Commercial Banks to Introduce Stress DSR by Year-End

Limit Calculated Assuming 1%P Increase When Choosing Variable Interest Rate

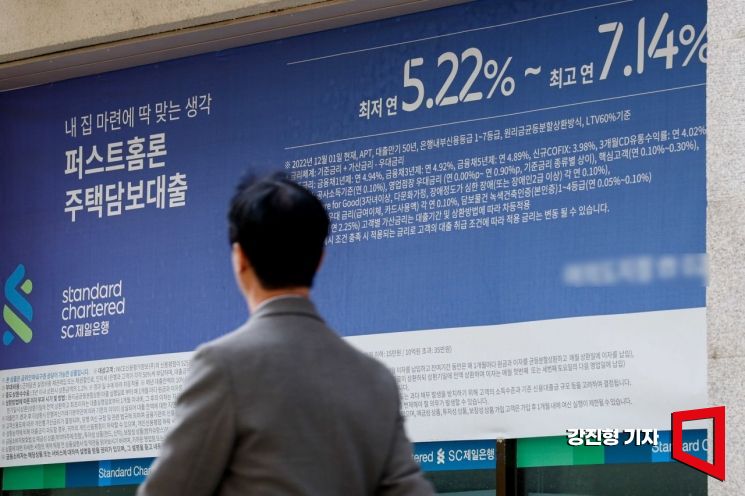

On the 23rd, as domestic market interest rates and bank loan interest rates rapidly rise, a banner displaying loan interest rates is hung on the exterior wall of a commercial bank in Seoul. Photo by Jinhyung Kang aymsdream@

On the 23rd, as domestic market interest rates and bank loan interest rates rapidly rise, a banner displaying loan interest rates is hung on the exterior wall of a commercial bank in Seoul. Photo by Jinhyung Kang aymsdream@

Starting from the end of this year, the loan limits for borrowers taking out mortgage loans (hereinafter referred to as "mudamdae") with variable interest rates will be reduced. As household debt has recently increased again, following the housing market trend, additional regulations will be implemented. To prevent the interest burden on the so-called "Youngkkeun-jok" (borrowers who take out loans to the fullest extent possible) from increasing during the interest rate hike period, a Stress DSR system will be introduced.

DSR (Debt Service Ratio) refers to the proportion of principal and interest payments that must be repaid within a year relative to annual income. The first-tier financial institutions are regulated at 40%, and the second-tier financial institutions at 50%. For example, if the annual salary is 50 million KRW, the borrower can only take out loans where the principal and interest repayments do not exceed 20 million KRW and 25 million KRW per year, respectively.

For borrowers with variable-rate mortgage loans, the monthly interest repayment burden can increase several times rapidly during periods of rising interest rates. The core of the Stress DSR system is to preemptively reflect such future risks when banks calculate loan limits, thereby reducing the borrower's interest burden and curbing household debt.

An official from the Financial Services Commission said, "Currently, DSR is assessed by looking at whether the borrower can repay the loan at the current interest rate level for one year, regardless of whether the rate is variable or fixed. When applying for a loan at commercial banks, if the borrower requests a loan within a DSR of 40%, the loan is granted; otherwise, it is not." He explained, "The key is whether this repayment capacity is valid, and since next year's interest rates may differ from the current level, this is reflected in the DSR calculation in advance."

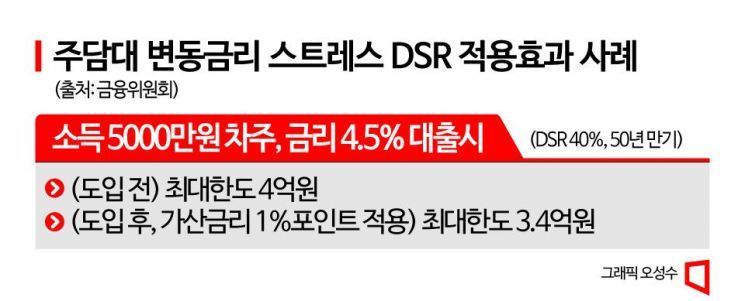

For example, if an office worker with an income of 50 million KRW takes out a loan with a variable interest rate of 4.5% per annum (50-year maturity), applying a DSR of 40% allows a maximum loan amount of 400 million KRW. However, assuming future interest rate hikes and applying an additional 1 percentage point, the DSR is calculated at 5.5%. Accordingly, the loan limit decreases to 340 million KRW. The Stress DSR for variable interest rates will be applied to banks starting at the end of this year.

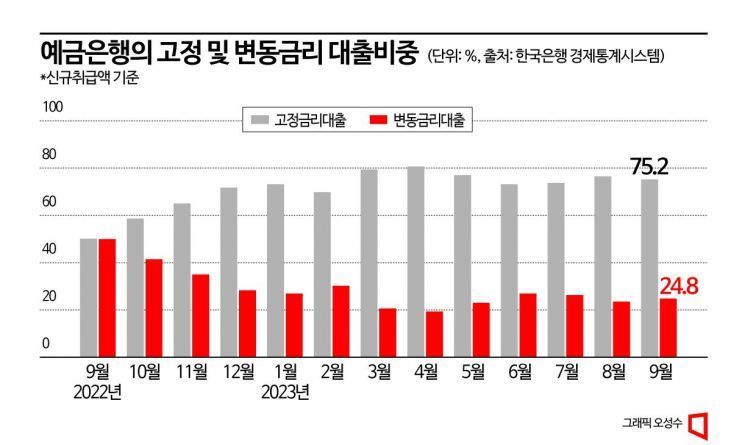

Looking at the proportion of mortgage loans by deposit banks, the current fixed-rate selection ratio is much higher than that of variable rates. According to the Bank of Korea's Economic Statistics System, as of the end of September, fixed rates accounted for 75.2%, and variable rates 24.8%. A commercial bank official said, "Most borrowers taking out mortgage loans this year have chosen fixed rates," adding, "The authorities requested banks to lower fixed rates to increase the fixed-rate proportion, which was reflected, and expectations for interest rate cuts have also disappeared."

As of the 30th, the variable interest rates at the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) range from 4.55% to 7.1%, while fixed rates range from 4.39% to 6.68%, with variable rates being higher. Another commercial bank official predicted, "Even if an interest rate cut period comes someday, fixed rates, which are based on daily moving bank bonds, will likely decrease faster than variable rates based on the COFIX, so the proportion of fixed-rate selections is expected to remain high for the time being."

Meanwhile, household debt continues to increase. As of the 26th, the outstanding household loans at the five major banks increased by 2.2504 trillion KRW for mortgage loans and 530.7 billion KRW for credit loans compared to the end of September.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)