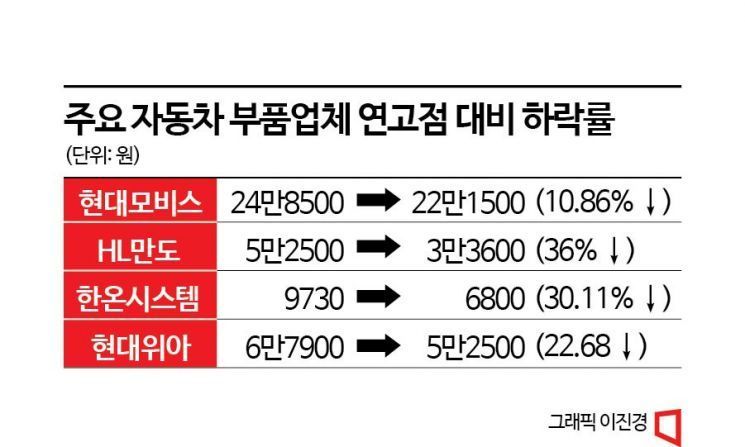

Hyundai Mobis, HL Mando, Hanon Systems Drop 10-30% from Peak

Eco-Friendly Vehicle Sales Growth Slows Sharply... Battery Manufacturers Postpone Factory Operations One After Another

Automotive parts stocks have struggled to rebound in the fourth quarter. This is attributed to increased uncertainty in growth due to a slowdown in demand for eco-friendly vehicles.

Hyundai Mobis closed at 221,500 KRW on the 13th, down 1,500 KRW (0.67%) from the previous trading day. This represents a 10.86% decline from the annual high of 248,500 KRW on July 14. During the same period, HL Mando fell from 52,500 KRW to 33,600 KRW, Hanon Systems from 9,730 KRW to 6,800 KRW, and Hyundai Wia from 67,900 KRW to 52,500 KRW, with all major parts manufacturers’ stock prices dropping more than 10-30% from their yearly highs.

Automotive parts stocks rose this year on expectations of benefiting from growth in the eco-friendly vehicle market. However, as market conditions changed in the second half of the year, stock prices have continued to decline due to a slowdown in the growth rate of eco-friendly vehicles. Additionally, negative factors such as cancellations of joint ventures and reduced investments between automakers and battery companies have emerged.

According to market research firm SNE Research, from January to September this year, a total of 9.665 million electric vehicles (BEV) and plug-in hybrid vehicles (PHEV) were registered across 80 countries worldwide, marking a 36.4% increase compared to the same period last year. However, considering that the electric vehicle growth rate was 61.3% last year, the growth rate itself has significantly slowed down.

Moreover, global automakers have recently been adjusting the pace of their transition to eco-friendly vehicles. The Turkish Ko? Group, which was pursuing a joint battery plant with LG Energy Solution and Ford in Turkey, recently decided to withdraw the tripartite memorandum of understanding (MOU) for establishing the joint venture. Additionally, SK On and Ford announced they are reviewing whether to delay the start of operations at the second plant in Kentucky, USA, originally scheduled for 2026. Volkswagen Group also announced it will postpone plans for its fourth electric vehicle battery plant in Eastern Europe.

Cho Suhong, a researcher at NH Investment & Securities, explained, "While the global automotive demand recovery trend is expected to continue next year, a slowdown in growth is inevitable. Concerns about declining demand in the electric vehicle market and the continuation of a high-interest-rate environment, along with macroeconomic uncertainties, are expected to persist next year."

However, some assessments suggest these concerns may be exaggerated. Although there are worries about a slowdown in electric vehicle demand, overall global vehicle sales are expected to increase next year compared to this year. Nam Jushin, a researcher at Kyobo Securities, predicted, "Global vehicle sales will reach 90.36 million units next year, a 4.6% increase from the previous year. Despite risks such as reduced new car consumption, semiconductor parts supply and transportation cost burdens are expected to be resolved, leading to a moderate growth trend returning to pre-COVID-19 normal levels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.