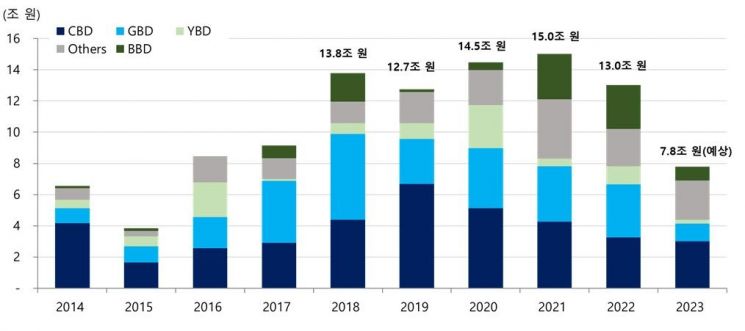

[2014~2023(E) Seoul and Bundang Office Transaction Scale Trends (Provided by Zenstar Mate Real Estate Research Institute)]

[2014~2023(E) Seoul and Bundang Office Transaction Scale Trends (Provided by Zenstar Mate Real Estate Research Institute)]

Genstarmate (CEO and President Changwook Lee) Real Estate Research Institute has released the "2023 Q3 Office Market Report" regarding the transaction scale trends of commercial offices in Seoul and Bundang.

According to the report, the transaction scale of commercial offices in 2023 is expected to close at 7.8 trillion KRW. This represents a decrease of about 40% compared to the 13 trillion KRW transaction scale in 2022, and is lower than the 8.4 trillion KRW scale recorded in 2016.

If scheduled transactions in Q4 2023, such as Samsung SDS Tower and Majesta City Tower 1, close without delay, the office transaction scale in Seoul and Bundang is expected to reach approximately 7.8 trillion KRW. Including equity transaction cases such as Scale Tower, Autoway Tower, and Pangyo Tech One, the total is expected to finish around 8.6 trillion KRW.

Following the Concordian transaction in Q2, the office market, which had been stagnant, showed a temporary recovery with consecutive deal closings. However, due to prolonged high interest rates and a lack of liquidity in the market, purchasing activities have been shrinking. In particular, with a flood of new GBD properties such as Hana Financial Gangnam Building and Centerpoint Gangnam (pre-sale), many deals that were initially aimed for sale within 2023 have been withdrawn or delayed, indicating that market uncertainty is likely to continue for the time being.

Domestically, despite maintaining a continuous freeze without additional interest rate hikes, the financial market remains unstable due to recent events such as the Israel-Palestine war outbreak and the rise in U.S. Treasury yields. Accordingly, active efforts to successfully close deals through price adjustments and seeking strategic investors (SI) in commercial real estate investment are being observed. However, the institute explains that it will likely take some time to absorb all the properties currently on the market.

Meanwhile, Genstarmate is a domestic commercial real estate consulting firm providing real estate research and consulting, asset management, investment and development advisory, lease consulting, corporate real estate services, and logistics real estate services.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.