Subsidy Effect Accumulates to 803.6 Billion KRW by Q3 This Year

Korean battery companies are expected to earn profits exceeding 1 trillion won this year solely from subsidies in the United States.

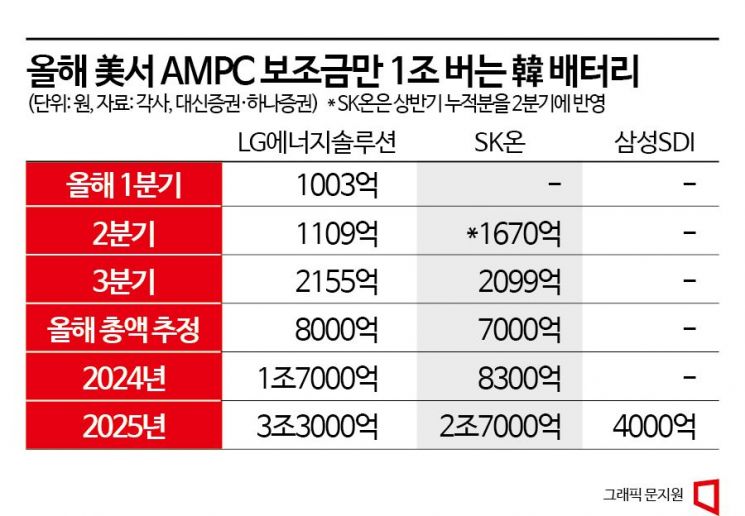

Currently, LG Energy Solution and SK On, which operate battery factories in the U.S., have accumulated profits of 803.6 billion won through the third quarter of this year thanks to the AMPC (Advanced Manufacturing Production Credit) subsidy. LG Energy Solution earned 426.7 billion won, and SK On earned 376.9 billion won. The AMPC, which has been fully reflected in financials since the first quarter of this year, is growing in scale as the yield rates and operating rates of LG Energy Solution’s and SK On’s battery factories in the U.S. increase.

In the securities industry, it is expected that LG Energy Solution and SK On will earn subsidy profits of 1.5 trillion won this year. LG Energy Solution currently operates joint venture factories with GM in Ohio and Tennessee, as well as a solely operated factory in Michigan. It is estimated to receive 1.7 trillion won in subsidies next year and 3.3 trillion won in 2025. SK On is currently operating its Georgia plants 1 and 2. It is projected to enjoy AMPC benefits of 830 billion won next year and 2.7 trillion won in 2025. Samsung SDI, which will operate a joint venture factory with Stellantis starting in 2025, is also expected to see subsidy benefits gradually increase from 400 billion won in the first year of operation to 800 billion won in 2026 and 1.6 trillion won in 2027.

AMPC is a subsidy provision under the U.S. Inflation Reduction Act (IRA). It contains key elements that encourage relocating eco-friendly energy-related manufacturing facilities to the U.S. Starting this year, subsidies of $35 (approximately 45,832 won) per kWh for battery cells produced and sold in the U.S., and $45 (approximately 58,927 won) for modules are provided. Although the payment method has not yet been finalized, it is highly likely that AMPC will adopt a 'direct pay' system that provides subsidies directly rather than reducing part of the tax at the time of sale. Battery companies expect to receive the AMPC subsidies reflected in their current earnings around next year.

This year, the dominant forecast was that battery companies’ profits would decline due to falling prices of raw materials such as lithium and nickel. Since raw material prices are linked to selling prices, a drop in raw material prices negatively affects selling prices. However, battery cell companies are continuing to achieve record-high performance during this 'lean season' thanks to subsidy benefits. AMPC is playing the role of 'new barley' helping battery companies endure the lean season.

In fact, LG Energy Solution recorded its highest-ever operating profit of 731.2 billion won in the third quarter of this year, a 40.1% increase compared to the same period last year (521.9 billion won). Excluding AMPC, operating profit was around 515.7 billion won, but with the addition of 215.5 billion won in subsidy profits, it achieved strong results. SK On also recorded its smallest-ever loss (-86.1 billion won) in the third quarter this year due to AMPC benefits and was on the verge of turning a profit.

On the other hand, cathode material companies that have not yet operated factories in the U.S. and thus have not benefited from AMPC suffered a direct hit from the decline in raw material prices. Ecopro’s operating profit decreased by 69% compared to the third quarter of last year, and LG Chem’s Advanced Materials division also saw profits drop by about 68%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.