Concerns Over Inflation Due to Israel-Palestine War and Strong US Economy

Both Korea and the US to Maintain 'Higher Interest Rates for Longer'

Domestic Bond Yields Expected to Stay Elevated for the Time Being

Domestic bond yields are expected to remain at high levels for the time being. Key factors include concerns over the escalation of the war between Israel and the Palestinian militant group Hamas, prolonged tightening by the U.S. Federal Reserve (Fed), and robust U.S. economic indicators.

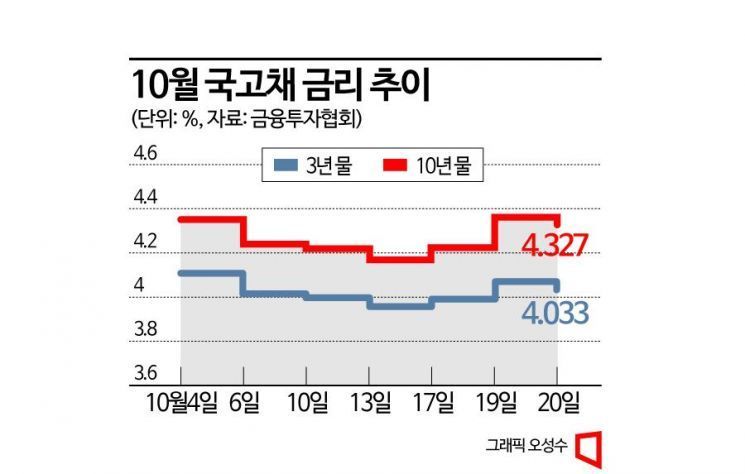

According to the Korea Financial Investment Association, on the 20th, the final yield on the 3-year government bond closed at 4.033%, down 3.7 basis points (1bp = 0.01 percentage points) from the previous session. The 10-year bond yield fell 3.5bp to 4.327%. Although long-term yields hit new highs due to rising U.S. Treasury yields, the subsequent decline in yields is interpreted as a correction from excessive price weakness. Looking at the October government bond yield trends, short-term yields rose again, while long-term yields returned to the 4.3% range.

On the 19th (local time), when the U.S. 10-year Treasury yield surpassed 5% for the first time in 16 years, domestic bond market yields also rose. The U.S. 10-year Treasury yield exceeding 5% is the first occurrence since July 2007, just before the global financial crisis. The U.S. 10-year Treasury yield serves as a benchmark for global long-term interest rates.

The bond market is expected to face upward pressure for the time being. First, there is concern over the escalation of the Israel-Palestine war. Since the outbreak of the war, international oil prices have shown a clear upward trend. Prolonged high oil prices could stimulate inflation. Looking at the price of Dubai crude oil, which South Korea mainly imports, it has trended upward from $75.21 per barrel (July 3) to $93.44 per barrel (October 20).

In particular, following the Ukraine war, the outbreak of the Israel-Palestine war has also fueled concerns over the U.S. fiscal deficit, which has contributed to rising bond yields. Issuance of government bonds is inevitable to support two wars. The U.S. records a fiscal deficit exceeding 5% of its gross domestic product (GDP) annually.

Jae-kyun Lim, a researcher at KB Securities, said, "Since the U.S. credit rating downgrade in August and the expansion of coupon bond issuance, the increase in U.S. Treasury issuance has been a factor in rising yields," adding, "If the Treasury maintains or slightly increases the issuance scale of long-term bonds, conscious of rising yields, market concerns may ease somewhat."

Meanwhile, Fed Chair Jerome Powell's hawkish remarks also influenced the market. In a speech at the New York Economic Club on the 19th (local time), Powell said, "For inflation to sustainably fall to around 2%, it appears necessary to have a period of below-trend growth and a cooling of the overheated labor market." He added, "A sustainable return to the 2% inflation target requires below-trend growth and further slowing in the labor market." This implies that, contrary to market expectations of an end to tightening, high interest rates may be maintained for a prolonged period.

Powell's hawkish remarks are backed by strong U.S. economic data. U.S. retail sales in September increased by 0.7% compared to the previous month, significantly exceeding the forecast of 0.3%.

The labor market remains hot. New unemployment claims for the week of October 8?14 decreased by 13,000 from the previous week to 198,000, marking the lowest level in nine months since the week of January 15?21 (194,000). Earlier, nonfarm payrolls for September increased by 336,000, nearly double the expected 170,000. This indicates that the U.S. economy remains solid, suggesting room for further tightening.

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee plenary meeting held at the Bank of Korea in Jung-gu, Seoul on the 19th. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee plenary meeting held at the Bank of Korea in Jung-gu, Seoul on the 19th. Photo by Joint Press Corps

South Korea also cannot avoid concerns about inflation. This is reflected in the Bank of Korea's October monetary policy statement, which added the phrase, "The timing for inflation to converge to the target level is likely to be delayed more than expected." It also stated, "The pace of inflation slowdown is judged to be likely more gradual than expected."

Ki-jung Kwon, a researcher at IBK Investment & Securities, analyzed, "Ultimately, the Israel-Palestine war has emerged as a new variable in the Bank of Korea's outlook," adding, "Considering that only one Monetary Policy Committee member mentioned the possibility of a rate cut, the upside risks to inflation and interest rates have increased."

A bond market official at the Korea Financial Investment Association also explained, "Although a minority opinion advocating rate cuts has emerged, the market focused on geopolitical uncertainties," adding, "Market participants had expected rate cuts around mid-next year (Q2), but the possibility of delayed rate cuts has increased, leading to rising bond yields."

The bond market views that the Bank of Korea, like the Fed, will "maintain higher benchmark interest rates for longer." The investment strategy team at SangSangIn Securities forecasted, "At this point, where inflation, the economy, financial stability, and war risks must be comprehensively considered, the period of rate freezes may be extended rather than rate adjustments," and predicted, "A rate freeze through the first half of 2024 will be an indispensable scenario."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.