Continuous Rise of New Shipbuilding Industry and Overcoming Restructuring Crisis

"The Supercycle Has Returned"

As the shipbuilding industry has seen a continuous streak of orders in recent years, expectations are growing that a supercycle, signifying an ultra-boom period, has arrived. Industry indicators are approaching the levels of the shipbuilding industry's greatest boom in 2008, and forecasts predict a positive trend continuing beyond next year.

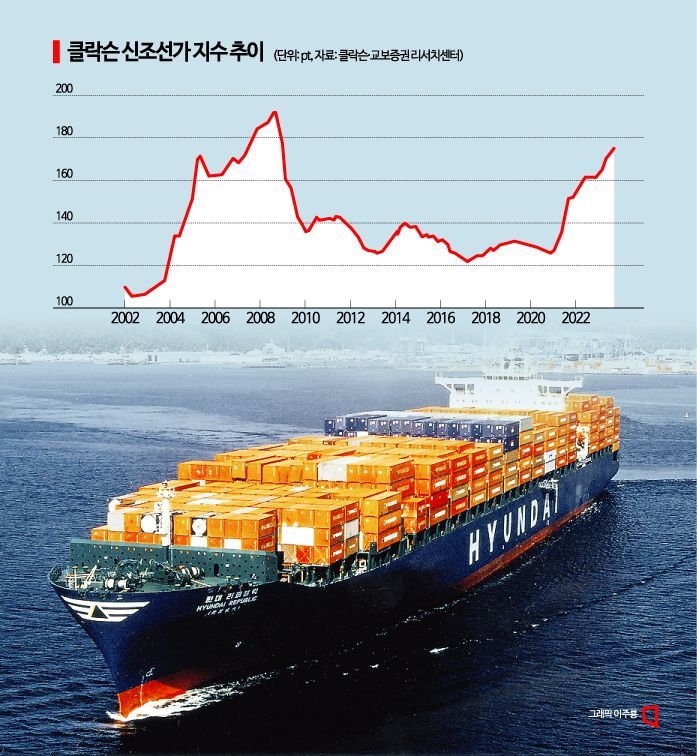

The revival of the shipbuilding industry, which had been in decline, can be seen in the steadily rising newbuilding price index.

The Clarkson newbuilding price index recorded 176.03 as of the 27th of last month. It rose by 0.65 points from 175.38 at the end of September, continuing its upward trend for 39 consecutive weeks since January 27. The newbuilding price index is a leading indicator of the shipbuilding sector, setting the world shipbuilding price at 100 in January 1988 and indexing monthly prices. A higher number indicates a significant increase in ship prices.

The newbuilding price index gradually rose from the early 2000s, peaking at 191.58 in September 2008. The previous 'supercycle' peak was precisely in September 2008. Shipbuilders, who had suffered from a downturn in the early 2000s, enjoyed an ultra-boom around 2008. The recent low point of the newbuilding price index was in 2020, dropping to 125.43 in December 2020 when the COVID-19 pandemic swept the globe.

The rebound came suddenly after COVID-19. In 2021, global 'supply bottlenecks' led to massive orders centered on container ships, and in 2022, due to Europe's natural gas supply instability caused by the Russia-Ukraine war, large-scale orders for LNG (liquefied natural gas) carriers followed.

This year, following Qatar's second LNG carrier orders, eco-friendly ship orders have continued due to carbon emission regulations on ships. By the end of September, LNG carrier orders totaled 43 vessels (32 by domestic shipbuilders), but including an estimated 40 or more vessels from Qatar's second order, the total is expected to exceed 90 vessels.

HD Hyundai Heavy Industries signed a Memorandum of Agreement (MOA) last month with QatarEnergy for the construction of 17 LNG carriers, and Hanwha Ocean and Samsung Heavy Industries are also expected to finalize contracts soon.

Next year is also expected to show a similar trend to this year. Senior researcher Ahn Yudong of Kyobo Securities said, "Considering scheduled LNG carrier projects, LNG carrier orders will remain robust next year," adding, "From 2027 to 2034, an average of 90 vessels per year is expected to be ordered, with domestic shipbuilders consistently securing around 70 of these." The order backlog of the three major domestic shipbuilders is already overflowing, so they are expected to pursue a selective order strategy under more favorable conditions.

An industry insider said, "Orders have so far been centered on ships, but if the offshore plant sector also revives, it will be a definite supercycle," adding, "With prolonged high oil prices, offshore plant orders are expected to gain momentum."

Domestic shipbuilders have overcome a decade-long wave of grueling restructuring. Those who could not survive this crisis have disappeared. Currently, there are 365 operating shipyards worldwide, down to one-third from 1,028 in 2008. Among these, only 278 shipyards have experience delivering ships. The few surviving shipbuilders are expected to share future ship orders. The worst period, where survival itself was a victory, is over. Now is the time to reap the fruits of victory.

Chinese companies, rapidly catching up with domestic shipbuilders, remain fierce competitors. China's orders this year amounted to 17.99 million CGT (compensated gross tonnage, equivalent to 726 standard vessels), accounting for 60% of global orders. China is also accelerating research on eco-friendly ship technologies.

Securing shipyard manpower remains a challenge. Although the government has increased foreign workers, a shortage of over 10,000 workers is feared. Wage increases to secure manpower could also lead to higher costs, posing a burden.

A major opportunity has arisen in the shipbuilding industry. More encouragingly, the supercycle has just begun. There is a high possibility that the boom will continue for several years. The problem is that once the supercycle ends, a cycle of hardship returns. Experts point out that the domestic shipbuilding industry should not become complacent during this boom.

Professor Jeong Heungjun of Seoul National University of Science and Technology stated at a forum held at the National Assembly on the 1st, "One of the wrong practices accumulated in the domestic shipbuilding industry is labor utilization," pointing out, "Within the in-house subcontracting structure, subcontracted workers receive on average 60% of the wages of regular employees, creating a low-wage structure that has become entrenched, and the difficult and hazardous working environment causes workers to leave." He added that the Shipbuilding Industry Basic Act should be enacted to normalize production and maintain skilled labor and employment stability while developing the industry.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.