateral short selling ban this time, unlike the global trend during the COVID-19 pandemic. They note that short selling accounts for only 0.6% of the KOSPI and 1.6% of the KOSDAQ in the Korean stock market, which has a market capitalization of $1.7 trillion, questioning the necessity of the ban. Bloomberg pointed out, "This short selling ban came ahead of the general elections in April next year," and added, "The ban will suppress foreign capital investment in the Korean stock market and complicate Korea’s efforts to gain developed market status in the MSCI index."

Brian Freitas, an analyst at SmartKarma Holdings, also said, "The short selling ban will further jeopardize Korea’s potential transition from an emerging market to a developed market." He added, "With the ban, there is no longer a way to curb unreasonable valuations, so large bubbles are expected to form in stocks favored by individual investors."

Reuters reported, "MSCI, a major index provider, cites uncertainty over short selling regulations as one of the issues Korea must resolve to be upgraded to developed market status," and noted, "This measure may delay Korea’s entry into developed market status in capital markets."

Meanwhile, the Korean government has been promoting inclusion in MSCI and WGBI to maximize economic benefits. The Korea Economic Research Institute estimated that inclusion in the MSCI Developed Markets Index in 2021 could bring in up to 61 trillion KRW in funds. Goldman Sachs estimated that the expected capital inflow if Korea is included in the MSCI Developed Markets Index could reach $56 billion.

The WGBI includes government bonds from 24 major countries such as the US, UK, Japan, and China. The assets tracking the WGBI are estimated at about $2.5 trillion. Among the world’s top 10 countries by nominal GDP, only Korea and India are not included in the WGBI. Inclusion in the WGBI would bring foreign capital tracking the index into the government bond market and enhance the credibility of government bonds. The Ministry of Economy and Finance projected that about 90 trillion KRW in foreign investment in government bonds would flow in upon WGBI inclusion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.