Sales of 18.961 trillion KRW and operating profit of 1.196 trillion KRW

Down 5.5% and 7.7% respectively from the previous quarter

POSCO Holdings received a disappointing performance report as steel prices fell due to sluggish economic conditions and prices of key raw materials for secondary batteries declined simultaneously. Concerns are rising that the downturn may continue into next year due to the ongoing economic recession in China and global uncertainties.

POSCO Holdings announced on the 24th that it achieved consolidated sales of KRW 18.961 trillion and operating profit of KRW 1.196 trillion in the third quarter. Compared to the same period last year, sales decreased by 10.4%, but operating profit increased by 33.3%.

However, due to the global steel market downturn and falling prices of battery materials such as lithium and nickel, sales and operating profit decreased by 5.5% and 7.7% respectively compared to the previous quarter.

The steel division recorded sales of KRW 15.803 trillion and operating profit of KRW 853 billion. Production and sales of products declined due to the weak steel market conditions, and selling prices also dropped, resulting in a decrease in profit compared to the previous quarter.

Um Ki-cheon, head of POSCO’s Marketing Strategy Office, explained at the conference call held that day, "We initially expected the economic outlook this year to be lower in the first half and higher in the second half, but the economy turned weak in the third quarter and this trend is expected to continue into the fourth quarter. We plan to expand steel sales toward sectors with good business conditions such as automobiles and shipbuilding."

Regarding negotiations with major clients and pricing, he said, "We agreed to raise prices for automotive products in the second half compared to the first half, and although the shipbuilding sector is showing favorable conditions, price negotiations have not yet been completed. For home appliances, due to poor market conditions, we concluded negotiations to maintain prices in the second half."

The eco-friendly future materials business, including secondary batteries, achieved sales of KRW 1.313 trillion but returned to an operating loss. POSCO Future M, which operates the secondary battery materials business, posted an operating profit of KRW 37.1 billion on a consolidated basis in the third quarter, down 54.6% from the same period last year. During the same period, sales rose 22.1% to KRW 1.2858 trillion, achieving the highest quarterly sales to date.

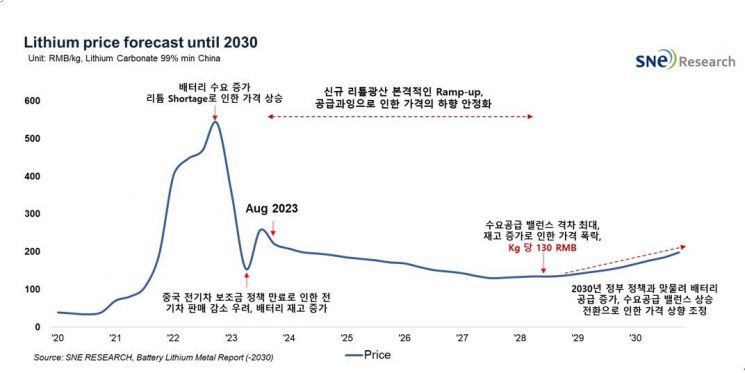

Recently, prices of raw materials such as lithium and nickel have fallen, causing cathode material prices to drop. Operating profit also fell 41.7% compared to the previous quarter. However, sales set a new record for the third consecutive quarter due to expanded sales of premium battery materials.

Lee Kyung-seop, head of POSCO’s Secondary Battery Materials Business Team, explained, "Raw material prices have dropped significantly compared to last year, but last year prices rose abnormally high. The lithium plant at the Argentine salt lake will be completed in 2024 and sales will begin in earnest from 2025, so lithium will be sold at normal prices at the time of sale."

Despite these circumstances, POSCO Holdings stated that it will pursue a strategy to "secure a global market position in growth markets." It also plans to proceed with investments in new businesses as scheduled. POSCO Holdings recorded cumulative investments of KRW 5.9 trillion through the third quarter.

POSCO Holdings announced plans to establish a global production system of 1 million tons by 2030, including expanding the 'High-grade NO' facility in Gwangyang for eco-friendly vehicle motor cores.

Additionally, it will establish a sales system of 7 million units by 2030 with the completion of a 1.5 million motor core factory in Mexico by POSCO International and POSCO Mobility Solutions. Using POSCO’s electrical steel sheets as materials, it will produce motor cores and supply them to Hyundai Motor Group, building a value chain for eco-friendly vehicle materials.

Jung Ki-seop, Chief Strategy Officer of POSCO Holdings, said, "Uncertainties in the business environment continue, and rising costs due to inflation pose many challenges to management activities, but we will secure a global market position through consistent and continuous investment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.