Disagreement Over Revenue Recognition Criteria: 'Gross vs Net Method'

Contract Interpretation Among Kakao Mobility, KM Solution, and Taxi Companies at Issue

FSS Alleges Revenue Inflation in Earnings Manipulation... "Excessive Revenue Recognition to Be Submitted to Audit Committee Early Next Year"

Industry: "Interpretation Differences on Accounting Methods Make Intense Disputes Inevitable"

"The accounting industry's debate over 'gross method vs net method' in revenue recognition stems from differing views on accounting treatment, and perspectives vary depending on interpretation. Therefore, the dispute between the Financial Supervisory Service (FSS) and Kakao Mobility will be fiercer than ever," said Accountant A, who has over 20 years of experience, on the 1st, describing the FSS's audit of Kakao Mobility's alleged accounting fraud as an issue without a clear answer.

The core of the FSS's suspicion regarding Kakao Mobility's accounting fraud lies in whether the 'business partnership contract' and the 'franchise contract' that Kakao Mobility and its subsidiary KM Solution each signed with transportation companies should be considered the same. The FSS views them as interdependent and recognizes them as a single contract, concluding that Kakao Mobility inflated its revenue. Accountant A emphasized, "The FSS needs to prove that the two contracts are interdependent, which will not be easy," adding, "Especially, it will be difficult to conclude that this was intentional accounting fraud."

If it were intentional, it would imply that the audit firms Samil and Samjong, which audited Kakao Mobility, either overlooked or assisted in inflating revenue, which is practically impossible. The three major domestic audit firms (Samil, Samjong, and Han Young) that audited Kakao Mobility expressed opinions that there were 'no issues' with Kakao Mobility's accounting treatment, viewing the two contracts as independent. Accountant B, with over 20 years of experience, explained, "When external auditors conduct audits, they focus intensively on areas of excessive revenue recognition, and whether revenue is recognized on a gross or net basis is the biggest risk item."

Are the Business Partnership Contract and Franchise Contract the Same or Not?

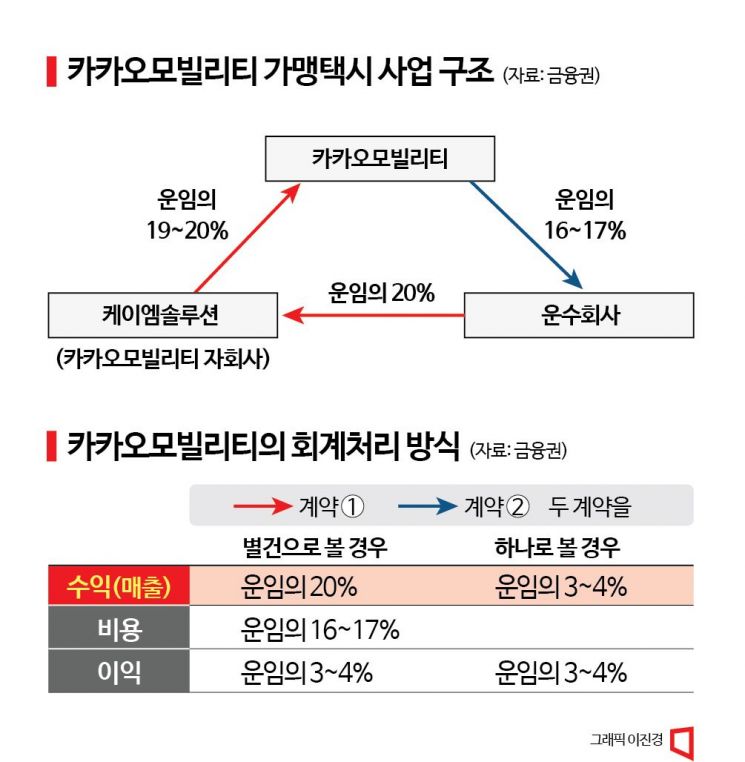

Interest has focused on the interpretation of 'accounting standards' as the Financial Supervisory Service (FSS) launched an accounting audit after detecting signs of a 300 billion KRW 'revenue inflation' by Kakao Mobility, a subsidiary of Kakao and operator of Korea's top taxi-hailing platform 'KakaoT.' The FSS considers the 'business partnership contract' and the 'franchise contract' that Kakao Mobility and its subsidiary KM Solution each signed with transportation companies as the same and believes Kakao Mobility inflated its revenue. The suspicious part of the alleged accounting fraud is that Kakao Mobility returns part of the commission it received from franchise taxi companies back to those companies. Kakao Mobility responded by saying it is a "difference in views with the supervisory authority regarding accounting treatment."

Kakao Mobility recognizes 20% of the fare for the franchise taxi service 'KakaoT Blue' as royalties through its subsidiary KM Solution. This is revenue for providing services such as vehicle dispatch platform and dedicated terminal maintenance. Kakao Mobility also pays commissions to franchise taxi companies. Franchise taxi companies provide vehicle movement data to the KakaoT platform and participate in advertising or marketing, receiving separate commissions based on conditions such as the number of trips. This amounts to about 15-17% of the fare.

The Financial Supervisory Service views the two contracts as effectively one contract. They argue that only the portion of revenue after deducting the commissions paid to franchise taxi companies from the royalties received should be recognized as revenue. The FSS estimates that Kakao Mobility inflated about 300 billion KRW, roughly half of its approximately 791.4 billion KRW annual revenue last year, in this manner.

Kakao Mobility maintains that the two contracts are separate, so it is legitimate to recognize the entire 20% royalty as revenue. A Kakao Mobility representative said, "Receiving royalties and paying commissions to franchise taxi companies are conducted under independent contracts, so they cannot be accounted for as a single transaction." They added, "We have undergone transparent annual audits by several major domestic accounting firms, and all auditors, including designated auditors, have issued unqualified opinions on our financial statements."

According to current accounting standards, multiple contracts should be considered as one if they are interdependent. Following this logic, in Kakao Mobility's case, the contract receiving 20% commission and the contract paying out 16-17% should be viewed as one. In this case, only the difference of 3-4% should be recognized as revenue. Accountant A explained, "Assuming home shopping revenue is 1,000 KRW, home shopping only provides the platform, and the tenant sells the product and pays a commission to home shopping, so if only the commission is recognized as revenue, this can be seen as highly interdependent." However, he added, "In Kakao Mobility's case, it may be difficult to view the two contracts as interdependent as the FSS interprets."

Kakao Mobility stated that data collected through the business partnership contract (paying 16-17% to transportation companies) is used not only for franchise business but also for completely separate business areas such as bike dispatch and future mobility development. Therefore, they argue that this cannot be attributed to the franchise contract (which receives 20% of taxi fares) and that treating them as separate contracts aligns with both accounting principles and economic substance. Accountant C said, "The perspective on the issue varies depending on the interpretation of whether the payments Kakao Mobility made to franchise members for advertising and marketing participation under the business partnership contract constitute a single flow or are distinct."

According to Korea's adopted International Financial Reporting Standards (K-IFRS) No. 1115 'Revenue from Contracts with Customers,' if a company pays consideration to a customer, and it is not for distinct goods or services transferred by the customer to the company, the accounting treatment should be on a net basis, deducting from revenue. Conversely, if the consideration paid to the customer is for distinct goods or services received from the customer, it should be accounted for on a gross basis, similar to purchases from other suppliers.

Accountant D explained, "In the department store industry, revenue recognition depends on who bears the inventory risk. If the department store buys and manages inventory under its own responsibility and sells it, revenue is recognized on a gross basis. If the department store only rents space and the manufacturer bears sales responsibility and inventory risk, revenue is recognized on a net basis."

A senior official in the financial investment industry said, "If Kakao Mobility intended to inflate revenue, the purpose could be seen as expanding its scale ahead of an initial public offering (IPO)," but added, "Since corporate value is not assessed solely on revenue, the motive for accounting fraud is insufficient." Accountant A also said, "If it is proven that the commission for fares and the commission for advertising were negotiated and contracted, it would be an intentional violation of accounting standards," but considered such a possibility unlikely.

Criminal Penalties Possible but Unlikely?

The FSS has been reviewing and auditing Kakao Mobility's financial statements since July. The FSS explained, "We conduct accounting reviews on companies planning IPOs, and audits are carried out only when repeated or intentional/negligent violations are found." Kakao Mobility selected an underwriter last year and is preparing for listing within the year. The FSS plans to complete the audit by early next year and submit the issue of Kakao Mobility's excessive revenue recognition to the Audit Committee. However, as a fierce dispute is expected, it may take considerable time before a final conclusion is reached.

If the FSS audit confirms Kakao Mobility's allegations, the Audit Committee and the Securities and Futures Commission will determine the level of penalties such as fines. After the Audit Committee makes a preliminary decision, the Securities and Futures Commission reviews it again. The Financial Services Commission makes the final decision on whether to impose fines. The fine amount ranges from 2% to 20% of the amount violating accounting standards. Company executives and related personnel may be fined 0.5 to 5 times their monetary compensation (up to 10% of the company's fine), and auditors may be fined 0.5 to 5 times their audit fees (in case of accounting audit standard violations).

If intentional accounting fraud is found, under the External Audit Act, management, the corporation, and auditors involved in preparing the audit report can be referred to investigative authorities for criminal prosecution. However, accounting experts believe this is unlikely since the major accounting firms issued unqualified audit opinions. The lack of motive and significant differences in interpretation contribute to this view. An accounting firm representative said, "The FSS seems to be investigating both accounting personnel and external auditors, but auditors will submit all audit documentation."

Meanwhile, the Korea Fair Trade Commission recently sent a review report (equivalent to a prosecutor's indictment) stating that Kakao Mobility abused its market-dominant position. The allegation is that Kakao Mobility, using its monopolistic market position, disrupted the market by not notifying passengers of calls to franchise taxis of competitors such as Wuti and Tada. Following the Fair Trade Commission's sanctions, Kakao Mobility is now also under audit by the FSS, making an IPO this year practically difficult.

Kakao Mobility announced on the 1st that it will hold an emergency meeting to gather taxi drivers' opinions to completely overhaul the taxi commission system, including franchise taxi commissions. This appears to be influenced by President Yoon Suk-yeol's remarks at the 21st Emergency Economic and Livelihood Meeting on the same day, stating, "Kakao's tyranny over taxis is very immoral," and "Measures must be taken."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)