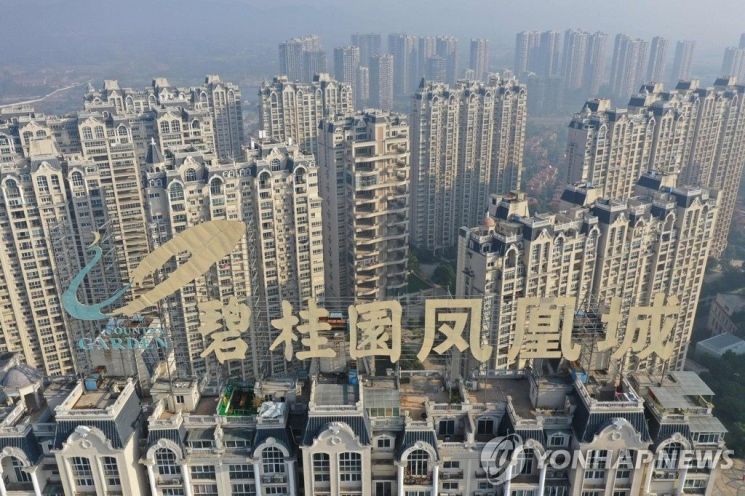

Country Garden, China's largest private real estate developer, officially denied rumors that the founding family had fled overseas.

On the 19th, Country Garden issued a statement through its official social media channels, saying, "We are aware of rumors that the founder and his daughter have left China." The company stated, "Malicious rumors have been posted on various online platforms, causing negative impacts," and clarified, "The founder of Country Garden and the chairman of the group's board are currently working normally in China." It added, "We appreciate the attention, support, and understanding toward the company during these difficult times," and emphasized, "We will hold legal responsibility for malicious rumors."

The mentioned founder is former chairman Yang Guochang, who stepped down from management in March, with his second daughter Yang Huiyan now serving as the sole chairperson. Yang Huiyan was once considered the wealthiest woman in Asia, but due to Country Garden's liquidity crisis and the resulting stock price decline, her ranking in Bloomberg's billionaire list has dropped significantly to 475th. Her assets, which were $34.1 billion (approximately 46 trillion KRW) in June 2021, have plummeted by 84% to $5.5 billion. Bloomberg described Yang Huiyan as "the billionaire who has lost the most wealth worldwide over the past two years."

Country Garden is currently facing difficulties in paying interest on its dollar bonds and is on the brink of default. On the 18th, when Bloomberg inquired about the repayment plan for $15.4 million (approximately 2.08 billion KRW) in interest, the company stated, "Due to adjustments in the domestic Chinese market and sluggish sales, the company expects to be unable to fulfill overseas payment obligations." One of the bondholders explained that even after the 30-day grace period following the interest payment date expired, they had not received the bond interest.

Country Garden holds $186 billion in debt, the largest among private real estate developers. The company was required to pay interest on the 17th-18th after the grace period ended, but its failure to make the interest payments has made an official default declaration inevitable.

China's real estate market has not recovered since the Evergrande default crisis in 2021. Real estate development investment from the first to third quarter of this year decreased by 9.1% compared to the same period last year, showing that despite the authorities' efforts to stimulate the real estate market, the market remains sluggish. The International Monetary Fund (IMF) has observed that the impact of China's real estate market downturn could also affect the Asia-Pacific economy.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)