Chinese authorities are reportedly requesting Ping An Insurance Group, China's largest insurer, to acquire a controlling stake in Country Garden (Biguoyuan). Although the company denied the claims, it appears that the government is directly intervening in the bailout efforts for Country Garden, which is facing a liquidity crisis.

According to major foreign media on the 9th, the authorities led by Premier Li Chang of the State Council instructed the Guangdong provincial government to have Ping An take over the company and assume its debts to rescue Country Garden. Ping An immediately issued a statement saying, "We have never received any related proposals or requests from government departments or agencies," and "There have been no plans or discussions regarding such a transaction." The company also explained, "We do not hold any shares of Country Garden."

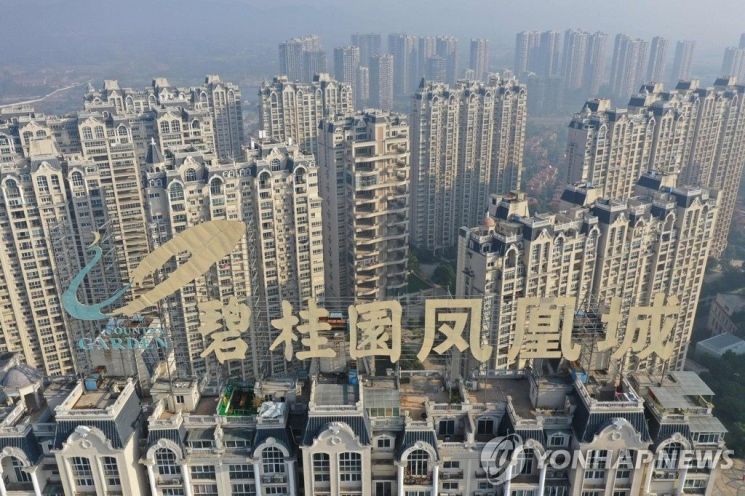

Country Garden, China's largest real estate developer, officially declared a default on its dollar bonds last month after a liquidity crisis. Country Garden holds a total debt of $186 billion (approximately 244 trillion KRW), the highest among private real estate developers in China. It was the largest construction company in China based on real estate sales in recent years, but its ranking dropped to seventh this year due to deteriorating financial conditions. However, it is still pursuing more than 3,000 real estate projects in small cities, so the ripple effects of the default are expected to spread throughout the market.

Ping An, which is also headquartered in Guangdong Province like Country Garden, is a publicly listed company, making it difficult to easily pursue a stake acquisition in Country Garden. Additionally, Ping An's debt reached 1.4 trillion yuan as of the end of last year, indicating that its financial situation is not strong.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.