Fintech Startup Habit Factory Releases Survey Results

The biggest factor influencing the choice of pension products was found to be the tax deduction rate.

Fintech startup Habit Factory announced on the 1st that it conducted a survey of 500 users of its application ‘Signal Planner’ and obtained these results. The survey was conducted over a month from September 15 to October 15.

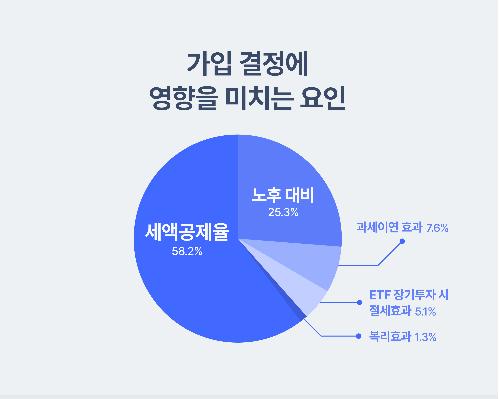

The factor with the greatest influence when deciding on a pension product was the tax deduction rate (58.2%). This was followed by retirement preparation (25.3%), tax deferral effect (7.6%), tax-saving effect when investing long-term in domestic and overseas listed Exchange-Traded Funds (ETFs) (5.1%), and compound interest effect (1.3%).

36.7% of participants responded that they first recognized the need for a pension while studying finance and investment. This figure increased by about 15 percentage points compared to last year’s survey. Additional year-end tax settlement payments (27.8%), recommendations from acquaintances (21.5%), and consultations with various financial product planners (8.9%) followed.

In the open-ended question about “concerns when managing a pension,” the highest proportions were appropriate payment amount, early withdrawal, and opportunity cost due to lump-sum payments. Other concerns included fees and principal guarantee.

For the multiple-choice question on “currently held products,” pension savings insurance (64.6%), IRP (62%), and pension savings funds (34.2%) were the most common.

Jung Yun-ho, co-CEO of Habit Factory, said, “The survey confirmed that there is a strong interest in tax savings,” adding, “It is important to look for the most effective product that suits one’s own situation for retirement preparation.”

Meanwhile, Habit Factory provides pension services that allow users to check pension assets and guide the amount needed to achieve their retirement goals. After mobile phone identity verification, users can check National Pension, Retirement Pension, and Personal Pension all at once. Non-face-to-face consultations via KakaoTalk are also available for customers who wish.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.