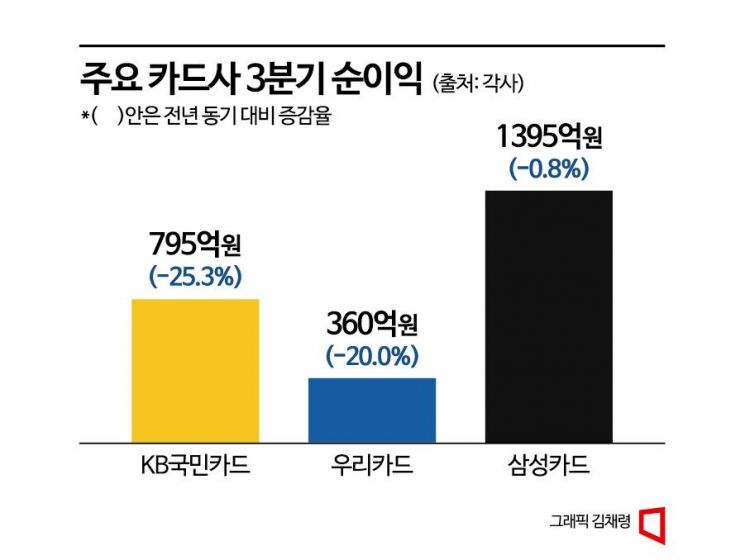

KB Kookmin and Woori Card Net Profit Plummets Over 20%

Samsung Card Only 0.8% Decline 'Holding Up'

Next Year's Market Outlook Also Challenging... "Continued Weakness Expected"

As credit card companies begin to release their third-quarter earnings for this year one by one, a sense of gloom is spreading. Net profits are plummeting, and concerns over funding costs remain due to high interest rates and domestic and international uncertainties, leading to expectations of continued poor performance for the time being.

According to industry sources on the 27th, KB Kookmin Card posted a net profit of 79.5 billion KRW (based on controlling interest) in the third quarter of this year. This represents a sharp decline of 25.3% compared to the same period last year. Considering that card usage amounted to 43.1 trillion KRW, a 4.0% decrease over the same period, the profit scale has significantly shrunk. Woori Card also failed to avoid sluggishness. Its net profit for the third quarter of this year was 36 billion KRW, down about 20% from the third quarter of last year. This contrasts with a 10.5% increase in card usage during the same period (cumulative basis). Shinhan Card and Hana Card, which are scheduled to announce their earnings on the same day, are also expected to show similar trends.

Samsung Card is evaluated to have performed relatively well. It recorded a consolidated net profit of 139.5 billion KRW in the third quarter of this year. The decrease compared to the same period last year was only 0.8%. Last year, Samsung Card proactively reduced the proportion of low-yield assets and secured funds in advance in preparation for the worsening business environment, becoming the only card company to achieve double-digit growth in net profit when others were experiencing sharp declines.

However, Samsung Card’s sales and operating profit also declined by 7.9% and 3.7%, respectively, to 1.022 trillion KRW and 186.8 billion KRW compared to the same period last year. Despite the total transaction volume, which corresponds to assets, increasing by 1.0% year-on-year to 42.1068 trillion KRW, the company experienced a setback.

The main reason for the stagnation in credit card companies’ earnings growth is largely attributed to funding cost issues. Since card companies do not have deposit-taking functions, financial costs have increased as borrowing rates in the bond market have risen. According to the Korea Financial Investment Association, the interest rate on specialized credit finance bonds (AA+, 3-year maturity), a major funding source for card companies, stood at 4.926% as of the 26th, approaching the 5% mark recorded earlier this year. This is a completely different situation compared to the 2% range until the beginning of last year.

The problem is that this situation is unlikely to improve anytime soon. High interest rates are expected to persist, and combined with high inflation and high oil prices, consumption is also expected to remain sluggish. The worsening household loan situation, which could increase delinquency rates, is another burden. If customers’ repayment ability deteriorates due to continued high interest rates and worsening economic conditions, credit loss expenses will inevitably increase. According to the Financial Supervisory Service, the delinquency rate for card companies was 1.58% in the first half of this year, up 0.38 percentage points from the end of last year. Samsung Card also stated in its earnings announcement that domestic uncertainties are expected to continue after the fourth quarter of this year and that the industry environment will remain challenging.

Seokyoung Shin, Senior Researcher at Hana Financial Management Research Institute, analyzed, "With the high interest rate trend expected to continue until the first half of next year, a 'high-cost structure' characterized by funding cost burdens and the need to set aside provisions for credit loss to manage delinquency rates will persist. Even if interest rates are cut in the second half of the year, the scale and speed of the cuts are expected to be gradual, and the increase in demand for card loans, a core revenue source, will be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.