Over $3 Trillion in Loans Maturing Within 5 Years

Benchmark Interest Rate at 5.25~5.5%... Refinancing Burden Surges

Corporate Bond Issuance Costs Also Soar

Default Concerns Grow Amid Liquidity Crisis

Moody's Monitoring Companies Increase Sharply

"Default Rate Could Reach 14%"

Due to the prolonged period of high interest rates, concerns about defaults (debt non-payment) among U.S. companies are growing. Over the past two years, rising interest rates have caused corporate borrowing costs to soar, leading to analyses that this could act as a trigger for a crisis that spreads from corporate bankruptcies to bank failures in the future.

According to data from the U.S. Federal Reserve (Fed) and foreign media compiled on the 6th (local time), the total loans of U.S. companies amount to $13 trillion (approximately 17,000 trillion KRW), of which loans maturing within five years exceed $3 trillion (approximately 3,900 trillion KRW).

In this situation, the U.S. benchmark interest rate has surged from 0-0.25% at the beginning of last year to 5.25-5.5% currently, forcing companies to refinance at higher rates. Typically, companies take out new loans to repay existing ones, but now they must refinance at higher interest rates. The cost of issuing corporate bonds has also increased due to the rate hikes.

According to ICE Bank of America (BofA), the average interest rate on investment-grade corporate bonds, known as the highest grade, has now exceeded 6%. At the end of 2020, the lower bound of the rate was below 2%, but it has jumped more than 4 percentage points in just three years. For speculative-grade corporate bonds, also called junk bonds or high-yield bonds, the current average interest rate stands at about 9.4%, more than double the lowest rate at the end of 2021.

Especially vulnerable are non-investment grade companies and small and medium-sized enterprises (SMEs) that struggle to bear the increased borrowing costs. According to the National Federation of Independent Business (NFIB), the short-term loan interest rate for U.S. small businesses reached 10% as of September, double the mid-2020 low of 4.1%. Until now, companies have maintained low rates by extending maturities or providing additional collateral. However, with prolonged high interest rates and continued tightening of financial conditions, companies with relatively lower credit ratings are finding it increasingly difficult to refinance existing debt.

In particular, forecasts of a possible economic recession next year are expected to accelerate this crisis. If employment slows and consumer spending decreases, corporate sales and profits will sharply decline. This, in turn, creates a vicious cycle leading to further employment and consumption downturns.

Thorsten Slok, Chief Economist at investment firm Apollo, stated, "Interest rates are causing increasingly severe pain, which will have significant repercussions," adding, "Companies with high levels of debt will become increasingly vulnerable." A restructuring specialist lawyer analyzed, "Tight monetary policy has generally had a complex impact on struggling companies. These companies have not recovered in terms of business performance and profitability, and now interest burdens have become the biggest problem, causing tremendous liquidity pressure."

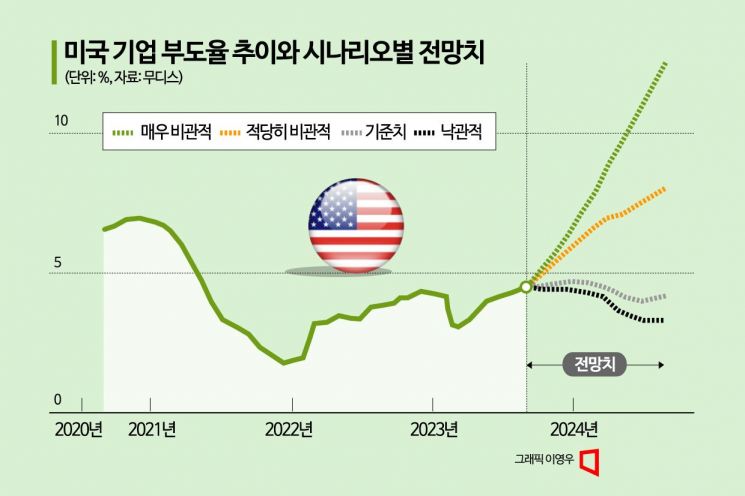

As companies face liquidity crises, concerns about defaults are also rising. Moody’s, one of the three major global credit rating agencies, has increased the number of companies it monitors for potential defaults to 240 as of the third quarter of this year, up significantly from 177 a year ago. Defaults themselves are also on the rise. Moody’s reported that the default rate in the U.S. rose to 4.9% as of September and is expected to reach 5.4% by January next year. In a very pessimistic scenario such as a recession, Moody’s warned that the U.S. default rate could soar to as high as 14% next year.

Roria from the U.S. law firm White & Case said, "When interest rates are between 1-2%, companies can take on a lot of debt and still have the capacity to repay it. But when rates rise to between 5% and 10%, the situation becomes much more difficult."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.