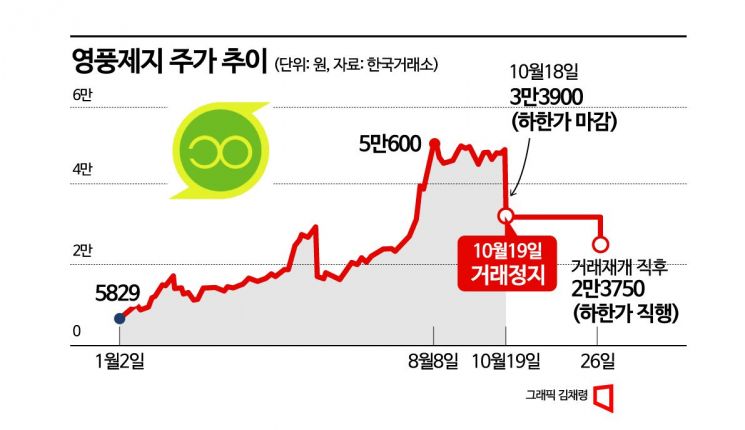

Trading Halt on Yeongpung Paper over Market Manipulation Suspicion, Plunges to Lower Limit Immediately After Resumption on 26th

Kiwoom Securities Faces Criticism for Late 100% Margin Rate Increase on Yeongpung Paper

FSS to Inspect Kiwoom Securities' Management, Plans to Expand Review Across Securities Industry

Yoon Mo and Lee Mo, who are suspected of market manipulation in connection with allegations of unfair trading involving Youngpoong Paper, are appearing at the Seoul Southern District Court on the morning of the 20th for a pre-arrest suspect interrogation (warrant hearing).

Yoon Mo and Lee Mo, who are suspected of market manipulation in connection with allegations of unfair trading involving Youngpoong Paper, are appearing at the Seoul Southern District Court on the morning of the 20th for a pre-arrest suspect interrogation (warrant hearing). [Image source=Yonhap News]

Trading of Yeongpung Paper, which was suspended on the 19th due to allegations of market manipulation, resumed today (26th). Yeongpung Paper's stock price immediately hit the lower limit as soon as the market opened. As of 10:15 AM, there is an accumulated lower limit order volume exceeding 18.5 million shares. Consequently, the red flag for Kiwoom Securities' collection of unpaid balances has intensified. Kiwoom Securities announced after the market closed on the 20th that "an unpaid balance of 494.3 billion KRW occurred in customer margin accounts due to Yeongpung Paper hitting the lower limit."

On the 18th, when Yeongpung Paper and its parent company Daeyang Metal recorded the lower limit price, the Korea Exchange suspended trading of these stocks starting from the 19th. This was right after some members of the group involved in the Yeongpung Paper market manipulation allegations were arrested. They are suspected of creating about 100 accounts at Kiwoom Securities and manipulating the stock price through wash trading and using margin loans.

Because of this, Kiwoom Securities, which suffered a backlash in April when former Dow Kiwoom Group Chairman Kim Ik-rae was implicated in the 'Ra Deok-yeon stock manipulation scandal,' has been criticized for becoming a 'playground' for the stock manipulation group that created the suspicious lower limit price of Yeongpung Paper. Other securities firms detected the suspicious trend and raised the margin rate for Yeongpung Paper to 100%, effectively blocking margin trading. However, Kiwoom Securities maintained the margin rate at 40% and only adjusted it to 100% on the 19th, when trading was suspended. This lax risk management, even after the 'Ra Deok-yeon stock manipulation scandal' involving Contracts for Difference (CFD) services, has made it difficult to avoid criticism for exacerbating the problem.

Financial authorities have expressed discomfort with Kiwoom Securities' actions. In particular, they plan to inspect the risk management practices of all securities firms, including Kiwoom Securities, in light of this incident. According to the financial authorities' policy to eradicate market manipulation, preemptive blocking of margin trading for stocks suspected of price manipulation will become a key aspect of securities firms' risk management capabilities. The group that manipulated Yeongpung Paper's stock price used Kiwoom Securities accounts as a channel for market manipulation, gaining illicit profits worth around 100 billion KRW. Loans from securities firms, such as credit and margin loans, can be exploited as funding sources for stock manipulators. Accordingly, the Financial Supervisory Service plans to demand strengthened risk management from all securities firms, including Kiwoom Securities.

Yeongpung Paper Manipulation Group Uses Kiwoom Securities Accounts for Market Manipulation

The scale of unpaid balances disclosed by Kiwoom Securities is close to the company's consolidated operating profit of 569.7 billion KRW in the first half of this year. The unusual disclosure of unpaid balances was due to the large amount, which was deemed a significant management issue. Kiwoom Securities plans to recover the unpaid balances through forced sales, and although the final amount of unpaid claims may decrease depending on customer repayments, the situation is challenging.

Margin trading with unpaid balances is a very short-term credit transaction where individual investors borrow money from securities firms to buy stocks and repay the settlement amount within two business days, the actual settlement date. It is distinguished from credit loan transactions, which usually have a maturity of around three months. Unpaid balances arise when investors fail to repay the margin loan amount. If investors do not pay the settlement amount, the securities firm forcibly sells the stocks to recover the funds, a process called forced sale.

This time, a significant portion of the unpaid balance margin trading at Kiwoom Securities reportedly came from about 100 accounts used for wash trading by the market manipulation group. As a result, on the 23rd, Kiwoom Securities' stock price plunged 23.9% from the previous trading day to close at 76,300 KRW. Kang Seung-geon, a researcher at KB Securities, explained, "Due to the cost burden related to Yeongpung Paper's unpaid balances being reflected in the fourth-quarter earnings, the annual profit forecast for this year is lowered by 23.3% to 529.3 billion KRW." Jeong Min-gi, a researcher at Samsung Securities, analyzed, "The loss scale for Kiwoom Securities will vary depending on the number of times Yeongpung Paper hits the lower limit. If it hits the lower limit for three consecutive trading days, the loss is expected to be about 200 billion KRW; if for five consecutive days, about 350 billion KRW."

A senior official in the financial investment industry said, "Most of the accounts with unpaid balances at Kiwoom Securities were abnormal accounts that used large amounts of unpaid balances exclusively for trading Yeongpung Paper," adding, "This suggests that the stock manipulation group opened accounts at Kiwoom Securities to manipulate the market."

While Other Securities Firms Blocked Margin Trading, Kiwoom Maintained It

Most securities firms detected the risk and blocked margin trading for Yeongpung Paper, but Kiwoom Securities did not. Firms such as Mirae Asset, Korea Investment & Securities, and NH Investment & Securities raised the margin rate for Yeongpung Paper to 100% from early this year until July, effectively blocking margin trading. However, Kiwoom Securities maintained the margin rate at 40% and only adjusted it to 100% on the 19th, when trading was suspended. When a securities firm sets the margin rate at 100%, the stock can only be purchased with cash, making margin trading impossible. Setting the margin rate at 40% means that with 400,000 KRW in cash, one can buy 1 million KRW worth of stock.

Securities firms calculate margin rates based on various factors such as the financial status of each stock, price volatility, liquidity, the proportion of credit loan transactions, and other market information, following the Korea Financial Investment Association's 'Model Regulations for Risk Management of Financial Investment Companies.' They monitor market conditions, price volatility, and market measures by the Korea Exchange to decide whether credit loans are allowed, but ultimately, the decision is made by the securities firm itself.

An official from the Korea Financial Investment Association explained, "The reason securities firms restrict credit loans, collateral loans, and margin trading is to prevent a surge in accounts with insufficient collateral due to excessive 'debt investment,' which causes unpaid claims to spiral out of control," adding, "Furthermore, the goal is to protect investors and secure the company's capital soundness."

Accordingly, securities firms have separate departments to manage risk. Kiwoom Securities also has a review department within the relevant division that selects risky stocks and calculates margin rates. However, Kiwoom Securities claims that Yeongpung Paper was not classified as a risky stock by the company.

A securities firm official pointed out, "Yeongpung Paper's stock price rose more than 12 times over 11 months without clear reasons, and despite being a paper company, its price-to-earnings ratio (PER) exceeded 300, leading to widespread suspicion of manipulation in stock communities," adding, "Yet, the failure to take preemptive measures indicates either poor risk management capability or neglect for commission revenue."

Calls for Strengthening Risk Management Capabilities

The securities industry is freezing up. Financial authorities are expected to inspect and demand strengthened risk management across all securities firms. Since the Ra Deok-yeon incident in April and another market manipulation case detected in June, financial authorities have implicitly pressured firms to focus on risk management. This is why securities firms proactively raised margin rates for unpaid balances and took other preemptive measures. There were results: in June, the second 'mass lower limit' incident exposed stock manipulation crimes because some securities firms detected abnormal price movements in five stocks within the same industry and refused to extend credit maturities, causing those stocks to hit the lower limit.

Jeong Min-gi, a researcher at Samsung Securities, pointed out, "Since the CFD incident in April, there has been a demand to strengthen risk management related to credit transactions," adding, "The current unpaid balance incident related to Yeongpung Paper has raised fundamental doubts about risk management and internal controls." A financial investment industry official said, "Designating margin rates and tradable stocks in margin and credit transactions is part of securities firms' risk management, and going forward, there will be demands for more detailed management," adding, "Financial authorities will strengthen monitoring to ensure internal control functions operate properly." Kiwoom Securities announced on the 25th that it will repurchase 70 billion KRW worth of its own shares and strengthen risk management.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)