Seoul Southern District Prosecutors' Office Reviewing Indictment of Bae Jae-hyun, Kakao Chief Investment Officer

Must Prove Fulfillment of Legal Intent Requirement 'Content of Purpose' Beyond Market Manipulation

Violation of 5% Rule Requires Proof of 'Joint Purpose Holding' by Kakao and One Asia Partners

Judicial Issues for Kakao Corporation Focus on Corporate Management and Supervision Responsibility for Executives

The Capital Market Special Judicial Police (Special Judicial Police) of the Financial Supervisory Service has referred Kakao executives and corporations suspected of violating the Capital Markets Act to the prosecution with a recommendation for indictment, signaling an intense legal battle over the legality of the SM Entertainment (SM) acquisition process.

According to financial authorities and the legal community on the 30th, the Financial Investigation Division 2 of the Seoul Southern District Prosecutors' Office (Chief Prosecutor Park Geon-young) received the case involving Kakao's Chief Investment Officer Bae Jae-hyun, Head of Investment Strategy Kang Ho-jung, and Head of Investment Strategy Division Lee Junho, suspected of violating the Capital Markets Act, from the Special Judicial Police on the 26th and is currently reviewing whether to indict. The Special Judicial Police are also preparing to take action regarding the custody of Kakao founder Kim Beom-su (Head of the Future Initiative Center), who was summoned for questioning on the 24th. The Special Judicial Police stated, "As evidence of collusion in market manipulation among the remaining suspects has been confirmed, we plan to promptly investigate and transfer additional suspects in accordance with law and principles."

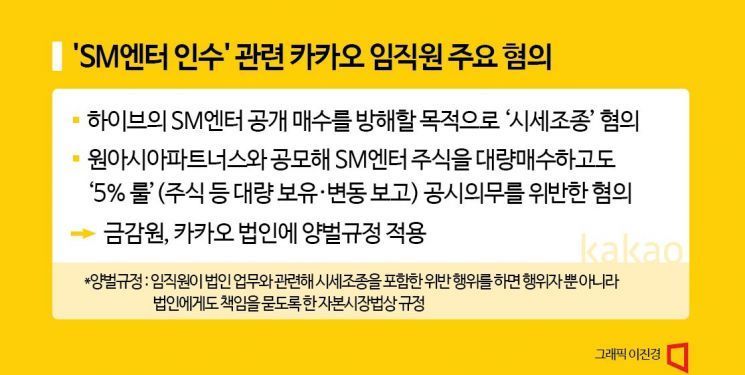

Currently, CEO Bae and others are accused of 'market manipulation' by conspiring with the private equity firm One Asia Partners to raise SM's stock price above the public tender offer price of HYBE, their competitor in the SM management rights acquisition battle, spending about 240 billion KRW. The Special Judicial Police believe they used typical market manipulation tactics such as 'high-price buy orders' that place orders above the market price and 'closing price involvement orders' that place high-price orders during after-hours trading at the end of the session.

For the market manipulation charges to be upheld, it must be proven that their actions constitute a 'purpose crime.' A purpose crime requires not only intent but also a specific purpose. Prosecutor-turned-lawyer Yesang Gyun of the law firm KDH said, "Even if the external conditions of market manipulation are met, it remains to be seen whether the 'content of purpose,' a legal requirement for intent, can be satisfied," adding, "because the purpose of preventing another company from acquiring SM is not a legally defined purpose for market manipulation."

Lawyer Park Seong-ha of Dongin Law Firm explained, "Besides clear evidence showing the purpose of market manipulation, the purpose can be indirectly proven through patterns of high-price buying or closing price management," adding, "proof can be attempted through various indirect expressions rather than direct agreements between parties." Materials secured during the Special Judicial Police's raid on the law firm Yulchon, which advised Kakao in August, are also considered key evidence to prove the charges. Park added, "In the past, memos from law firm representatives and lawyers were used as important evidence in the Hyundai Securities stock manipulation case."

CEO Bae and others also face charges of violating the so-called '5% rule' for failing to report large holdings of SM shares together with One Asia Partners. The Special Judicial Police believe they failed to comply with the Capital Markets Act's obligation to report to the Financial Services Commission or the stock exchange within five days when the total shares held by themselves or special related parties exceed 5% of issued shares. One Asia Partners is suspected of maintaining a close relationship with Kakao.

Lawyer Yesang Gyun said, "Under the Capital Markets Act, special related parties include family, relatives, and major shareholders, and joint holders refer to those who intend to jointly acquire or dispose of shares based on contracts or agreements," adding, "it is necessary to examine which category Kakao and One Asia Partners fall into in this case." Lawyer Park Seong-ha noted, "The judgment on the 5% rule violation will depend on whether evidence proving the 'joint purpose holding' of SM shares by Kakao and One Asia Partners was found through raids or other means."

The issue of whether the Kakao corporation, subject to joint punishment provisions, will be penalized is also a major point of interest. Currently, Kakao is the major shareholder holding 27.17% of Kakao Bank shares. Under the Internet Banking Special Act, industrial capital holding more than 10% of an internet bank's shares must not have been fined or punished for violations of tax laws, specific economic crimes, or fair trade laws in the past five years. If Kakao is prosecuted and fined, the financial authorities may order the disposal of its shares.

The key issue in the judicial treatment of Kakao as a corporation is its management and supervisory responsibility over its executives. Lawyer Park Seong-ha said, "If the executives are found guilty in court and it is concluded, as the Special Judicial Police claim, that illegal acts were committed with legal counsel, Kakao as a corporation could be punished under joint punishment provisions for not only management failure but active participation." Lawyer Yesang Gyun explained, "The application of joint punishment provisions is basically applied regardless of whether it is exceptional, but exceptions can be made. However, if it is recognized that the corporation exercised due care and supervision to prevent illegal acts by executives, it will not be held criminally liable."

On the 27th, at the National Assembly's Political Affairs Committee audit, Financial Supervisory Service Governor Lee Bok-hyun expressed agreement with the call to strictly punish Kakao as a corporation and founder Kim Beom-su, who is also head of the Future Initiative Center. When asked about the investigation progress into Kim Beom-su's involvement in market manipulation, he said, "It is proceeding according to procedures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)