[Asking About Carbon Neutrality] ①

POSCO Declares 'First Mover'

European Companies Prepare for Long Term

True Competitiveness Is 'Scale-Up'

Leading in Hydrogen Flow Reduction Technology

Time to Collaborate and Brainstorm Together

"We see the transition to carbon neutrality as a second startup. If POSCO has grown as a 'Fast Follower' rapidly reaching the technology level of advanced steelmakers, the carbon neutrality transition means becoming a 'First Mover.' We are pioneering a path no one has taken before. Just as the first molten iron poured out from the Pohang Steelworks 50 years ago, moving the entire nation, the moment of producing steel through hydrogen reduction and feeling that excitement will come soon."

Jang Se-hwan, head of POSCO's Carbon Neutral Strategy Group, said, "We are introducing pilot facilities for large-scale hydrogen reduction steelmaking using 100% hydrogen instead of coal," adding, "From 2026, we will utilize pilot facilities with an annual capacity of 300,000 tons to complete commercial technology by 2030."

POSCO Group declared carbon neutrality by 2050 in December 2020, the first Asian steelmaker to do so, and established the Carbon Neutral Strategy Group as a control tower organization directly under the CEO in January last year to concretize the roadmap. We met Jang Se-hwan, who is pioneering this new path toward carbon neutrality, on the 17th at the POSCO Center meeting room in Gangnam-gu, Seoul.

- Swedish steelmaker SSAB even made trucks using hydrogen reduction steelmaking.

▲ Whether it is technically feasible and whether it has commercial competitiveness are different matters. SSAB produces 1 ton of hydrogen reduction steel per hour. If production continues without equipment failure, theoretically, it would be 8,760 tons per year. POSCO’s single blast furnace produces up to 5 million tons annually, which is about 1/550th of that. POSCO is preparing for mass production from a commercialization perspective. Scale-up is the real competitiveness and core technology. Securing this technology is important. POSCO is pushing investment in a 300,000-ton scale hydrogen reduction steelmaking pilot facility by 2026. It plans to gradually expand to 1 million tons and 2.5 million tons. Additional technology development such as hydrogen heating is underway, and annual facility conversion plans are established, so we believe the goals can be achieved.

POSCO’s core hydrogen reduction steelmaking technologies are fluid reduction and large electric smelting furnace operation technologies. POSCO already possesses these two core technologies. At the Pohang FINEX facility, 3.5 million tons are produced annually using the fluid reduction method, and its subsidiary SNNC operates an Electric Smelting Furnace (ESF) with a charging capacity of 1.5 million tons. Global steelmakers benchmark these technologies and have proposed technical cooperation.

- Steel is a representative industry with high greenhouse gas emissions. It seems POSCO’s carbon neutrality achievement will not be easy.

▲ It is indeed a difficult path, but we can achieve our set targets of 30% by 2035, 50% by 2040, and 100% by 2050. We have detailed numerical and execution strategies annually, including how much hydrogen is needed and how much purchased or self-generated power is required. This is not a vague plan. I cannot even show you the Excel files... The CO2 emissions from steel production are about 2 tons per ton of steel, which is very low compared to 16 tons for aluminum and 46 tons for magnesium. Steel is an eco-friendly material with a recycling rate of over 85%. The total emissions are high because the usage volume is absolutely large. For the foreseeable future, it will be difficult for materials to replace steel. We still live in the Iron Age.

Mr. Jang has been with POSCO for 21 years. Just before his appointment as group head, he was in charge of the practical establishment of POSCO’s 2050 carbon neutrality roadmap at the Steel Planning Office. Creating a carbon neutrality strategy at POSCO, a company with high greenhouse gas emissions, was impossible without steel knowledge, experience, and understanding of all organizational sectors. After making the roadmap, he felt the need for an organization to plan and coordinate company-wide. The top management, upon receiving the report, instructed the establishment of a dedicated carbon neutrality organization to ensure the plan would not remain just a document but become a competitive and practical transition, leading to the birth of the Carbon Neutral Strategy Group. "The blueprint is drawn, and now the background and details must be filled in one by one. I started with a heavy sense of responsibility."

- Are overseas advanced steelmakers well prepared for carbon neutrality?

▲ I traveled for about two weeks last July to check the trends and progress of overseas competitors in Europe and elsewhere. Europe has established carbon neutrality methods from scientific and technological perspectives, not as an environmental campaign, and companies and governments jointly set transition plans and provide systematic support to secure national industrial competitiveness. The SALCOS project in Salzkita receives about 1.4 trillion KRW, equivalent to 40% of total costs. ArcelorMittal is also converting facilities with about 2 trillion KRW support in Europe, including 1.2 trillion KRW for the Dunkirk steelworks. Japan, with similar industrial conditions, announced the GX (Green Transformation) policy this year, providing direct support for facility conversion. Japan sees carbon neutrality as an opportunity for industrial re-advancement and has created a fund of about 200 trillion yen to support corporate carbon neutrality transition.

- What about Chinese steelmakers, who have overwhelmingly large crude steel production?

▲ China’s carbon neutrality target year is 2060. Although the national goal is 10 years later than ours, global stakeholders such as customers strongly demand carbon reduction, so it cannot be postponed. General consumers are also shifting their awareness to be willing to pay more for eco-friendly products for the global environment. Baowu Steel, the world’s largest crude steel producer, is conducting carbon reduction using pure oxygen in blast furnaces and testing shaft-type direct reduced iron using gas including some hydrogen.

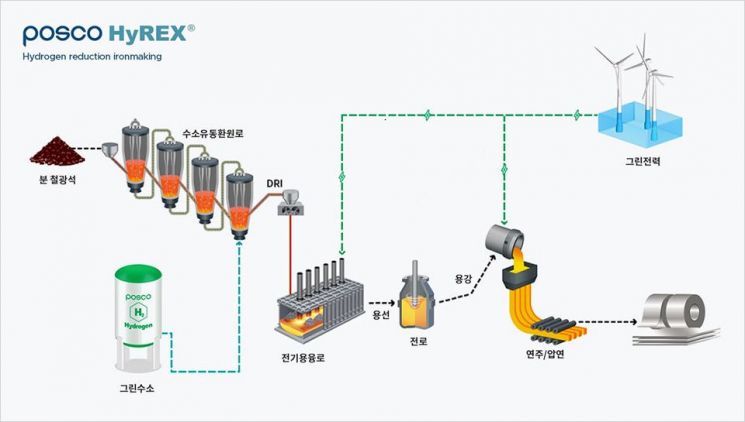

Conceptual diagram of POSCO-type hydrogen reduction steelmaking technology 'HyREX' [Image source=POSCO]

Conceptual diagram of POSCO-type hydrogen reduction steelmaking technology 'HyREX' [Image source=POSCO]

- How far has POSCO come?

▲ In terms of investment scale related to carbon neutrality, POSCO is at a global top-tier level. European small and medium steelmakers with annual production capacity of 6 to 7 million tons say they will convert 50% or 100% of facilities by the mid-2030s. One electric furnace with 3 million tons per year corresponds to about 50% conversion. Our company produces 38 million tons annually, so one 3 million-ton furnace is about 8%. POSCO plans to invest in a large electric furnace with an annual capacity of 2.5 million tons in Gwangyang in 2026 and a 300,000-ton hydrogen reduction steelmaking pilot facility in Pohang the same year. The level of technology development and investment scale are not small compared to competitors.

- Carbon Capture, Utilization, and Storage (CCUS) technology is also a hot topic in the industry. What is POSCO’s competitiveness?

▲ Cost reduction. Carbon capture costs account for 60-70% of the total in CCUS projects. The more carbon captured at once from the air, the higher the efficiency. For example, at 60% concentration, capturing 100 units captures 60 units of carbon, while at 20%, only 20 units are captured. POSCO can capture carbon at 70% concentration using its proprietary fluid reduction technology called FINEX. This is more than twice as efficient and cost-effective compared to general blast furnace or power plant carbon capture at 20-30%. We also plan to actively participate in the 'Donghae Gas Field Utilization CCS Project.'

POSCO is reviewing a liquefied carbon dioxide business based on its competitive carbon capture cost. The goal is to supply liquefied carbon dioxide to the domestic market within a few years. The investment scale for related facilities is about 100 billion KRW. The plan is to capture carbon from blast furnace flue gas and directly produce liquefied carbon dioxide with 99.9999% purity. Liquefied carbon dioxide is widely used in carbonated beverages, semiconductors, shipbuilding, medical, agriculture, and other fields. It has mainly been produced by the petrochemical industry, but due to the deepening economic recession, plant operating rates have dropped, causing a shortage of carbon dioxide supply.

- What should the government prepare for ahead of the carbon neutrality era?

▲ When the carbon neutrality era comes, hydrogen must fully replace the role of fossil fuels. It must act as a reducing agent in metal manufacturing processes such as iron ore and also as a fuel for stable power supply. How stably and economically hydrogen can be procured is the key to the carbon neutrality transition. The U.S. offers a 30% tax credit on clean hydrogen production facility investments or subsidies of $3 per kg, and Australia’s Under2 policy aims to supply hydrogen within 2 Australian dollars per kg. Europe is considering a subsidy policy of 4 euros per kg of hydrogen. Japan’s industry has requested the government to supply hydrogen at 100 yen per kg. I understand that Korea is also reviewing hydrogen support measures at the government level. Companies and the government must jointly plan infrastructure and support measures for hydrogen production, transportation, and storage. Also, as power shifts from engines to motors, electricity demand is expected to increase. Securing power generation capacity and expanding the grid are necessary. CF100 HVDC Grid (Carbon-Free 100% High Voltage Direct Current Grid) centered on coastal areas where power plants and energy-intensive industries are located could be a new alternative for grid load and Scope 2 carbon reduction in industries.

"In the past, companies collapsed if they fell behind competitors, but nowadays, they collapse if they cannot keep up with change. The fact that the U.S. includes steel in its security strategy and Europe includes it in CBAM shows the status of steel. I believe that Korea’s shipbuilding, automobile, and heavy industries have global competitiveness largely because they receive high-quality steel at competitive prices and on time. For carbon neutrality in the steel sector, it is now time for companies and the nation to put their heads together and think together."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.