Companies Facing Financing Difficulties Secure 85 Billion Won in Liquidity

Collateralizing Owned Real Estate, Kamco Provides Credit Support

HJ Heavy Industries (formerly Hanjin Heavy Industries), an affiliate of Dongbu Construction, and four other mid-sized and small companies including auto parts manufacturer ECSIS are securing liquidity ranging from 10 billion to 30 billion KRW each, backed by real estate collateral and support from the Korea Asset Management Corporation (KAMCO). Collateralized Loan Obligations (CLOs), which often appear during times of crisis, have become a funding source supporting these companies.

KAMCO is deeply establishing itself in the daily lives of ordinary people not only through corporate and financial restructuring but also by providing refinancing loans for low-credit borrowers.

KAMCO is deeply establishing itself in the daily lives of ordinary people not only through corporate and financial restructuring but also by providing refinancing loans for low-credit borrowers.

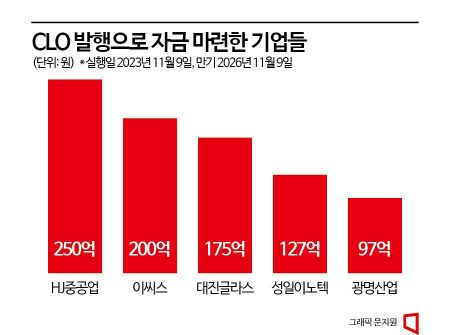

According to the investment banking (IB) industry, HJ Heavy Industries (25 billion KRW), ECSIS (20 billion KRW), Daejin Glass (17.5 billion KRW), Sungil Innotek (12.7 billion KRW), and Gwangmyeong Industry (9.7 billion KRW) will receive loans totaling 84.9 billion KRW on the 9th, secured by their real estate holdings. Special Purpose Companies (SPCs) established by KB Securities and Hyundai Motor Securities will raise funds by issuing CLOs backed by the loans extended to these five companies. The loan maturity for each company is three years in total, but early repayment is allowed starting from 15 months after issuance.

The CLOs backed by the loan collateral are issued in two tranches: 30 billion KRW of senior securities and 54.9 billion KRW of subordinated securities. When the companies repay principal and interest on the loans, senior CLO investors receive their payments first. To enhance repayment stability, HJ Heavy Industries has pledged its Geoje factory, while the other companies have offered real estate such as factory land and buildings as collateral. Additionally, KAMCO has provided credit guarantees to cover principal and interest repayment for the senior securities.

CLOs are a type of asset-backed security (CDO) issued against loans. They are commonly used by companies facing deteriorating creditworthiness or adverse market conditions that make it difficult to secure funding.

Loans extended to multiple companies are restructured and issued as securities with repayment priority, including senior and subordinated tranches. Subordinated investors bear relatively higher risk of loss. While Credit-Backed Obligations (CBOs) guaranteed by the Korea Credit Guarantee Fund are backed by bonds, CLOs are backed by loans.

The companies receiving funding all face deteriorating performance and financial conditions, making it difficult to raise funds independently in the capital markets. HJ Heavy Industries appeared to improve its performance and financial status after being acquired by the Dongbu Construction consortium in 2020. However, since last year, the construction industry downturn has led to large losses this year, worsening its financial condition again. As of the end of June this year, most of its 860 billion KRW in borrowings are due within one year, increasing short-term liquidity risk.

ECSIS has weakened its financial capacity after recording net losses for three consecutive years. Daejin Glass, Sungil Innotek, and Gwangmyeong Industry are also reportedly struggling to secure funds amid high interest rate conditions.

An IB industry insider said, "As banks reduce credit exposure, companies facing difficulties in securing funds have been able to raise necessary capital at relatively low interest rates with KAMCO support," adding, "As the funding environment worsens, the number of companies receiving support through CLO issuance is expected to continue increasing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.