"Global Debt Burden Increases, Economic Slowdown May Follow"

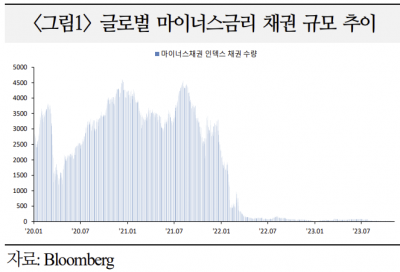

Due to the global interest rate hikes, the number of global negative-yield bonds has decreased by about 4,000 over the past three years.

According to the International Financial Center on the 11th, the number of global negative-yield bonds, which exceeded 4,600 in 2020, has decreased to 8 as of the 8th. Negative-yield bonds are bonds traded below zero interest rates.

The International Financial Center explained, "Negative-yield bonds rapidly decreased last year due to major countries raising policy rates and market interest rates rising. The number of negative-yield bonds, which was 2,296 at the end of 2021, dropped to 52 at the end of November last year, and further decreased to 8 as of the 8th."

Since the 2008 global financial crisis, stable inflation has continued, leading to a significant decline in global interest rates. After the European Central Bank (ECB) introduced negative policy rates, countries such as Sweden, Switzerland, and Japan joined, increasing the issuance volume of negative-yield bonds. In 2020, as countries actively eased monetary policies to respond to the pandemic, more than 4,600 bonds, including those from Europe, the UK, Switzerland, and Scandinavia, were included in the negative-yield category. However, since last year, as central banks of major advanced countries raised policy rates, interest rates have started to rise globally, and the number of negative-yield bonds has gradually decreased.

Accordingly, major investment banks and market experts forecast that the global high-interest rate trend will continue for the time being, and they assess that negative-yield bonds will no longer be actively traded.

Since the end of last year, the Bank of Japan has also begun gradual normalization of monetary policy by adjusting the upper limit of long-term interest rates under the Yield Curve Control (YCC) policy, further reducing the number of negative-yield bonds traded in the financial market.

According to Bloomberg, the perception that the Bank of Japan will raise its policy rate from -0.1% in the first quarter of next year is spreading, and negative-yield bonds are expected to disappear. The Bank of Japan’s move to relax the 1% cap on 10-year government bond yields implies that the negative interest rate policy could end sooner than expected.

The International Financial Center suggested, "The disappearance of negative-yield bonds in the global bond market can be seen as a transition from abnormal to normal, but it is necessary to be cautious about the potential increase in global debt burdens and economic slowdown that may follow as the high-interest rate trend continues."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.