Discussion on Legalizing Upper Limit for Duty-Free Shop Customer Referral Fees

50% of Group Tour Sales Go to Daigou Fees

"Rapid Growth of Chinese Duty-Free Shops, Korea's Self-Defeating Competition and Decline"

Experts Expect Fee Rate Around 15-20%

However, Many Obstacles Remain Before Law Passage Due to Stakeholder Interests

A bill to legislate the upper limit of commission fees for duty-free shop customer referrals is set to be proposed. The plan aims to normalize excessively high referral commissions and strengthen the competitiveness of the domestic duty-free market. Essentially, the commission fee refers to the money paid by duty-free shops to travel agencies or guides who connect tourists, and this also includes discount benefits provided to Botaerisang (Daigou) or individual tourists. In recent years, with the consecutive occurrences of the 'Hanhanryeong'?a ban on group tours to Korea?and the COVID-19 pandemic, the commission fees paid to Daigou have increased exponentially.

On the 11th, a duty-free shop in Seoul appeared quiet due to the sparse visits of Chinese tourists. Photo by Jo Yongjun jun21@

On the 11th, a duty-free shop in Seoul appeared quiet due to the sparse visits of Chinese tourists. Photo by Jo Yongjun jun21@

50% of Group Sales Go to Referral Commissions

According to the National Assembly and the distribution industry on the 20th, Representative Jin Sun-mi's office plans to submit a bill next month to legally regulate duty-free shop referral commissions. The bill involves amending the Customs Act, which defines the authority of the Korea Customs Service, with the intention of submitting it before the tax law processing deadline of November 30 this year. The main content of the bill is to set an upper limit on referral commissions. The bill does not specify a concrete commission cap; it is expected that the government will determine detailed limits after assessing the current situation. A representative from Jin's office stated, "Since it is difficult to regulate, we are refining the specific details," adding, "While discussions on the detailed rates are necessary, the core idea is to include duty-free shop referral commissions within the scope of regulation."

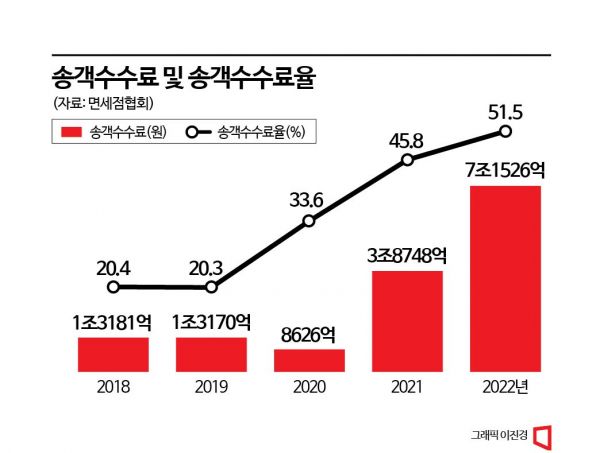

The reason referral commissions have become excessively high lies in the cutthroat competition among domestic duty-free shops trying to generate sales in a challenging business environment. According to a survey by the Korea Duty Free Association, during the COVID-19 period, as sales to Daigou increased, the referral commission rate exceeded 50% last year. From 2014 to 2019, before COVID-19, the referral commission rate was around 20%. If previously, for sales of 1 million KRW, 200,000 KRW was paid as commission to Daigou, last year, Daigou took more than half of the money received. Although the rate has dropped to 30-40% due to self-help efforts by the Korea Customs Service and the industry, the duty-free sector expresses concerns that the commission rate could rise again if unexpected situations occur. A Korea Duty Free Association official strongly asserted, "There is no law that the same situation won't repeat," and emphasized, "referral commissions must be brought under legal regulation."

There is also an opinion that legislation is necessary to revive the competitiveness of Korean duty-free shops, which are threatened by China. Currently, domestic duty-free shops have not recovered their sales to pre-COVID-19 levels. Operating profit margins recorded 6% in 2019 but dropped to -7.2% in 2020. Unlike the stagnant domestic duty-free shops, Chinese duty-free shops have grown at an average annual rate of about 23% over the past five years. Since 2020, the world's largest duty-free operator has changed to CDFG, a subsidiary of China International Travel Service (previously the Swiss company Dufry). Joo Sung-joon, a lawyer at Pacific Law & Consulting who studied ways to improve duty-free shop referral commissions, pointed out, "CDFG will continue to grow due to policies encouraging Chinese duty-free consumers to spend domestically," adding, "Due to the structural characteristics of the duty-free industry, self-correction is impossible, and destructive competition that threatens market survival is inevitable."

Academics generally consider an appropriate referral commission rate to be around 15-20%. Although rates should vary between peak and off-peak seasons, applying an average rate at this level is generally considered reasonable.

Meanwhile, the upcoming bill does not include improvements to duty-free shop license fees. This is because the government can adjust the fee rate according to the situation, as deficits appeared temporarily due to COVID-19. License fees refer to taxes the government collects based on sales in exchange for granting exclusive rights to duty-free operators. The duty-free industry demands improvements to allow license fees to be paid based on operating profit or store area rather than sales, arguing that it is unreasonable to pay fees while operating at a loss. Recently, Representative Ko Yong-jin of the Democratic Party also took the lead in proposing a partial amendment to the Customs Act to collect license fees based on operating profit.

Duty-Free Shops Have 'Different Dreams'... Passage Expected to Be Difficult

However, even if referral commissions are put under scrutiny, the key issue is whether stakeholders can reach an agreement and successfully resolve the matter. The problem lies in how to set the commission rate, and even aside from conflicts between the duty-free industry and other sectors, there is significant disagreement among duty-free shops themselves. New duty-free shops agree with legislating an upper limit on referral commissions but are unlikely to welcome aggressively lowering the commission rate.

In fact, when the Duty Free Association started a research project earlier this year to assess referral commissions, duty-free shops did not clearly disclose operating costs, citing confidentiality, which made it difficult to grasp the actual situation. As a result, the research project ended without calculating appropriate referral commission rates for major duty-free shops. This suggests that consensus will be difficult even between established duty-free shops with loyal customers and new entrants. Opposition from the travel industry is another hurdle. The domestic travel industry structure involves travel agencies bringing Chinese tourists with low-priced packages and earning margins through referral commissions. Professor Kim Jae-ho of the Department of Tourism Management, Service Division, Inha Technical College, said, "To reach an agreement with the travel industry, the low-price-focused domestic travel industry structure must be changed, but this is not easy to break," adding, "Although there will be growing pains, holding a council involving stakeholders such as the travel industry to set commission rates annually could be one solution."

Finally, the government's stance is also a variable. The government side says that rather than expecting solutions in the legal domain, self-regulation efforts by the industry should come first. At a seminar on 'Enhancing the Global Competitiveness of the Duty-Free Industry' two months ago, a Ministry of Economy and Finance official said, "It is quite embarrassing to expect the government to solve this through legal means," and added, "If Chinese group tourists return, the pressure on commissions will naturally decrease."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)