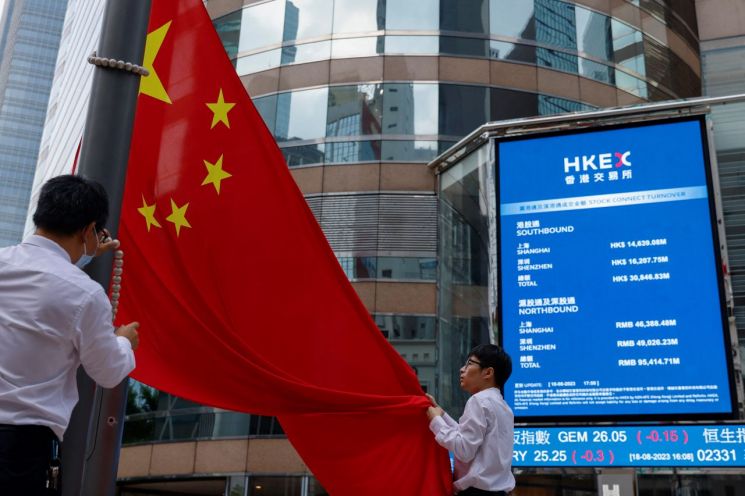

Major Asian stock markets closed higher on the 23rd, as concerns over the sharp rise in U.S. Treasury yields and economic downturn failed to significantly dampen investor sentiment.

On the day, China's Shanghai Composite Index closed at 2,962.63, up 0.78% from the previous session, while the large-cap CSI 300 Index rose 0.37% to 3,487.13. After an early decline, the Chinese stock market rebounded on news that China's sovereign wealth fund was buying CSI 300 Index ETFs to support the market.

Japan's Nikkei 225 Index (0.20%) and Korea's KOSPI Index (1.12%) also rebounded in a V-shaped recovery to close higher. The KOSPI initially fell over 1% due to forced selling but turned strong as bargain buying emerged.

On the day, major Asian markets showed volatile intraday swings amid various factors, including pressure from rising U.S. Treasury yields and heightened caution ahead of U.S. economic data releases.

The 10-year U.S. Treasury yield, which had briefly surpassed 5% during the session, retreated amid growing concerns over an economic slowdown. Some expect Treasury yields to continue their upward trend. Trace Chen, portfolio manager at Brandywine Global, said, "Due to high fiscal spending tendencies, yields will remain elevated for longer and at higher levels," and predicted that a yield surpassing 6% is not impossible.

Bill Gross, known as the "Bond Guru" on Wall Street, issued a warning about preparing for the impact of economic deterioration. The founder of global bond manager PIMCO stated on social media platform X that "the regional bank massacre and record-high auto loan delinquency rates indicate a significant slowdown in the U.S. economy," and forecasted that the U.S. economy will enter a recession in the fourth quarter.

Markets are also concerned that geopolitical uncertainty caused by the Israel-Palestine conflict could slow economic activity and drive global inflation higher.

Gary Dugan, Chief Investment Officer (CIO) of Dalma Capital, said, "Inflation fears are intensifying due to the recent surge in international oil prices," adding, "If this level of oil price increase continues into early next year, it could trigger another wave of inflation worldwide."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.