①HBM History

Samsung Falls Behind in 'Numbers'

Increased Investment Could Lead to Reversal

69% VS 24%

This is the stock price increase rate of SK Hynix and Samsung Electronics as of the 25th compared to the beginning of the year.

-3.7 trillion KRW VS -1.792 trillion KRW

This is the Q3 operating profit forecast for Samsung Electronics' semiconductor (DS) division and SK Hynix's operating profit.

Samsung Electronics is undoubtedly the number one company in Korea. Furthermore, it is the world leader in the memory semiconductor business. SK Hynix is the second. Although the ranking difference is only one, there has been an insurmountable fourth-dimensional wall between the two. However, recently, an unimaginable situation has occurred where SK Hynix is numerically overwhelming Samsung Electronics.

The areas where SK Hynix numerically overwhelms Samsung Electronics are the stock price increase rate, which reflects the company's future value, and the market share of HBM, a next-generation advanced memory semiconductor. Also, SK Hynix is evaluated to be relatively holding up well in recent earnings. Sometimes simple numbers are more persuasive than flashy rhetoric. This is exactly such a moment. Hynix has driven its fangs into Samsung Electronics' number one fortress.

Why is Hynix performing well in earnings and stock price? It is because SK Hynix has taken the lead over Samsung in the battle for dominance in advanced products like HBM development, securing excellent customers, and leading-edge processes. HBM semiconductors are high-performance products made by vertically stacking multiple DRAM chips. They significantly increase data processing speed compared to existing products. They are mainly installed in graphic processing units (GPUs) that process artificial intelligence (AI) data.

On the 26th, SK Hynix announced in its Q3 earnings conference call that sales of graphic DRAM including HBM accounted for over 20% of total DRAM sales. Since Q3 DRAM sales were 6.0744 trillion KRW, at least 1.2149 trillion KRW was earned from HBM sales. Thanks to the high value-added HBM effect, SK Hynix's Q3 DRAM earnings turned positive after two quarters. Among the three companies leading the global DRAM market (Samsung Electronics, SK Hynix, Micron), SK Hynix is the only one to have successfully turned a profit.

Kim Wang-su, PL (Project Leader) of DRAM Product Planning at SK Hynix, holding the 12-layer HBM3, a 4th generation HBM (High Bandwidth Memory) semiconductor product.

Kim Wang-su, PL (Project Leader) of DRAM Product Planning at SK Hynix, holding the 12-layer HBM3, a 4th generation HBM (High Bandwidth Memory) semiconductor product. [Photo by SK Hynix]

The history of HBM semiconductors dates back 10 years. In 2013, SK Hynix was the first to develop HBM semiconductors. They boldly bet on the future of the AI market. At that time, there were concerns even within the company about investing in HBM development. However, by persistently improving HBM technology, they have now reaped such results.

An SK Hynix employee inspecting wafers in a semiconductor manufacturing facility cleanroom.

An SK Hynix employee inspecting wafers in a semiconductor manufacturing facility cleanroom. [Photo by SK Hynix]

Not only in product development but also in leading-edge processes and customer orders, SK Hynix has surpassed rivals like Samsung Electronics and US-based Micron. Following the first-generation product in 2013, the fourth-generation product (HBM3), currently supplied to Nvidia, was also first developed by Hynix in October 2021. This was possible because they were the first to develop the process of vertically stacking multiple DRAM chips. In June last year, they succeeded in mass production just seven months after developing the fourth-generation product. At that time, SK Hynix called itself the "first mover," a term symbolizing Samsung in the memory semiconductor industry. They also led international standardization work with JEDEC (the Joint Electron Device Engineering Council). Samsung is expected to start mass production of the fourth-generation product only by the end of the year. SK Hynix also first developed the fifth-generation (HBM3E) product in August.

On the other hand, Samsung Electronics is known not to have invested as much effort in HBM as SK did. HBM semiconductors still account for only about 1% of the total memory semiconductor market shipments in 2023. Ten years ago (2013), it was difficult to predict when the AI market would grow to a global "new normal" level. It is analyzed that it was hard to pour in large amounts of money. However, earlier this year, with generative AI like Microsoft’s ChatGPT sweeping the global market, SK’s HBM betting strategy began to be seen as ahead of Samsung’s. In the so-called competition of selection and concentration, Hynix has won a great victory.

The reason SK’s faster product development speed compared to Samsung and Micron also affects earnings is that it secured transactions with excellent customers like Nvidia earlier. Nvidia holds about 90% of the global AI GPU market share. This means SK Hynix secured customers like Nvidia faster than Samsung Electronics. Customers rarely change suppliers unless there are fatal quality defects such as a significant drop in semiconductor yield (good product ratio).

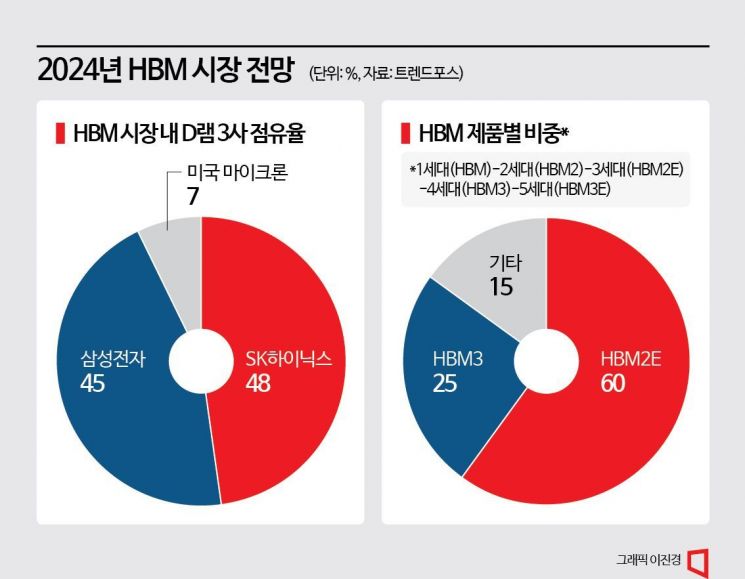

The impact of securing excellent customers is reflected in the numbers. TrendForce’s estimated market share for this year is 46-49% for both companies, but according to official numbers released until the end of last year, SK Hynix had about 50%, about 10 percentage points higher than Samsung Electronics’ 40%. Shinhan Investment Corp.’s estimated market share for next year also shows SK Hynix (48%) ahead of Samsung Electronics (45%).

It is too early to raise a toast. Samsung Electronics’ DS division posted a loss close to 9 trillion KRW in the first half, yet invested a record-high 13.78 trillion KRW in research and development (R&D). They also poured 25.3 trillion KRW into facility investment in the first half. They significantly increased foundry (semiconductor contract manufacturing) investment and maintained memory semiconductor investment at the usual level. If Samsung increases the proportion of investment in HBM semiconductors, the current lead of SK Hynix could quickly change.

A semiconductor industry insider said, "There is no company in the market yet that consumes AI memory semiconductors in large quantities like Nvidia," adding, "SK Hynix’s advantage will continue for the time being, but Samsung Electronics will try hard to supply to avoid damage to its image."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.