Simultaneous Board Meetings of Both Companies on the 30th

Discussion on Slot and Cargo Business Sale Plans

Low Possibility of Board Breach of Duty

'Opposing Agenda → Merger Collapse' May Cause Greater Losses

Post-Board Approval Situation More Critical

Finding Buyer for Cargo Business Division Difficult

The boards of directors of Korean Air and Asiana Airlines, considered the biggest turning point in their merger, will meet on the 30th. Korean Air, after much deliberation, made a decisive move when the European Union (EU) demanded the sale of the cargo business, stating that the existing measures were insufficient. Approval from Asiana Airlines' board is required to submit the merger remedy plan based on this to the EU. Although the board is unlikely to oppose this, the question remains whether the cargo business can be sold afterward.

As the court's decision on Korean Air's acquisition of Asiana Airlines approaches, on the 30th, Korean Air and Asiana Airlines passenger planes were moving toward the runway at Gimpo Airport apron in Gangseo-gu, Seoul. The Seoul Central District Court is expected to deliver a ruling today or tomorrow on the injunction request filed by activist private equity fund KCGI against Hanjin KAL to prohibit the issuance of new shares. If the court dismisses the injunction request, the acquisition process will accelerate, but if the injunction is granted, the acquisition is likely to be canceled. Photo by Kim Hyun-min kimhyun81@

As the court's decision on Korean Air's acquisition of Asiana Airlines approaches, on the 30th, Korean Air and Asiana Airlines passenger planes were moving toward the runway at Gimpo Airport apron in Gangseo-gu, Seoul. The Seoul Central District Court is expected to deliver a ruling today or tomorrow on the injunction request filed by activist private equity fund KCGI against Hanjin KAL to prohibit the issuance of new shares. If the court dismisses the injunction request, the acquisition process will accelerate, but if the injunction is granted, the acquisition is likely to be canceled. Photo by Kim Hyun-min kimhyun81@

For the merger of the two companies, approval from competition authorities in each country is necessary. The merger must be reported to 14 countries. If approval is not obtained from even one of the mandatory reporting countries, the merger cannot proceed. Currently, approval has been received from competition authorities in 11 countries. The remaining mandatory reporting countries are the EU, the United States, and Japan.

The EU Commission, responsible for corporate mergers, demanded countermeasures, expressing concerns that the merged company would monopolize both passenger and cargo businesses if Korean Air merges with Asiana Airlines. Specifically, it was anticipated that competition in passenger transport services on four Korea-Europe routes (Frankfurt in Germany, Paris in France, Rome in Italy, and Barcelona in Spain) would be weakened. Furthermore, in the cargo sector, the merged company would become the largest carrier on routes between Europe and Korea, potentially leading to higher service prices or lower quality.

Korean Air drafted a remedy plan that includes transferring the traffic rights for the four passenger routes to the domestic low-cost carrier (LCC) T'way Air. It is also reported that Asiana Airlines' cargo business will be sold after the merger. This plan addresses both the monopoly concerns raised by Europe and domestic criticism that key businesses are being sold overseas. The EU has provided detailed additional requirements on this draft, and Korean Air plans to submit the final version reflecting these by the end of this month.

Both companies will hold board meetings at the same time on the 30th to discuss approval of this final plan. Korean Air's board will naturally approve the merger plan. The issue lies with Asiana Airlines' board. Korean Air must obtain approval from Asiana Airlines' board for the sale of the cargo business and the return of slots (the rights for airlines to use airport facilities at desired times to take off and land) to submit the remedy plan to the EU Commission.

From Asiana Airlines' board perspective, passing the agenda might be seen as causing harm to Asiana Airlines. They could also argue that it might constitute a breach of fiduciary duty. However, even if the remedy plan is approved, Asiana Airlines will not suffer immediate losses. Moreover, since the conditions for the sale of the cargo business have not been finalized, the board's approval cannot be considered an act that benefits the acquirer, making the likelihood of breach of fiduciary duty charges low.

Additionally, if the board opposes the plan citing potential breach of fiduciary duty and the merger fails, the board could be committing an even greater breach of fiduciary duty. Missing the timing could lead to the company disappearing altogether. If the merger fails due to board opposition, Asiana Airlines would have to survive on its own or find a new buyer. Otherwise, the main creditor, Korea Development Bank, might have to inject public funds again. However, this is realistically considered impossible. It is difficult for Asiana Airlines to stand alone due to its enormous debt. Finding a third party willing to take on the debt and acquire the company is also challenging.

As of June this year, Asiana Airlines' debt stands at approximately 12 trillion won. Of this, aircraft lease debt alone amounts to 4.3379 trillion won, and the debt ratio reaches 1741%. Korea Development Bank, which has already provided 3.6 trillion won in public funds, reportedly informed Asiana Airlines that additional financial support would be difficult if the merger fails. Ultimately, it is difficult for Asiana Airlines' board to oppose merger-related issues.

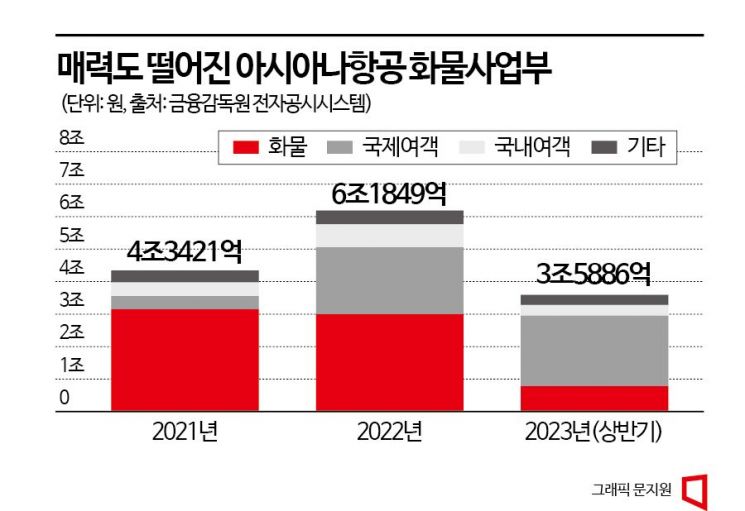

The real problem comes after board approval. Finding a domestic company to purchase the cargo business is not easy. First, the 'attractiveness' of the cargo business has declined. Asiana Airlines' cargo sales, which soared to 3 trillion won during the COVID-19 pandemic in 2021, fell to 779.5 billion won in the first half of this year. The acquiring company would also have to take on the cargo business debt, estimated at around 1 trillion won.

Korean Air selected Samjong KPMG as the advisory firm for the sale of Asiana's cargo business and conducted a preliminary bidding process, but Jeju Air, considered the top LCC, did not participate. Four companies?T'way Air, Air Premia, Eastar Jet, and Air Incheon?submitted letters of intent (LOI). However, it is reported that even T'way Air, the largest among them, is considering withdrawing from the acquisition.

Meanwhile, Korea Development Bank maintains that the sale of the cargo business is a prerequisite for the merger. On the 24th, Kang Seok-hoon, chairman of Korea Development Bank, stated, "The merger must be completed through the sale of the cargo business, and I believe Asiana's board will make a reasonable decision."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.